PH BIR -OT 2006 free printable template

Show details

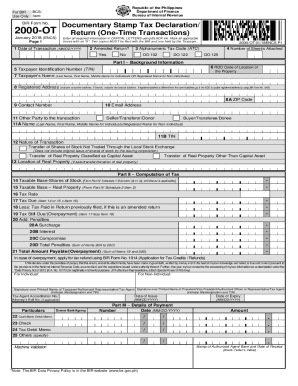

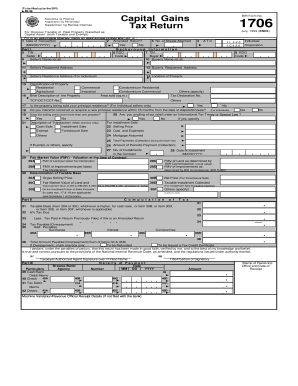

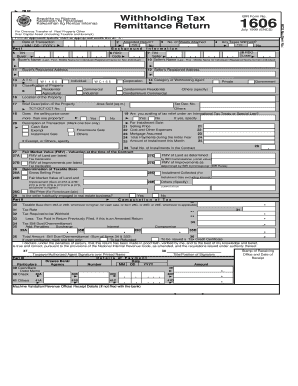

(To be filled up by the BIR) DAN: PSO: Republican NG Filipinas Catamaran NG Pananalapi Hawaiian NG Rental Internal SIC: Documentary Stamp Tax Declaration/Return BIR Form No. 2000-OT (ONE- TIME TRANSACTIONS)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PH BIR -OT

Edit your PH BIR -OT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH BIR -OT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PH BIR -OT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PH BIR -OT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 2000-OT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH BIR -OT

How to fill out PH BIR -OT

01

Gather necessary documents such as income statements and tax identification number (TIN).

02

Obtain the correct version of the PH BIR-OT form from the Bureau of Internal Revenue's website or office.

03

Fill out the personal information section with accurate details.

04

Include your income sources and amounts in the appropriate sections.

05

Calculate your total income and applicable taxes according to the instructions provided.

06

Review your entries for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the completed form to the BIR office or through the online portal, if applicable.

Who needs PH BIR -OT?

01

Individuals with other sources of income that do not fall under regular employment.

02

Freelancers and self-employed individuals who need to report their income.

03

Anyone required to file a tax return in the Philippines.

Instructions and Help about PH BIR -OT

Fill

form

: Try Risk Free

People Also Ask about

Who pays the documentary stamp tax Philippines?

The tax is paid by the person making, signing, issuing, accepting or transferring the documents.

What is Form 2000?

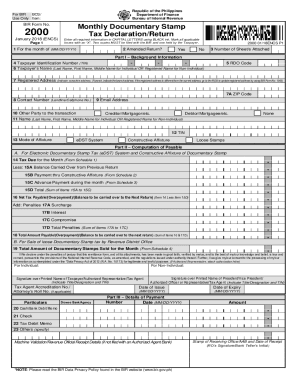

BIR Form 2000 is known as the Monthly Documentary Stamp Tax Declaration. Documentary Stamp Tax, also simply known as DST, is a tax in the Philippines applied to transaction documents regularly.

How much is the documentary stamp?

For specific transactions involving sale, delivery, or transfer of stock or property, as per the law, there is a documentary stamp tax of one peso and fifty centavos (Php 1.50) for every two hundred pesos (Php 200) or fractional part of the par value of such property.

How to fill out Form 2000?

0:34 2:17 Guide on how to fill out BIR Form 2000-OT (Documentary Stamp Tax YouTube Start of suggested clip End of suggested clip The atc nature of transaction. And if this is an amended return the date of transaction. Take noteMoreThe atc nature of transaction. And if this is an amended return the date of transaction. Take note the date of transaction is based on another date of sale or donation.

Where can I get a documentary stamp?

In the Authorized Agent Bank (AAB) within the territorial jurisdiction of the RDO which has jurisdiction over the residence or principal place of business of the taxpayer or where the property is located in case of sale of real property or where the Collection Agent is assigned.

How do I get a documentary stamp?

Mandatory Photocopy of the document to which the documentary stamp shall be affixed. Proof of exemption under special laws, if applicable; Proof of payment of documentary stamp tax paid upon the original issue of the stock, if applicable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out PH BIR -OT using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign PH BIR -OT and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out PH BIR -OT on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your PH BIR -OT. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out PH BIR -OT on an Android device?

Use the pdfFiller mobile app and complete your PH BIR -OT and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is PH BIR -OT?

PH BIR -OT refers to the Bureau of Internal Revenue's Official Taxpayer's Registration system in the Philippines, specifically for reporting income and other tax obligations.

Who is required to file PH BIR -OT?

Individuals and entities earning income in the Philippines are required to file PH BIR -OT, including sole proprietors, corporations, and partnerships.

How to fill out PH BIR -OT?

To fill out PH BIR -OT, taxpayers need to provide personal details, income earned, deductions, and other relevant financial information as specified in the form.

What is the purpose of PH BIR -OT?

The purpose of PH BIR -OT is to ensure that taxpayers accurately report their income and comply with tax obligations to the Bureau of Internal Revenue.

What information must be reported on PH BIR -OT?

Information required on PH BIR -OT includes taxpayer's name, tax identification number (TIN), income amounts, allowable deductions, and other pertinent financial data.

Fill out your PH BIR -OT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH BIR -OT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.