Get the free form 915 fillable

Get, Create, Make and Sign

Editing form 915 fillable online

How to fill out form 915

How to fill out form 915?

Who needs form 915?

Video instructions and help with filling out and completing form 915 fillable

Instructions and Help about publication 915 worksheets 2 fillable form

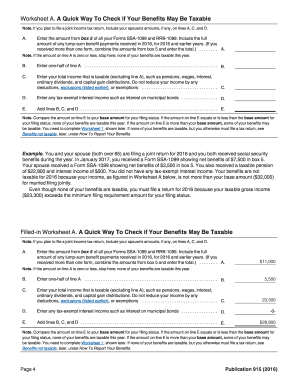

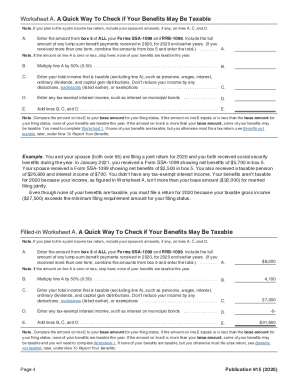

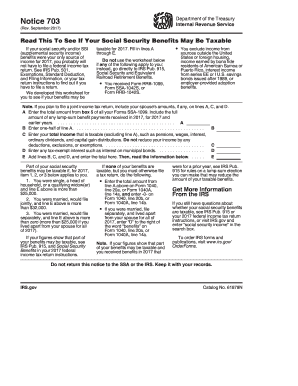

Hello Emily Bolton Here I am a CPA and certified tax coach to online marketers and entrepreneurs every year I get this question, and so I thought I'd bring it up to you today as a little video tip it has to do with social security and our and the question I get is are my social security benefits taxable, and I hate the answer because the answer is well sometimes they are, and sometimes they're not it depends on like yikes hate to give that answer button taxes that's kind of generally the answer oftentimes, so this is what it boils down to if Social Security benefits are your only income then generally speaking they're not taxable, and you wouldn't have to file a tax return however if you do have other income sources including tax-exempt interest then some portion of your social security benefits may in fact be taxable so what portion well that depends on and is it taxable okay that depends on as well two ways to find out one the IRS website does have an interactive tool to help you discern that amount, so I've provided a link to that in my blog so by all means go there and go check out the website and find out for yourself that way if you want to just try to quickly get a sense of whether they are not one of the quick test is to do this to take half of your social security income and add it to all other income including that tax-exempt interest amount and compare that total to the base amount for your filing status now it gets complicated again because it depends on what is your filing status well again I'm going to put that information in my blog, so you can go there and check it out but real quick if you're married filing jointly that's 32,000 if you are married filing separately and at some point during the year lived with your spouse then the base amount is zero if you're single had a household or qualified widow with a dependent child or married filing separately and have been separated from your spouse and have not lived together at all during the prior year then that base amount is twenty-five thousand, so I hope that that helps you determine whether Social Security benefits are taxable it's certainly not going to tell you how much because again there is another threshold but at least that will tell you whether you do need to file a tax return if they're taxable and get that ball rolling, so I suggest that you go to your tax accountant and get some help there or there's some online filing tax software that you can get help with by all means contact me if you need any help I'll be glad to give you a helping hand I hope that helps have yourself a blessed day, and thank you for joining me on this tax tip take care god bless bye

Fill tax publication 915 fillable worksheet 1 : Try Risk Free

People Also Ask about form 915 fillable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 915 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.