CT REG-8 2020 free printable template

Show details

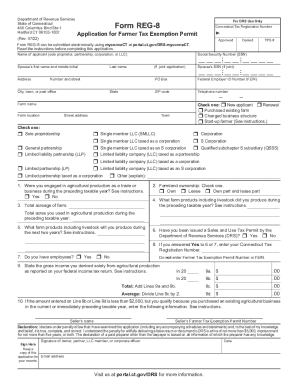

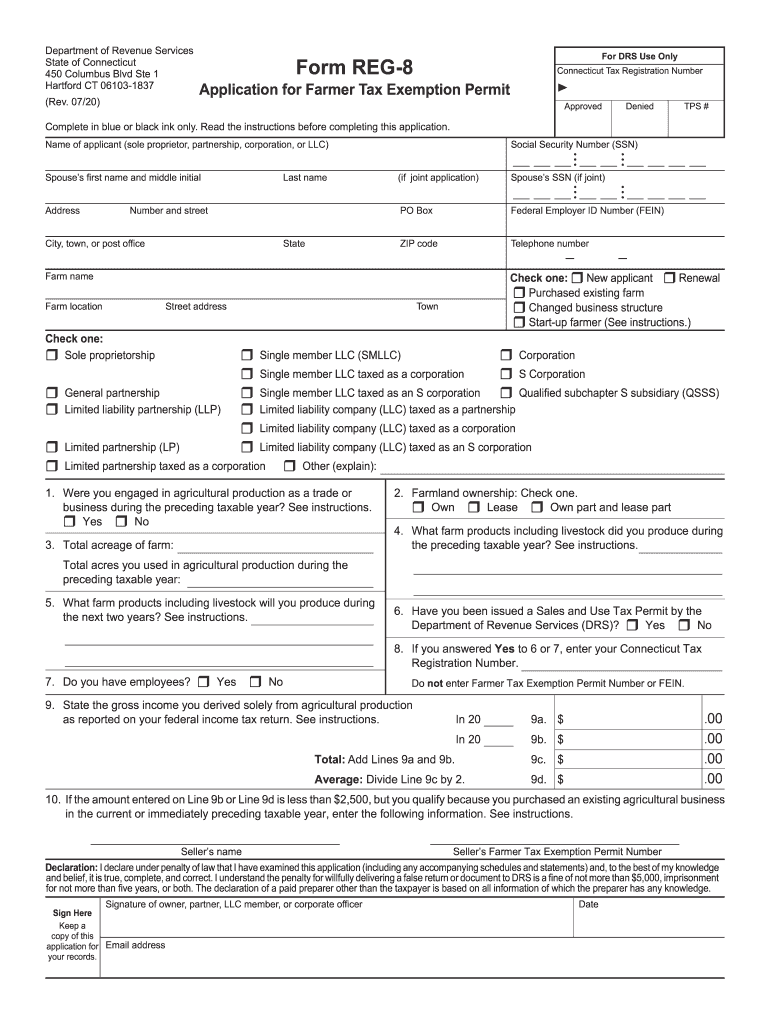

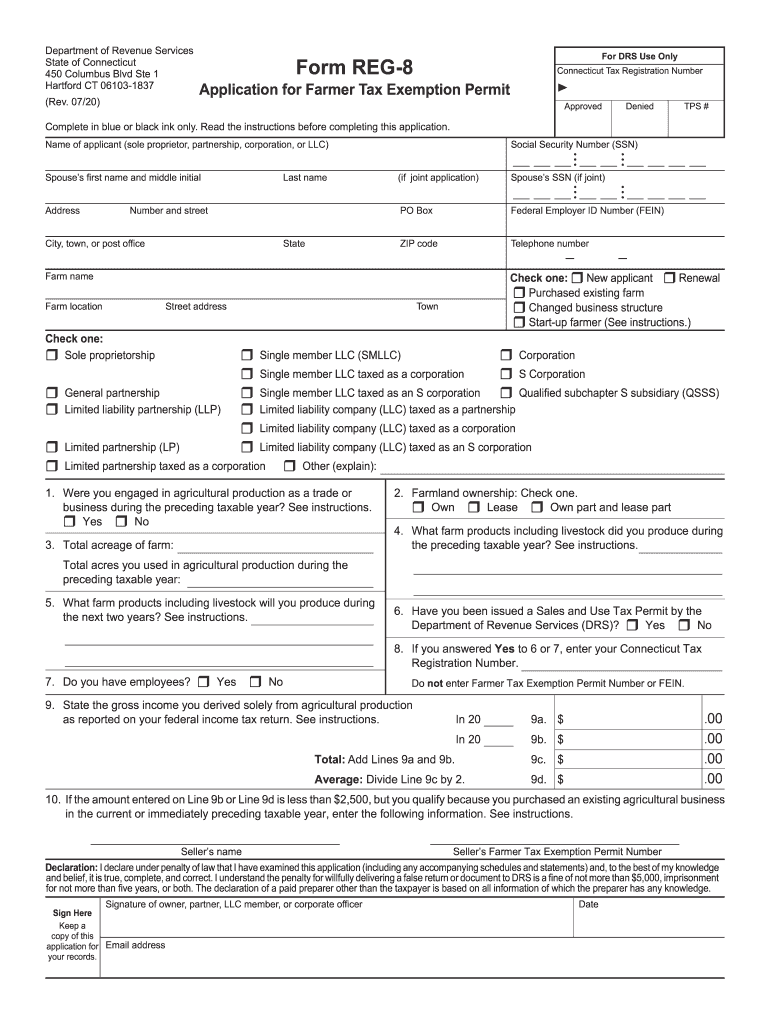

General Instructions If you engage in agricultural production as a trade or business use Form REG-8 Application for Farmer Tax Permit. Department of Revenue Services State of Connecticut 450 Columbus Blvd Ste 1 Hartford CT 06103-1837 Rev. 12/18 For DRS Use Only Form REG-8 Connecticut Tax Registration Number Application for Farmer Tax Exemption Permit Approved Denied TPS Complete in blue or black ink only. A husband and wife who file a joint federal income tax return can submit a joint Form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT REG-8

Edit your CT REG-8 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT REG-8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT REG-8 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT REG-8. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT REG-8 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT REG-8

How to fill out CT REG-8

01

Obtain the CT REG-8 form from the Connecticut Department of Revenue Services website or local office.

02

Start by filling in your business information, including the name, address, and federal employer identification number.

03

Specify the type of business entity (e.g., corporation, LLC, etc.) in the appropriate section.

04

Indicate the date your business started operating in Connecticut.

05

Fill out the section regarding the type of tax you are registering for.

06

Provide the contact information for the person responsible for tax matters.

07

Review the completed form for any errors or missing information.

08

Sign and date the form.

09

Submit the form to the appropriate Connecticut Department of Revenue Services office, either by mail or electronically.

Who needs CT REG-8?

01

Businesses operating in Connecticut that require tax registration.

02

Newly established companies that need to register for various state taxes.

03

Any entity that has employees and needs to address payroll taxes.

04

Businesses looking to conduct sales and needing to register for sales and use taxes.

Fill

form

: Try Risk Free

People Also Ask about

Are farms tax exempt in CT?

Connecticut General Statutes - Section 12-412(63) Retail sales of tangible personal property used exclusively in agricultural production are exempt from sales and use taxes provided the purchase qualifies for an exemption and the purchaser has been issued a Farmer Tax Exemption Permit.

What qualifies you as exempt on taxes?

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

Do you pay taxes as a farmer?

Farm income will be reported on your personal income tax return and the tax assessed there. The most common sources of farming business income are the sales of livestock, produce and grains, and other products raised or bought for resale. Items paid for in cash must also be reported.

Is farming income taxed?

