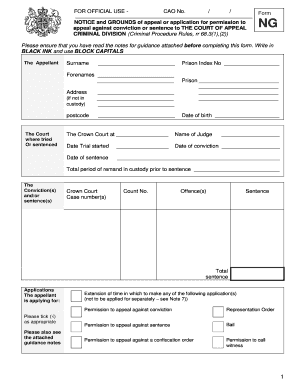

Get the free Schedule 5 (Form 8849)

Show details

This form is used by individuals or entities who have paid the second tax to the government to claim a refund for the second tax paid on certain fuels. It requires specific information regarding the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule 5 form 8849

Edit your schedule 5 form 8849 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule 5 form 8849 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule 5 form 8849 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule 5 form 8849. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule 5 form 8849

How to fill out Schedule 5 (Form 8849)

01

Obtain Schedule 5 from the IRS website or other official sources.

02

Enter your name, address, and taxpayer identification number at the top of the form.

03

Review the instructions carefully to identify the specific claims for refund you are making.

04

Complete Part I, including the columns for the number of gallons and type of fuel.

05

Fill out any applicable sections in Part II regarding the fuel tax credits.

06

Attach any necessary documentation or supporting schedules as required.

07

Review your entries for accuracy and ensure all required fields are filled in.

08

Sign and date the form before submission.

09

Submit Schedule 5 along with your Form 8849 to the appropriate IRS address.

Who needs Schedule 5 (Form 8849)?

01

Businesses or individuals who have paid fuel taxes and seek a refund.

02

Any taxpayer who qualifies under the specific refund claims outlined in IRS guidelines.

03

Those involved in certain operations that use fuels subject to refund allowances, such as agriculture or commercial fishing.

Fill

form

: Try Risk Free

People Also Ask about

What is cycle 5 IRS?

It shows the year and calendar week and day of the week it was submitted and received. ing to the IRS 05 means Thursday and 14 means the 14th week when the IRS started accepting returns, so you should see refund soon enough.

What is IRS tax Class 5?

Now you know right from the IRS manual 6209 that Tax Class 2 is for Individual Income Tax and Tax Class 5 is for Estate and Gift Taxes. Next we should refer to IRS Manual 6209 for a chart of IRS Forms and the tax classes the forms are used for.

What is the line 5 on the Schedule A tax return?

Line 5. The deduction for state and local taxes is generally limited to $10,000 ($5,000 if married filing separately). State and local taxes subject to this limit are the taxes that you include on lines 5a, 5b, and 5c. Safe harbor for certain charitable contributions made in exchange for a state or local tax credit.

What is IRS schedule 5?

The purpose of Schedule 5 (Form 1040) is to allow taxpayers to report other payments and refundable credits that may impact their overall tax liability. This form helps to ensure that taxpayers do not overlook important credits available to them, which may ultimately reduce their tax burden.

What is a Schedule Five?

Schedule V Schedule V drugs, substances, or chemicals are defined as drugs with lower potential for abuse than Schedule IV and consist of preparations containing limited quantities of certain narcotics. Schedule V drugs are generally used for antidiarrheal, antitussive, and analgesic purposes.

Can you file form 8849 online?

At this point, the only Excise forms available for electronic filing are Form 2290, Heavy Highway Vehicle Use Tax; Form 720, Quarterly Federal Excise Tax; and Form 8849, Claim for Refund of Excise Taxes (Schedules 1, 2, 3, 5, 6 and 8).

What is a Schedule 5 8849?

Schedule 5 (Form 8849), Section 4081(e) Claim A person who has paid and reported a section 4081 tax to the government on taxable fuel uses Schedule 5 (Form 8849) to claim a refund of that tax if a prior section 4081 tax on that fuel has also been paid and reported to the government.

How often can you file form 8849?

You may file a refund claim for each of the first 3 quarters of your income tax year if the aggregate amount of refund claimed for these 3 quarters is at least $750. For the 4th quarter of your income tax year, you must claim the credit on Form 4136.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule 5 (Form 8849)?

Schedule 5 (Form 8849) is used by taxpayers to claim a refund of excise taxes on fuel that is either unused or used in certain non-taxable activities.

Who is required to file Schedule 5 (Form 8849)?

Individuals or businesses that have paid federal excise tax on fuel and are seeking a refund due to qualifying reasons must file Schedule 5 (Form 8849).

How to fill out Schedule 5 (Form 8849)?

To fill out Schedule 5 (Form 8849), taxpayers must provide their identifying information, detail the type and amount of fuel and tax paid, and include any relevant refund claims based on usage or exemptions.

What is the purpose of Schedule 5 (Form 8849)?

The purpose of Schedule 5 (Form 8849) is to allow taxpayers to reclaim excise taxes on fuel that was not used in a taxable manner or for qualifying exempt purposes.

What information must be reported on Schedule 5 (Form 8849)?

Schedule 5 (Form 8849) requires taxpayers to report information such as their contact details, details of the fuel used, the amount of federal excise tax paid, and the basis for the refund claim.

Fill out your schedule 5 form 8849 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 5 Form 8849 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.