IRS 8869 2000 free printable template

Show details

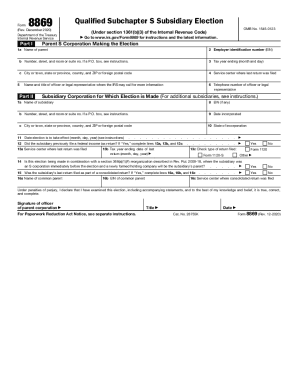

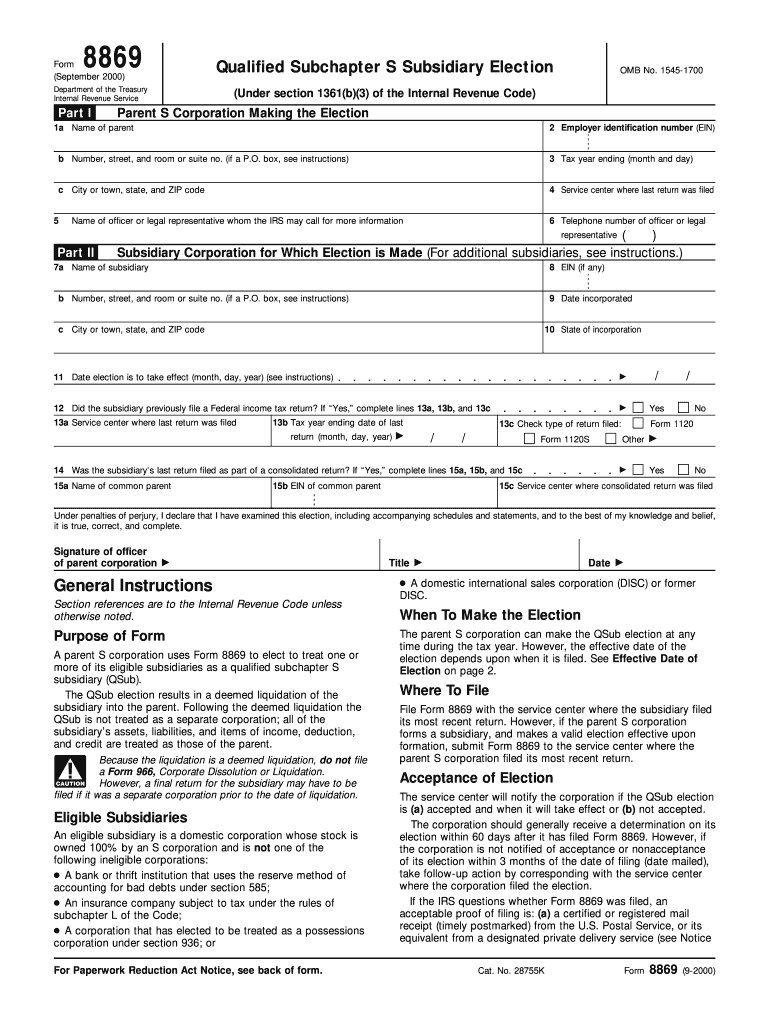

Form (September 2000)

