CT REG-8 2008 free printable template

Show details

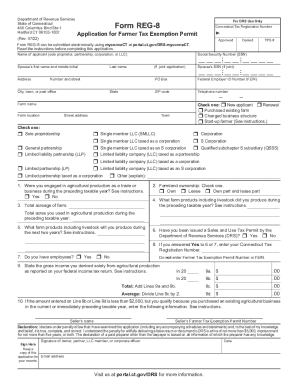

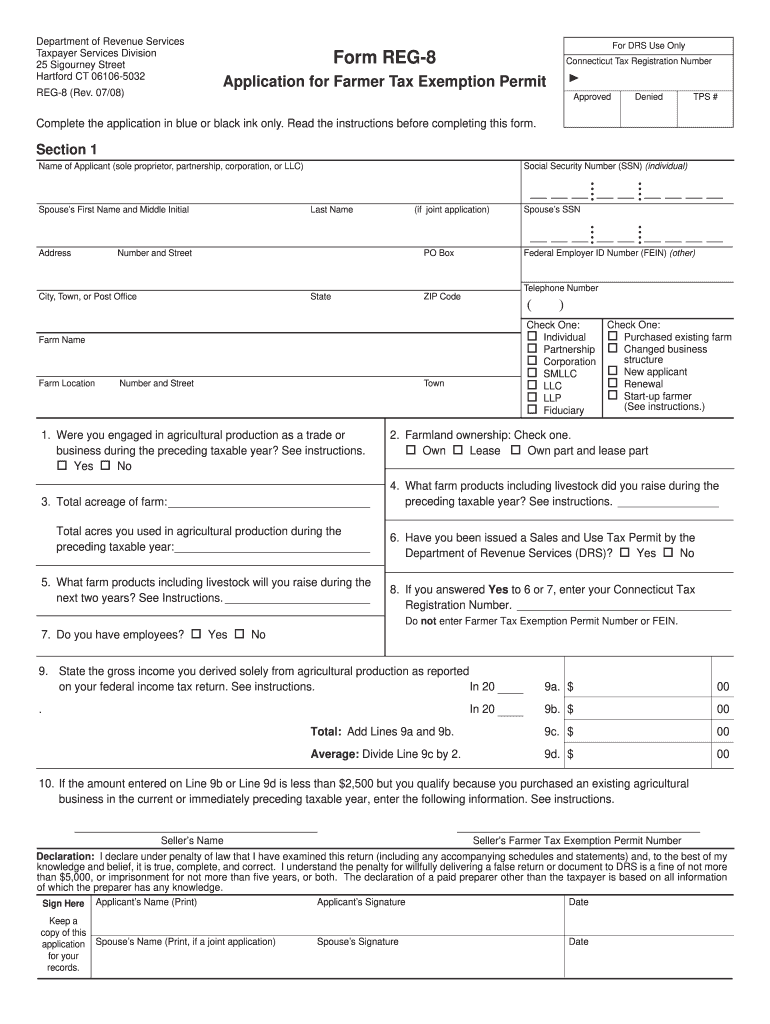

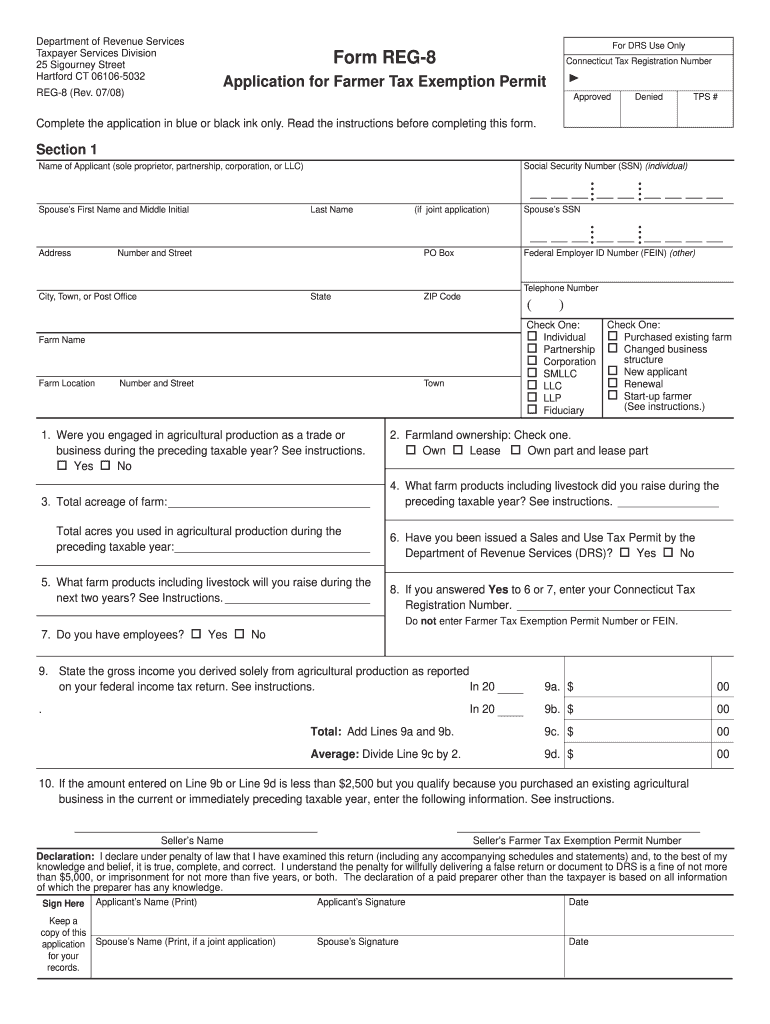

General Instructions If you engage in agricultural production as a trade or business use Form REG-8 Application for Farmer Tax Permit. Department of Revenue Services Taxpayer Services Division 25 Sigourney Street Hartford CT 06106-5032 REG-8 Rev. 07/08 For DRS Use Only Form REG-8 Connecticut Tax Registration Number Application for Farmer Tax Exemption Permit Approved Denied TPS Complete the application in blue or black ink only. See the table tha...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT REG-8

Edit your CT REG-8 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT REG-8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT REG-8 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT REG-8. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT REG-8 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT REG-8

How to fill out CT REG-8

01

Begin by obtaining the CT REG-8 form from the Connecticut Department of Revenue Services website or your local tax office.

02

Fill in your business name, address, and contact information at the top of the form.

03

Provide your Connecticut Tax Registration Number if you have one.

04

Indicate the type of business entity you are registering by checking the appropriate box.

05

Fill out the principal business activity, including a brief description of what your business does.

06

Include the names and addresses of all partners, members, or officers of the business.

07

Indicate the date your business started or will start in Connecticut.

08

Review the completed form for accuracy and completeness.

09

Submit the form either online or by mailing it to the appropriate address as indicated in the instructions.

Who needs CT REG-8?

01

Any business entity that operates or intends to operate in Connecticut and needs to register for a sales and use tax permit or other state tax accounts must fill out the CT REG-8 form.

02

This includes sole proprietors, partnerships, corporations, LLCs, and other business organizations.

Fill

form

: Try Risk Free

People Also Ask about

Are farms tax exempt in CT?

Connecticut General Statutes - Section 12-412(63) Retail sales of tangible personal property used exclusively in agricultural production are exempt from sales and use taxes provided the purchase qualifies for an exemption and the purchaser has been issued a Farmer Tax Exemption Permit.

What qualifies you as exempt on taxes?

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

Do you pay taxes as a farmer?

Farm income will be reported on your personal income tax return and the tax assessed there. The most common sources of farming business income are the sales of livestock, produce and grains, and other products raised or bought for resale. Items paid for in cash must also be reported.

Is farming income taxed?

