KY 51A158 free printable template

Show details

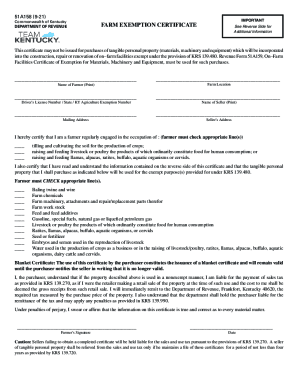

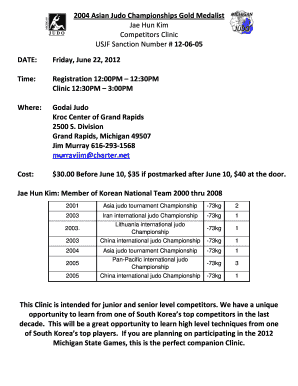

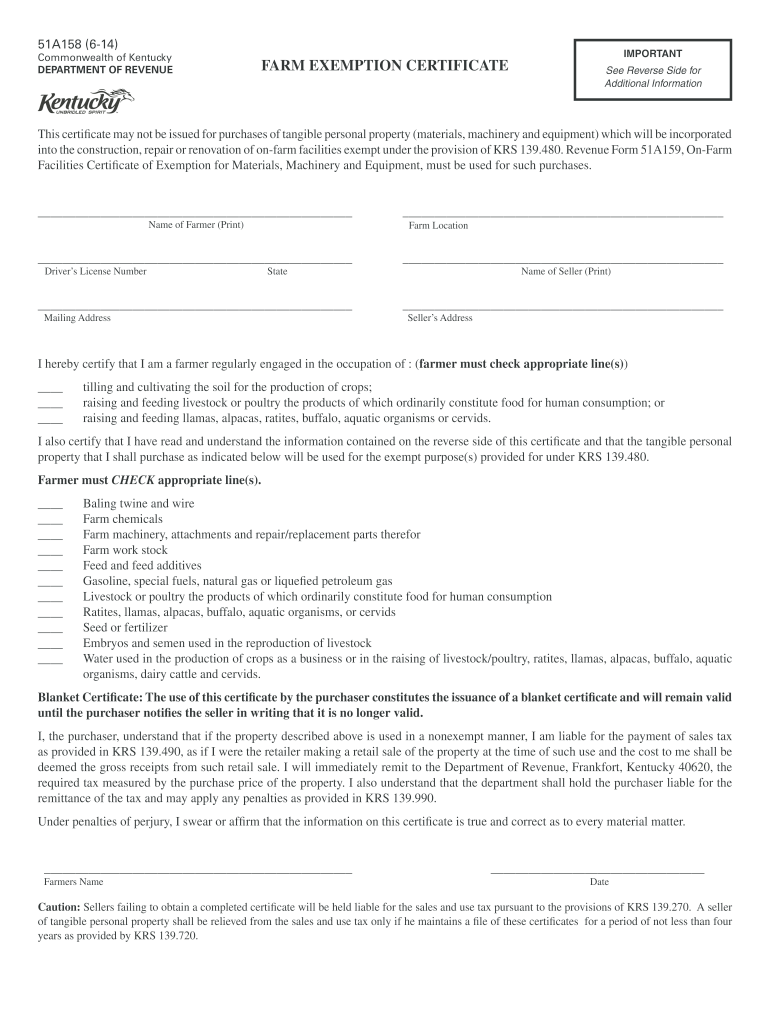

51A158 (6-14) Commonwealth of Kentucky DEPARTMENT OF REVENUE FARM EXEMPTION CERTIFICATE IMPORTANT See Reverse Side for Additional Information This certificate may not be issued for purchases of tangible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ky farm exemption form

Edit your ky farm exemption form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ky farm exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ky farm exemption form online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ky farm exemption form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A158 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

How many acres is a farm in Kentucky?

Under the enabling legislation for the amendment, to qualify as farmland the property had to contain a minimum number of acres (10 acres for agricultural land and 5 acres for horticultural land) and had to be used for agricultural or horticultural purposes.

How do I get farm exemption in ky?

You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment (Form 51A159) to each of your vendors using your Agriculture Exemption Number.

What is the tax break for farming in Kentucky?

Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural assets, subject to a $25,000 calendar year cap and a $100,000 lifetime cap.

What items are exempt from farm tax in Kentucky?

Examples of items which qualify for exemption in addition to the more commonly known items of “farm machinery” are: irrigation systems, tobacco curing equipment, farm wagons, portable insecticide sprayers, chain saws, mechanical cleaning equipment, mechanical shop equipment, mechanical posthole diggers, silo unloaders

How many acres do you need to be considered a farm in Kentucky?

"Agricultural land" means: Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ky farm exemption form to be eSigned by others?

When your ky farm exemption form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find ky farm exemption form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ky farm exemption form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in ky farm exemption form?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your ky farm exemption form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Fill out your ky farm exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ky Farm Exemption Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.