Preparing tax returns for farmers and ranchers requires specialized knowledge of tax rules and provisions that apply only to those in the business of farming. Individuals, partnerships, and trusts and estates generally report farm income and expenses on Form 1040, Schedule F.

What qualifies as a farm in Alabama?

A farm includes livestock, dairy, poultry, fish, vegetables and fruit.

Who is exempt from paying taxes?

For example, for the 2021 tax year (2022), if you're single, under the age of 65, and your yearly income is less than $12,550, you're exempt from paying taxes. Ditto if you're married and filing jointly, with both spouses under 65, and income less than $25,100.

Who is allowed not to pay taxes?

For example, in 2022, you don't need to file a tax return if all of the following are true for you: Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income)

Who qualifies for farm tax exemption in CT?

Connecticut Department of Agriculture In order to receive any of the above exemptions, you must derive at least $15,000 in gross sales or demonstrate $15,000 in expenses on the farm. You also must declare to Town by November 1 (within 30 days after the assessment date) these exemptions on Form M-28. C.G.S. Sec.

How do I become farm tax exempt in NY?

To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. New York tax law exempts certain items used in farm production from state and local sales and use taxes.

How do I get a CT tax registration number?

How do I get my Income Tax Identification Number? You can register online at the CT Department of Revenue (DOR) website. Contact the agency directly at 1-860-297-5962 for registration assistance or to check if a tax identification number is already assigned for your business.

How do I get a CT tax permit?

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

Do I need a CT tax ID number?

Connecticut State Identification Number You must obtain a Sales and Use Tax Permit from the Connecticut Department of Revenue Services if you intend to engage in any of the following activities in Connecticut: Sale, rental or lease of goods; Sale of a taxable service; or.

What can a farmer claim on tax?

Some of the expenses that farmers commonly deduct cover the cost of livestock and feed, seeds, fertilizer, wages paid to employees, interest paid during the year on farm-related loans, depreciation to recover a portion of equipment costs, utilities and insurance premiums.

Is CT Tax Registration Number same as Ein?

Note: An EIN Number is not the same thing as a Connecticut Tax ID Number. An EIN is issued by the IRS. And a Connecticut Tax ID Number is issued by the Connecticut Department of Revenue.

Is farming considered income?

Income from normal farm business operations is reported on the Schedule F (Form 1040).

Are farmers exempt from paying tax?

Exemption from Income Tax – All Accredited Farmers and Fisherfolk Enterprises may be exempt from income tax on income derived from the enterprise provided they are registered as Barangay Micro-Business Enterprises (BMBEs).

How much does it cost to get a tax ID number in CT?

Connecticut makes it easy for you, as there is only one type of sales tax permit available in the state. How much does a sales tax permit in Connecticut cost? To apply for a Connecticut sales tax permit, there is a $100 fee.

How do I get my farm status in CT?

In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must be forwarded to Taxpayer Services at DRS for review. The application is then either approved or denied.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CT REG-8?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the CT REG-8 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete CT REG-8 online?

pdfFiller has made it simple to fill out and eSign CT REG-8. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the CT REG-8 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign CT REG-8 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is CT REG-8?

CT REG-8 is a form used in Connecticut for business registration. It is specifically for reporting and registering for various taxes that businesses may be subject to within the state.

Who is required to file CT REG-8?

Any business entity that is starting operations in Connecticut and intends to engage in taxable activities or is required to register for state taxes must file CT REG-8.

How to fill out CT REG-8?

To fill out CT REG-8, you need to provide information such as the business name, address, type of business entity, and details regarding the taxes you wish to register for. It's important to follow the instructions provided on the form carefully.

What is the purpose of CT REG-8?

The purpose of CT REG-8 is to ensure that businesses are properly registered for state taxes and to facilitate compliance with Connecticut's tax laws.

What information must be reported on CT REG-8?

CT REG-8 requires information such as the business's legal name, trade name (if applicable), address, type of business entity, ownership details, and types of taxes the business will be subject to, such as sales and use tax or business entity tax.

Fill out your CT REG-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT REG-8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.