Get the free Health Care Expenses - tuscolacounty

Show details

This document outlines the provisions for Ordinary Medical Expenses (OME) and Extraordinary Medical Expenses (EME) related to child support as per the Michigan Child Support Formula, including instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health care expenses

Edit your health care expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health care expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health care expenses online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit health care expenses. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health care expenses

How to fill out Health Care Expenses

01

Gather all receipts and documentation for health care expenses.

02

Organize expenses by category (e.g., medical, dental, vision).

03

Enter the date of each expense.

04

Provide descriptions for each expense, including the service provider.

05

Record the amount paid for each expense.

06

Include any insurance reimbursements received for each expense.

07

Calculate the total health care expenses for the reporting period.

Who needs Health Care Expenses?

01

Individuals who have incurred health care costs.

02

Families looking to track their medical expenses.

03

Taxpayers seeking to claim health care deductions.

04

Anyone who wants to better manage their health care budget.

Fill

form

: Try Risk Free

People Also Ask about

What are health care expenses?

Health care costs can be defined in three ways: 1) the expense incurred by providers in the delivery of health care services 2) the amount that is paid for services rendered by private and public payers; and 3) out-of-pocket patient spending for health care services.

What is not considered a qualified medical expense?

Other examples of nondeductible medical expenses are nonprescription drugs, doctor prescribed travel for "rest," and expenses for the improvement of your general health such as a weight loss program or health club fees (the weight loss program is deductible if it is to treat a specific disease).

What are examples of health costs?

Typical medical expenses that you may have to cover that are not reimbursed include copays, coinsurance, and deductibles. They can also include any other services that your health insurance will not cover, such as glasses, crutches, and wheelchairs.

What are associated medical expenses?

An Associated Medical Expense is a type of expense that includes various aspects covered under a medical insurance policy , such as room rent costs, RMO and nursing charges costs, operation theatre costs, doctor/surgeon/specialist/anaesthesiologist fees, etc.

What are eligible healthcare expenses?

Common IRS-qualified medical expenses Acupuncture. Ambulance. Artificial limbs. Artificial teeth* Birth control treatment. Blood sugar test kits for diabetics. pumps and lactation supplies. Chiropractor.

What does the IRS consider qualified medical expenses?

An IRS-qualified medical expense is defined as an expense that pays for healthcare services, equipment, or medications. Funds used to pay for IRS-qualified medical expenses are always tax-free.

What are qualified health care expenses?

They include the costs of equipment, supplies, and diagnostic devices needed for these purposes. Medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don't include expenses that are merely beneficial to general health, such as vitamins or a vacation.

What is a qualified healthcare expense?

Dental treatments (including X-rays, cleanings, fillings, sealants, braces and tooth removals*) Doctor's office visits and co-pays. Drug prescriptions. Eyeglasses (Rx and reading)* Fluoride treatments*

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Care Expenses?

Health Care Expenses refer to the costs incurred for medical treatments, preventative care, medications, hospital stays, and other healthcare services.

Who is required to file Health Care Expenses?

Individuals or households that incurred significant medical expenses during the tax year may be required to file Health Care Expenses with their tax returns, particularly if they are itemizing deductions.

How to fill out Health Care Expenses?

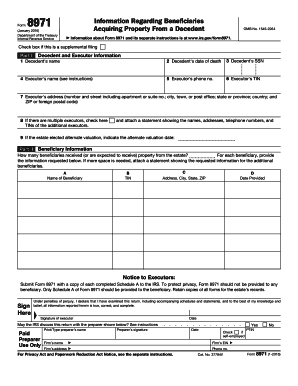

Health Care Expenses can be filled out by collecting all relevant medical receipts, totaling the expenses, and reporting them on the designated tax forms, such as Schedule A (Form 1040) for itemized deductions.

What is the purpose of Health Care Expenses?

The purpose of reporting Health Care Expenses is to allow taxpayers to potentially deduct medical costs that exceed a certain percentage of their adjusted gross income, thereby reducing their taxable income.

What information must be reported on Health Care Expenses?

Health Care Expenses must include information such as the total amount of qualifying medical expenses, dates of service, names of healthcare providers, and any reimbursements received for these expenses.

Fill out your health care expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Care Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.