8869

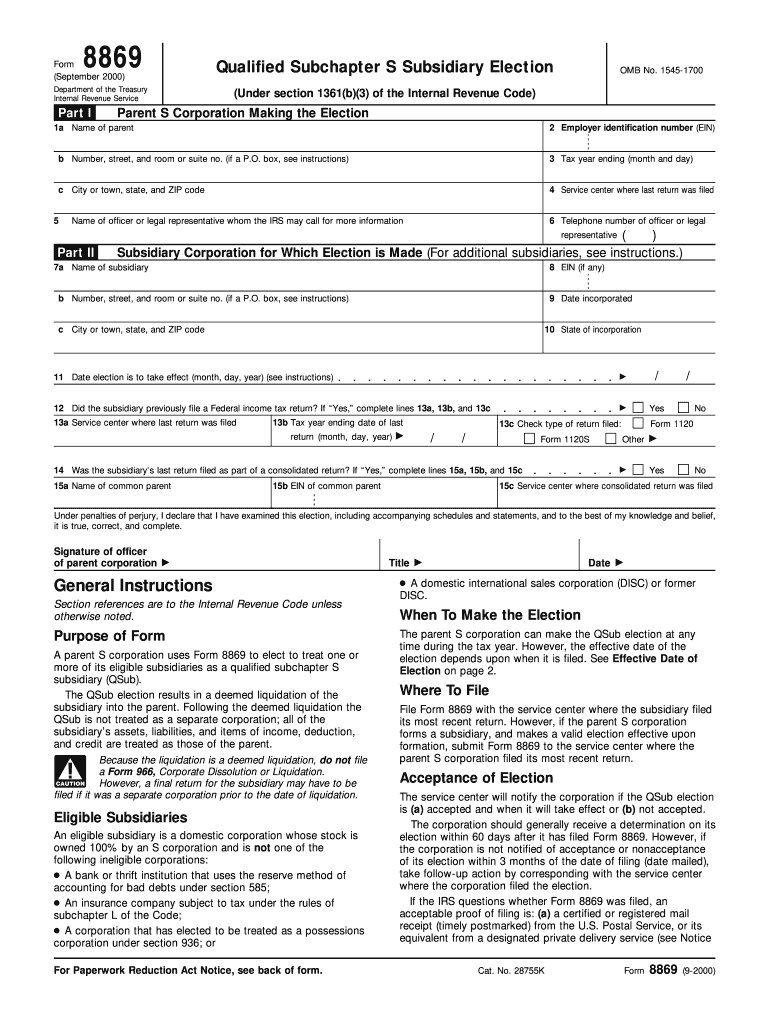

Qualified Subchapter S Subsidiary Election

(Under section 1361(b)(3) of the Internal Revenue Code)

OMB No. 1545-1700

Department of the Treasury Internal Revenue Service

Part

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8869

Edit your IRS 8869 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8869 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8869 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8869. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8869 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8869

How to fill out IRS 8869

01

Download IRS Form 8869 from the IRS website.

02

Enter the name of the corporation and the information for the parent corporation in Part I.

03

Provide the Employer Identification Number (EIN) for both the parent and subsidiary corporations.

04

Indicate the effective date of the tax election in line 6.

05

Complete Part II by checking box 1 if you are an eligible S corporation and box 2 if claiming a small business tax credit.

06

Fill out Part III with the amount of income for the subsidiary corporation and other required financial details.

07

Review the instructions carefully for any additional information needed in the calculations.

08

Sign and date the form, ensuring all required signatures are included.

09

Submit the completed form to the appropriate IRS office by the deadline.

Who needs IRS 8869?

01

Businesses that are planning to elect to be treated as an S corporation for tax purposes.

02

Taxpayers who want to make an election under Section 1362(a) for a subsidiary corporation.

03

Companies with multiple corporations looking to ensure they meet IRS requirements for tax status.

Fill

form

: Try Risk Free

People Also Ask about

Where do I file IRS 8869?

Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

How does a QSub election work?

The QSub election results in a deemed liquidation of the subsidiary into the parent. Following the deemed liquidation, the QSub is not treated as a separate corporation and all of the subsidiary's assets, liabilities, and items of income, deduction, and credit are treated as those of the parent.

How do I file an S Corp election with the IRS?

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Does a QSub have to file a 2553?

To be treated as a QSSS, the parent corporation files IRS Form 8869 (Qualified Subchapter S Subsidiary Election) pursuant to IRC Sec. 1361(b) (3). The subsidiary does not file a IRS Form 2553, because a QSSS is not treated as a separate corporation for tax purposes. See, IRC Section 1361(b)(3)(A)(i).

Can a single member LLC be a QSub?

Although an S-corporation generally cannot have an entity as a stockholder, an S-corporation can own: A qualified subchapter S subsidiary (QSub). A disregarded entity (for example, a single member LLC).

What is a 8869 tax form?

A parent S corporation uses Form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter S subsidiary (QSub). The QSub election results in a deemed liquidation of the subsidiary into the parent.

Does a QSub file a final tax return?

This schedule notifies the FTB that the QSub's items of income, deduction, and credit will be included in the parent's return and the QSub will not file a separate California franchise or income tax return.

