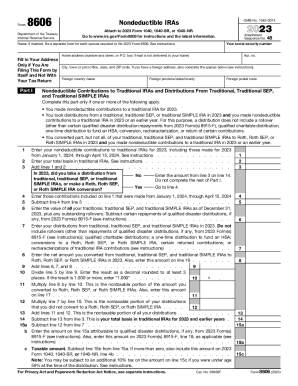

Who Must File Form 8606?

Form 8606 is devoted to nondeductible IRAs. IRA stands for the Individual Retirement Arrangement. You must file this form if your made some of nondeductive contributions to a standard IRA for the last year. It must include a qualified reservist distribution repayment. If you obtained a distribution from a simple IRA and the basis is 0 or more, you must also submit this form. When you convert the sum from one IRA to another, this form also must be completed.

What is Form 8606 for?

The form may be used when reporting nondeductive contributions that an applicant has made this year to the standard IRAs. You may also use this form dealing with simple individual retirement arrangements. Check the instructions for more information about the notion of IRA and simple IRA (Publication 590).

When is Form 8606 Due?

This form must be filed by the due date of the forms to which it may be attached. If you need more time, you are eligible to request the time extension completing a separate form.

Is Form 8606 Accompanied by Other Forms?

Our 8606 must be filed along with Form 1040A, 1040 or 1040NR. Additionally, you must attach your return to all these documents.

What Information Must Be Included in Form 8606?

The form has three parts. Part 1 is called the Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs. You must provide the detailed information about all your nondeductive IRAs in this section of the document. Part 2 is devoted to 2016 Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs and the last part of the form is aimed at Roth IRAs distributions. Sign the document when all lines are filled in properly.

Where should I Send Form 8606?

The form must be sent to the Internal Revenue Service.