Get the free Refund Application, Part 2

Show details

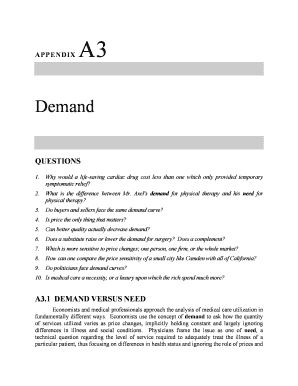

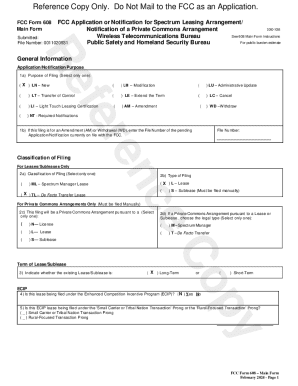

This document is an interactive PDF form for applying for a refund from the MTRS annuity savings account. It requires personal and service separation data from the applicant and sections to be completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund application part 2

Edit your refund application part 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund application part 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit refund application part 2 online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit refund application part 2. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund application part 2

How to fill out Refund Application, Part 2

01

Begin by carefully reading the instructions provided with the Refund Application.

02

Locate Part 2 of the Refund Application form.

03

Fill in your personal information, including your name, address, phone number, and email.

04

Provide details about the purchase, including the date of purchase and item description.

05

Indicate the reason for your refund request in the designated section.

06

Attach any required supporting documents, such as receipts or confirmation emails.

07

Double-check all the information for accuracy.

08

Sign and date the application before submission.

Who needs Refund Application, Part 2?

01

Customers who wish to request a refund for a product or service they purchased.

02

Individuals who have experienced issues with their purchase and seek resolution through a refund.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for a refund application?

Documents required for GST refund GST refund application - Form RFD-01. Tax invoices related to the refund claim. Proof of tax payment - Challans. Export documents - Shipping bills or LUT. Bank account details for refund credit. Additional documents (as required)

How do you politely ask for a refund?

State explicitly that you are requesting a refund and specify the amount. It's also helpful to mention your preferred method of refund, whether it's a return to your credit card, a check, etc. The better you document your concerns, the easier it is for the company to process your e-mail.

How do I ask for a refund in English?

I kindly request a refund of [Amount Paid] and instructions for return the product. Please process the refund to my original form of payment. Thank you for your understanding and prompt resolution of this issue. Should you require further details, I am available at [Your Contact Information].

How do I ask for a refund without sounding rude?

Ask Openly: Politely ask if they could return it. For example, ``Would you be able to pay me back when you have a chance? I'd really appreciate it.'' Be Flexible: If they are unable to pay you back immediately, consider discussing a timeline that works for both of you.

What words to use to get a refund?

Get Custom Synonyms reimburse. repay. pay back. compensate. render (to) reciprocate. give back. pay off.

How do I insist on a refund?

If you think you're entitled to a refund, then in the first instance, you should go back to the store or contact the online retailer. Depending on what's wrong, you may be asked for proof or purchase, which could be the original till receipt, or a copy of the transaction on your bank or credit card statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Refund Application, Part 2?

Refund Application, Part 2 is a form used to request a refund for overpaid taxes or fees.

Who is required to file Refund Application, Part 2?

Individuals or businesses that have overpaid their taxes or fees and wish to reclaim those funds are required to file Refund Application, Part 2.

How to fill out Refund Application, Part 2?

To fill out Refund Application, Part 2, gather the necessary financial documents, complete the form with accurate information, and ensure that all required fields are filled out before submission.

What is the purpose of Refund Application, Part 2?

The purpose of Refund Application, Part 2 is to formally request a refund from the relevant tax authority for amounts that were overpaid.

What information must be reported on Refund Application, Part 2?

The information that must be reported includes identification details of the applicant, the amount overpaid, the tax period in question, and any relevant supporting documentation.

Fill out your refund application part 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund Application Part 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.