Get the free 8606 form 1994

Show details

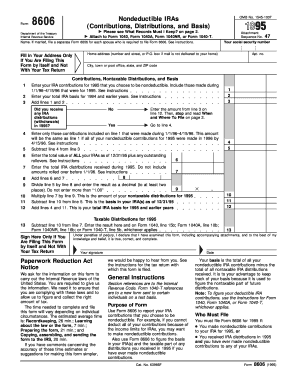

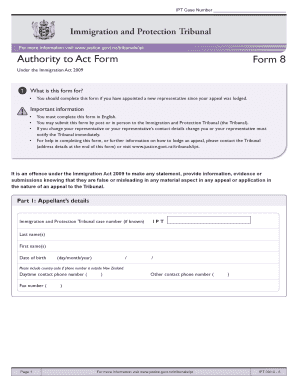

Or if you didn t file a 1988 Form 8606 enter the total of the amounts from lines 4 and 13 of your 1987 Form 8606. Printed on recycled paper Line 5 Although the 1994 IRA contributions you made during 1/1/95 4/17/95 line 4 can be treated as nondeductible for purposes of line 1 they are not included in your basis for purposes of figuring the nontaxable part of any distributions you received in 1994. Attach to Form 1040 Form 1040A or Form 1040NR. Att...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 8606 form 1994 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8606 form 1994 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 8606 form 1994 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 8606 form 1994. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out 8606 form 1994

Point by point instructions on how to fill out the 8606 form 1994:

01

Begin by obtaining the 8606 form 1994 from the Internal Revenue Service (IRS) website or by visiting their local office.

02

Familiarize yourself with the purpose and requirements of the form by reading the instructions provided with the form.

03

Gather all the necessary information and documents, such as your Social Security number, tax return information, and any relevant financial statements.

04

Start by filling out the top section of the form, which includes personal information such as your name, address, and filing status.

05

Proceed to Part I of the form, where you will report your contributions to non-deductible traditional IRA accounts for the tax year specified on the form.

06

Follow the instructions under Part I to accurately report the amount of your contributions and complete any additional calculations required.

07

If you have any distributions or rollovers from your non-deductible traditional IRA account, move to Part II and fill out the necessary information.

08

Again, carefully follow the instructions to accurately report any distributions or rollovers and calculate the taxable amount, if applicable.

09

Finally, review your completed form for any errors or omissions before signing and dating it. Keep a copy for your records and submit the original form to the IRS by the designated deadline.

10

Those who need to fill out the 8606 form 1994 are individuals who made contributions to non-deductible traditional IRA accounts during that specific tax year. The form is used to track and report such contributions, as well as any distributions or rollovers from these accounts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 8606 form?

The 8606 form is used to report nondeductible contributions to traditional IRAs and the distribution of previously taxed amounts from traditional, SEP, and SIMPLE IRAs.

Who is required to file 8606 form?

Individuals who have made nondeductible contributions to their traditional IRAs or have received distributions from certain types of IRAs are required to file the 8606 form.

How to fill out 8606 form?

To fill out the 8606 form, you need to provide information about your IRA contributions, withdrawals, and any basis (after-tax amounts) in the IRA. You may need to refer to your IRA account statements and previous tax filings to complete the form accurately.

What is the purpose of 8606 form?

The purpose of the 8606 form is to calculate the taxable portion of distributions from IRAs that include both deductible and nondeductible contributions. It helps determine the tax owed on the distribution.

What information must be reported on 8606 form?

The 8606 form requires reporting of the total basis in the IRA, the amount of nondeductible contributions made, any distributions received, and the taxable portion of the distribution. It also includes calculations to determine the remaining basis in the IRA.

When is the deadline to file 8606 form in 2023?

The deadline to file the 8606 form for the year 2023 would be April 15, 2024.

What is the penalty for the late filing of 8606 form?

The penalty for the late filing of the 8606 form is generally $50 for each month or part of the month the form is late, up to a maximum of $500 or 25% of the tax owed on the distribution, whichever is less.

How can I modify 8606 form 1994 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 8606 form 1994, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in 8606 form 1994?

The editing procedure is simple with pdfFiller. Open your 8606 form 1994 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the 8606 form 1994 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 8606 form 1994 in seconds.

Fill out your 8606 form 1994 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.