Get the free Form 4684

Show details

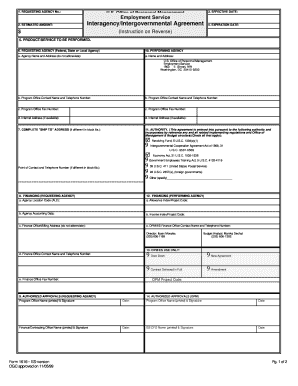

Use Form 4684 to report gains and losses from casualties and thefts. This includes losses from fire, storm, shipwreck, or other casualty, or theft, and details the conditions under which these losses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 4684

Edit your form 4684 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4684 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 4684 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 4684. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 4684

How to fill out Form 4684

01

Obtain Form 4684 from the IRS website or a tax professional.

02

Begin by filling out your personal information at the top of the form.

03

Indicate the year the loss occurred in the designated box.

04

Complete Part I for Casualties and Thefts, detailing the event and how it affected your property.

05

In Part II, record the details of your property that was damaged or stolen.

06

Calculate the amount of loss you are reporting, including any insurance or compensation received.

07

Double-check all entries for accuracy and completeness.

08

Attach any necessary supporting documentation to substantiate your claim.

09

Submit the completed Form 4684 along with your tax return.

Who needs Form 4684?

01

Individuals or businesses that have experienced a loss due to theft, casualty, or natural disasters.

02

Taxpayers who are seeking to claim a deduction for property losses on their tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form 4684 used for?

Form 4684 is an Internal Revenue Service (IRS) form for reporting gains or losses from casualties and thefts which may be deductible for taxpayers who itemize deductions. Casualty losses can be the result of fires, floods, and other disasters.

What qualifies for for casualty loss deduction under IRS Code section 165?

except as provided in subsection (h), losses of property not connected with a trade or business or a transaction entered into for profit, if such losses arise from fire, storm, shipwreck, or other casualty, or from theft.

What qualifies as a casualty loss deduction?

Understanding Casualty Losses and Their Application The IRS allows taxpayers to deduct losses resulting from sudden, unexpected, or unusual events. These events include natural disasters, thefts, and accidents that damage or destroy property. For a loss to qualify, it must be: Physical.

What qualifies as a qualified disaster loss?

A disaster loss is a loss that is attributable to a federally declared disaster and that occurs in an area eligible for assistance pursuant to the Presidential declaration. The disaster loss must occur in a county eligible for public or individual assistance (or both).

What qualifies as a loss for tax purposes?

You have a capital gain if you sell the asset for more than your adjusted basis. You have a capital loss if you sell the asset for less than your adjusted basis. Losses from the sale of personal-use property, such as your home or car, aren't tax deductible.

What qualifies for a casualty loss deduction?

Understanding Casualty Losses and Their Application The IRS allows taxpayers to deduct losses resulting from sudden, unexpected, or unusual events. These events include natural disasters, thefts, and accidents that damage or destroy property. For a loss to qualify, it must be: Physical.

What is an example of a casualty gain?

Example. A single taxpayer's home is destroyed by a hurricane and the taxpayer is paid $400,000 by his insurance company. The taxpayer's basis in the home was $100,000 so the casualty gain is $300,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 4684?

Form 4684 is a tax form used in the United States to report gains and losses from the sale of property due to casualty or theft.

Who is required to file Form 4684?

Individuals, corporations, or other entities that have experienced a casualty loss or theft and wish to deduct the loss on their tax return are required to file Form 4684.

How to fill out Form 4684?

To fill out Form 4684, taxpayers must provide details about the property lost or damaged, calculate the loss, and report any insurance reimbursements received. A step-by-step guide is provided within the form's instructions.

What is the purpose of Form 4684?

The purpose of Form 4684 is to help taxpayers report and claim deductions for losses due to casualty events or theft on their federal income tax returns.

What information must be reported on Form 4684?

Form 4684 requires the reporting of details such as the type of property, the date of the casualty or theft, the cost or adjusted basis of the property, the fair market value before and after the event, and any insurance proceeds received.

Fill out your form 4684 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4684 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.