TX DARS1020 2013 free printable template

Show details

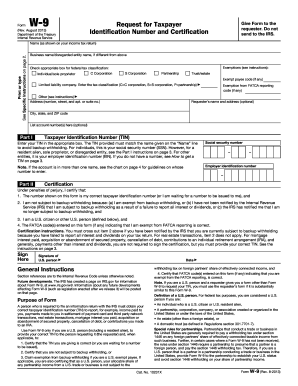

Agency Use Only DDS CPCSC AP New Set-up New MC Other DARS Substitute W-9 and Direct Deposit Form Box 1 Box 2 Box 3 Legal Name as shown on your tax return DBA City Phone Box 5 Box 6 State ZIP Payment Address if different from Tax Address Fax Email Social Security Number SSN Taxpayer Identification Employer Identification Number EIN Number Note Enter the same number used when filing your tax return. Texas Corporation Federal Tax Classification Business Designation Box 7 Box 8 Box 9 Box 4 Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX DARS1020

Edit your TX DARS1020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX DARS1020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX DARS1020 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX DARS1020. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX DARS1020 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX DARS1020

How to fill out TX DARS1020

01

Obtain the TX DARS1020 form from the Texas Department of Aging and Disability Services website or local office.

02

Fill in the applicant's personal information, including name, address, and contact details.

03

Provide information regarding the applicant's disability or condition.

04

Indicate the services or support requested in the appropriate section.

05

Attach any required documentation that may support the application.

06

Review the form for completeness and accuracy before submission.

07

Submit the form by mail or in person to the designated DARS office.

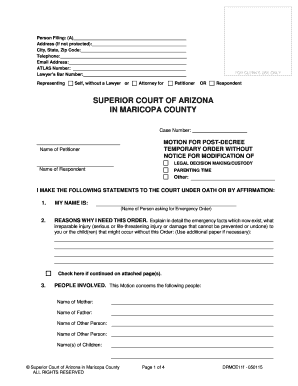

Who needs TX DARS1020?

01

Individuals applying for disability services or support in Texas.

02

Families or guardians seeking assistance for eligible individuals with disabilities.

03

Organizations assisting their clients with applications for services from DARS.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a W9 form online?

Most employers will provide you with a blank W-9 as a part of standard onboarding. Visit the IRS website to download a free W-9 Form from IRS website if you haven't received your form.

What is a W 9 form in Texas?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid. Acquisition or abandonment of secured property.

Is there an electronic W9 form?

It can be called a “request for taxpayer identification number and certification” but “W-9” is more typically used. W-9s can be e-signed and sent back to you digitally, saving time for contract workers and companies alike.

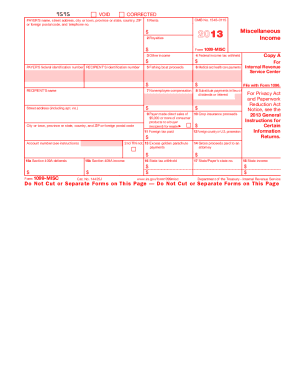

What is the difference between a 1099 and a W9?

The difference between 1099 vs W-9 is a straightforward one: the contractor fills out the W-9 form to provide information to the business they work for, and that business later reports the contractor's yearly earnings on the 1099 form.

Can I download a W 9 form?

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Who is required to fill out a W9?

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or “freelancer.” Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in TX DARS1020?

The editing procedure is simple with pdfFiller. Open your TX DARS1020 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit TX DARS1020 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing TX DARS1020.

Can I edit TX DARS1020 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share TX DARS1020 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

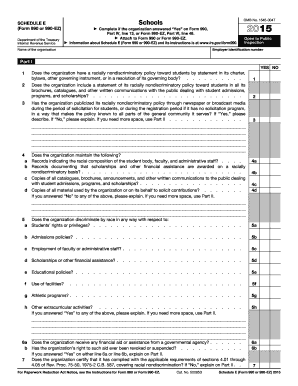

What is TX DARS1020?

TX DARS1020 is a document used in the state of Texas for reporting services or support provided to individuals with disabilities or special needs.

Who is required to file TX DARS1020?

Entities or individuals who provide services to individuals with disabilities, such as service providers or organizations receiving state funding, are required to file TX DARS1020.

How to fill out TX DARS1020?

TX DARS1020 must be filled out by providing detailed information about the services offered, the clients served, the duration of the services, and any additional required documentation as specified in the form's instructions.

What is the purpose of TX DARS1020?

The purpose of TX DARS1020 is to collect data and ensure accountability regarding the services provided to individuals with disabilities in Texas, ultimately aiming to improve these services.

What information must be reported on TX DARS1020?

Information that must be reported on TX DARS1020 includes the names of clients served, types of services provided, the duration of those services, and any specific outcomes or results achieved.

Fill out your TX DARS1020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX dars1020 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.