What does QSSS stand for?

To be treated as a QSSS, the parent corporation files IRS Form 8869 (Qualified Subchapter S Subsidiary Election) pursuant to IRC Sec. 1361(b) (3). The subsidiary does not file a IRS Form 2553, because a QSSS is not treated as a separate corporation for tax purposes. See, IRC Section 1361(b)(3)(A)(i).

How do you make a Q sub election?

For a corporation to constitute a QSub, three requirements must be met: the subsidiary must be a domestic corporation that would otherwise qualify as an S corporation, the parent S corporation must own 100 percent of the stock of the subsidiary, and. the parent must make an election to treat the subsidiary as a QSub.

Who can make 338 election?

338 election. This election can be made when the acquiring corporation (the buyer) makes a qualifying purchase of 80% or more of the target company's stock. The target company can be either a C corporation or an S corporation, and the buyer can be either a C corporation or an S corporation.

Can an S Corp file a consolidated tax return?

An S corporation can own 80 percent or more of the stock of a C corporation, which can elect to join in the filing of a consolidated return with its affiliated C corporations. However, an S corporation is ineligible to be a member of the affiliated group and to join in the election to file a consolidated return.

What is a qualified S Corp subsidiary?

For a corporation to constitute a QSub, three requirements must be met: the subsidiary must be a domestic corporation that would otherwise qualify as an S corporation, the parent S corporation must own 100 percent of the stock of the subsidiary, and. the parent must make an election to treat the subsidiary as a QSub.

Can an S corporation have a foreign subsidiary?

An S corporation can legally own a foreign subsidiary, but the foreign subsidiary cannot achieve QSub status. An S corporation must hold a foreign subsidiary as a C corporation, and a C corporation must pay tax at the corporate rate on its earnings.

How to make a 338 election?

If the target is an S corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the QSP. File Form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation.

Who files form 8869?

A parent S corporation uses Form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter S subsidiary (QSub).

Where do I file IRS Form 8869?

File Form 8869 with the service center where the subsidiary filed its most recent return. However, if the parent S corporation forms a subsidiary, and makes a valid election effective upon formation, submit Form 8869 to the service center where the parent S corporation filed its most recent return.

How do I make a Section 338 election?

If the target is an S corporation, a section 338(h)(10) election must be made by all of the shareholders of the target, including shareholders who do not sell target stock in the QSP. File Form 8023 by the 15th day of the 9th month after the acquisition date to make a section 338 election for the target corporation.

What is a qualified subchapter?

For a corporation to constitute a QSub, three requirements must be met: the subsidiary must be a domestic corporation that would otherwise qualify as an S corporation, the parent S corporation must own 100 percent of the stock of the subsidiary, and. the parent must make an election to treat the subsidiary as a QSub.

What is a Q sub?

A QSub is a domestic corporation that itself would be eligible to make an S corporation election and is 100 percent owned by an S corporation that makes the QSub election for its subsidiary. 4. For federal income tax purposes, the QSub is not treated as a separate corporation.

Does a QSub file a tax return?

This schedule notifies the FTB that the QSub's items of income, deduction, and credit will be included in the parent's return and the QSub will not file a separate California franchise or income tax return.

What is a qualified subchapter trust?

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8869 for eSignature?

Once your IRS 8869 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get IRS 8869?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IRS 8869 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the IRS 8869 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your IRS 8869 in seconds.

What is IRS 8869?

IRS 8869 is a tax form used by eligible entities to elect to be treated as a partnership or corporation for federal tax purposes.

Who is required to file IRS 8869?

Entities that wish to make an election to be treated as a partnership or corporation for tax purposes must file IRS 8869.

How to fill out IRS 8869?

To fill out IRS 8869, provide the required information about the entity, including its name, address, and the specific election being made, and submit it to the IRS.

What is the purpose of IRS 8869?

The purpose of IRS 8869 is to allow entities to formally elect their classification for tax purposes, which can affect how income is reported and taxed.

What information must be reported on IRS 8869?

Information that must be reported includes the name and address of the entity, the classification being elected, and any other relevant details as required by the form instructions.

Fill out your IRS 8869 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8869 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.