IRS W-9 2002 free printable template

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2002 previous version

What is IRS W-9?

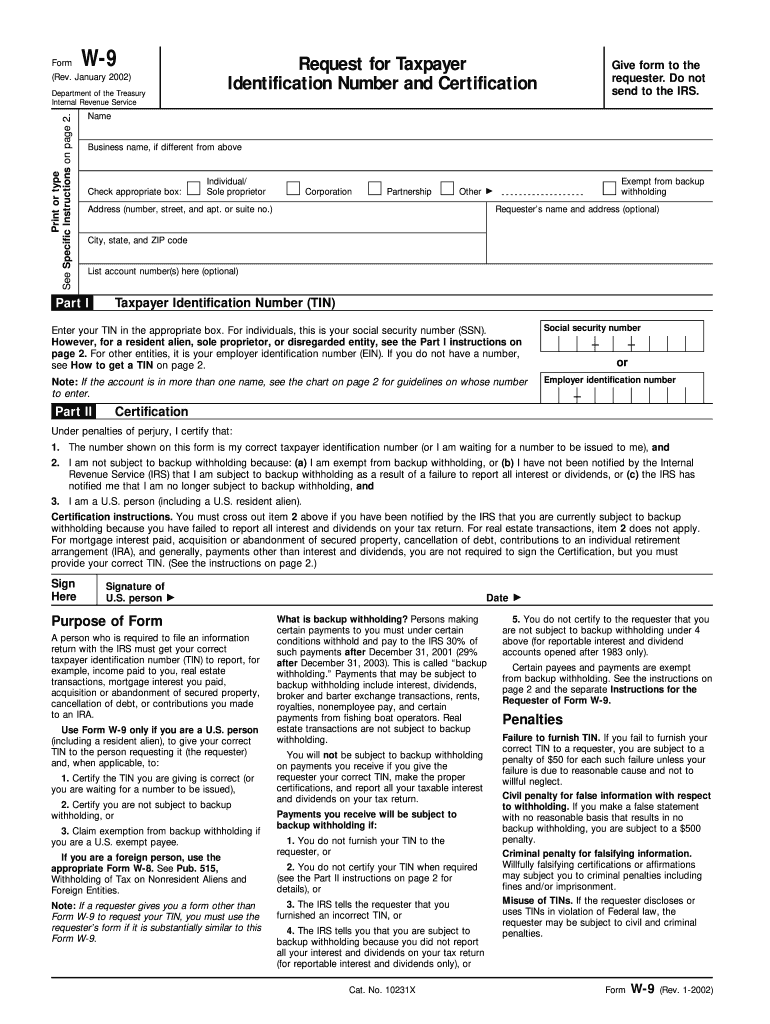

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-9

What should I do if I made a mistake on my IRS W-9?

If you realize that you've made a mistake on your IRS W-9, it's important to submit a corrected version to the requester. Clearly indicate that it is a correction by writing 'Corrected' at the top of the form. This ensures that the requester updates their records correctly. Keep a copy of the corrected form for your own records.

How can I track the status of my submitted IRS W-9?

To verify the receipt of your submitted IRS W-9, contact the requester directly, as the IRS does not provide tracking for W-9 submissions. If you submitted electronically, ask about any confirmation they provide. Be aware that submission issues may arise, so maintaining open communication can help address problems early.

What are the common errors to avoid when submitting an IRS W-9?

Common errors when submitting your IRS W-9 include providing incorrect taxpayer identification numbers or missing signature and date. To avoid these issues, double-check your Personal Identification Number (TIN) against IRS records and ensure all sections are complete before submission. These errors could delay processing or create problems for tax reporting.

Can I e-file my IRS W-9, and what should I know about it?

Yes, you can e-file your IRS W-9, but you must use the platform provided by the requester for proper submission. It's essential to ensure compatibility with the system requirements of their e-filing process. Additionally, be aware of any service fees involved, and keep in mind that you may need to provide a printed signature if the platform requires it.

What do I do if I receive a notice regarding my IRS W-9?

If you receive any notice related to your IRS W-9, carefully read the communication to understand the issue. These notices often outline the necessary steps you must take, such as providing additional documentation or correcting errors. Prepare the requested information and respond promptly to avoid delays in processing.

See what our users say