IRS W-2c 1991 free printable template

Show details

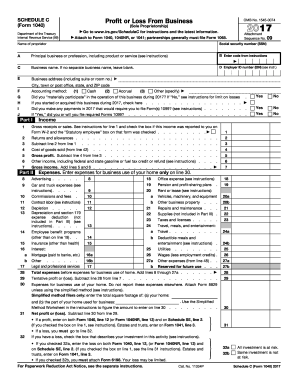

Text files for this cycle update? . 5-Page 1 of 12 Form W-2c (Page 2 is BLANK) O.K. to print Revised proofs requested Date Use carbon paper to make copies. Year and Form being corrected Employer's

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-2c

How to edit IRS W-2c

How to fill out IRS W-2c

Instructions and Help about IRS W-2c

How to edit IRS W-2c

To edit the IRS W-2c, access a blank copy of the form through a trusted online resource or software. Use the editing tools available in pdfFiller to modify the necessary information directly on the form. This may include correcting any errors such as misspelled names, incorrect Social Security numbers, or erroneous wages. Save your changes regularly to avoid losing any information during the editing process.

How to fill out IRS W-2c

Filling out the IRS W-2c requires several steps to ensure accuracy and compliance. Begin by identifying the employee's name, address, and Social Security number at the top of the form. Next, fill in the corrected amounts for wages, taxes withheld, and any other information that requires adjustment. Utilize the instructions provided by the IRS to guide your completion, ensuring all corrections are accurately reflected. Consider using pdfFiller's features for form-filling assistance.

About IRS W-2c 1991 previous version

What is IRS W-2c?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-2c 1991 previous version

What is IRS W-2c?

The IRS W-2c, or “Corrected Wage and Tax Statement,” is a tax form used by employers to correct errors on the original W-2 form issued to employees. The form serves as an official notification to the IRS about any changes that affect federal income tax withholding or wage reporting. This ensures that the information reported to the IRS is accurate, preventing complications for both employers and employees.

What is the purpose of this form?

The purpose of the IRS W-2c is to provide corrections to previously reported wage and tax information. Employers use this form when they identify mistakes on a W-2, such as incorrect employee details, wage discrepancies, or tax amounts. Correcting these errors is crucial for accurate tax filing and compliance, as it affects the employee's tax return and potential refunds or liabilities.

Who needs the form?

Employers who have issued a W-2 form with incorrect information must complete and file the IRS W-2c. This includes companies that made errors in reporting employee wages, withholding taxes, or other relevant information impacting the employee’s tax obligations. Employees receiving a corrected W-2c form also need to retain it for their records to ensure their tax filings reflect the corrected information.

When am I exempt from filling out this form?

Generally, you would be exempt from filing the IRS W-2c if there are no errors on your original W-2 form. If your W-2 accurately reflects your wages, tax withholding, and personal information, there is no need to file a correction. Additionally, if an employee does not receive a W-2 from an employer because they are not eligible for a health insurance subsidy or if wages fall below the reporting threshold, a W-2c may not be necessary.

Components of the form

The IRS W-2c includes several key components that facilitate the correction of wage reporting. The form comprises fields for the employee's personal details, the original W-2 form details, and the corrected information. Important sections include employee wages, Social Security benefits, and federal income tax withheld. Clear distinction between the original and corrected amounts is essential for both accuracy and clarity.

What are the penalties for not issuing the form?

Employers who fail to issue a W-2c when necessary may face various penalties from the IRS. This includes fines for late submission or failure to file. Penalties can accumulate for each incorrect or unfiled form, affecting the employer’s financial standing and compliance status. It is important for employers to promptly address any discrepancies to avoid these potential liabilities.

What information do you need when you file the form?

When filing the IRS W-2c, you will need accurate information regarding the original W-2, including its reference number, employer details, and employee information. Gather any documentation that supports the corrections you intend to make, such as payroll records, prior communications, and tax documents. This preparation ensures that you provide complete and accurate information on the correction form.

Is the form accompanied by other forms?

The IRS W-2c generally does not need to be accompanied by additional forms when submitted to the IRS, unless specified otherwise. Employers may, however, need to attach other documentation if they are making comprehensive corrections that involve additional tax reporting considerations. Always adhere to IRS guidelines for submitting the W-2c to ensure compliance with all regulations.

Where do I send the form?

The completed IRS W-2c should be sent to the IRS at the address specified in the form instructions, which may vary based on the employer's location and the method of submission. Additionally, employers must provide copies to the affected employees for their tax records. Make sure to verify the current mailing address for the IRS to avoid delays in processing the correction.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

This program is so easy to use...any document can be converted in to a fillable form, and even saved as a Word doc. Really love this program!

After contacting customer support, I was told that certain web browsers are more compatible than others in completing forms. Once I changed from Mozilla Firefox to Chrome, I was able to complete all fields of the form without problems. But it would have been helpful to publicize this information on your website so that much time was not wasted.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.