Preparing tax returns for farmers and ranchers requires specialized knowledge of tax rules and provisions that apply only to those in the business of farming. Individuals, partnerships, and trusts and estates generally report farm income and expenses on Form 1040, Schedule F.

What qualifies as a farm in Alabama?

A farm includes livestock, dairy, poultry, fish, vegetables and fruit.

Who is exempt from paying taxes?

For example, for the 2021 tax year (2022), if you're single, under the age of 65, and your yearly income is less than $12,550, you're exempt from paying taxes. Ditto if you're married and filing jointly, with both spouses under 65, and income less than $25,100.

Who is allowed not to pay taxes?

For example, in 2022, you don't need to file a tax return if all of the following are true for you: Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income)

Who qualifies for farm tax exemption in CT?

Connecticut Department of Agriculture In order to receive any of the above exemptions, you must derive at least $15,000 in gross sales or demonstrate $15,000 in expenses on the farm. You also must declare to Town by November 1 (within 30 days after the assessment date) these exemptions on Form M-28. C.G.S. Sec.

How do I become farm tax exempt in NY?

To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. New York tax law exempts certain items used in farm production from state and local sales and use taxes.

How do I get a CT tax registration number?

How do I get my Income Tax Identification Number? You can register online at the CT Department of Revenue (DOR) website. Contact the agency directly at 1-860-297-5962 for registration assistance or to check if a tax identification number is already assigned for your business.

How do I get a CT tax permit?

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

Do I need a CT tax ID number?

Connecticut State Identification Number You must obtain a Sales and Use Tax Permit from the Connecticut Department of Revenue Services if you intend to engage in any of the following activities in Connecticut: Sale, rental or lease of goods; Sale of a taxable service; or.

What can a farmer claim on tax?

Some of the expenses that farmers commonly deduct cover the cost of livestock and feed, seeds, fertilizer, wages paid to employees, interest paid during the year on farm-related loans, depreciation to recover a portion of equipment costs, utilities and insurance premiums.

Is CT Tax Registration Number same as Ein?

Note: An EIN Number is not the same thing as a Connecticut Tax ID Number. An EIN is issued by the IRS. And a Connecticut Tax ID Number is issued by the Connecticut Department of Revenue.

Is farming considered income?

Income from normal farm business operations is reported on the Schedule F (Form 1040).

Are farmers exempt from paying tax?

Exemption from Income Tax – All Accredited Farmers and Fisherfolk Enterprises may be exempt from income tax on income derived from the enterprise provided they are registered as Barangay Micro-Business Enterprises (BMBEs).

How much does it cost to get a tax ID number in CT?

Connecticut makes it easy for you, as there is only one type of sales tax permit available in the state. How much does a sales tax permit in Connecticut cost? To apply for a Connecticut sales tax permit, there is a $100 fee.

How do I get my farm status in CT?

In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must be forwarded to Taxpayer Services at DRS for review. The application is then either approved or denied.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT REG-8 to be eSigned by others?

When you're ready to share your CT REG-8, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find CT REG-8?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CT REG-8 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in CT REG-8 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit CT REG-8 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is CT REG-8?

CT REG-8 is a registration form used in the state of Connecticut for businesses to register for state tax purposes.

Who is required to file CT REG-8?

Any business entity that intends to operate in Connecticut and needs to obtain a tax registration number is required to file CT REG-8.

How to fill out CT REG-8?

To fill out CT REG-8, provide the required information such as the business name, address, type of business entity, and the nature of business activities. Follow the instructions provided with the form for accurate completion.

What is the purpose of CT REG-8?

The purpose of CT REG-8 is to collect essential information from businesses for tax registration and compliance with state tax laws.

What information must be reported on CT REG-8?

CT REG-8 requires businesses to report their legal business name, address, type of business entity, Social Security number or Federal Employer Identification Number, and the nature of the business activities.

Fill out your CT REG-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT REG-8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.