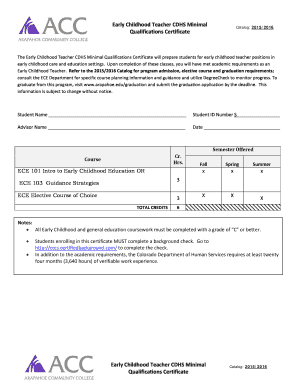

IRS 13614-NR 2020 free printable template

Show details

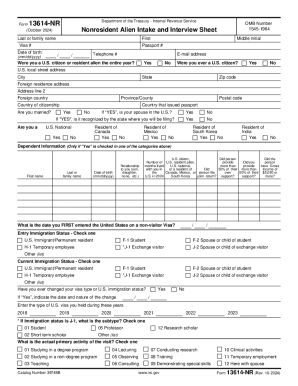

Department of the Treasury Internal Revenue ServiceNow 13614NR (October 2020)Last or Family NameFirstITIN or Social Security # Date of Birth:Middle Initial Visa #/(mm/dd/YYY)OMB Number 15452075Nonresident

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13614-NR

Edit your IRS 13614-NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13614-NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 13614-NR online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 13614-NR. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13614-NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13614-NR

How to fill out IRS 13614-NR

01

Obtain a copy of IRS Form 13614-NR from the IRS website or your local IRS office.

02

Begin by filling out your personal information, including your name, address, and Social Security Number or Individual Taxpayer Identification Number (ITIN).

03

Indicate your filing status by checking the appropriate box (e.g., single, married filing jointly).

04

Report your income information in the designated sections, including wages, interest, dividends, and any other sources of income.

05

Provide details regarding your identified deductions and credits.

06

Answer any additional questions related to your residency status, prior year tax returns, and any international income sources.

07

Review your completed form for accuracy and completeness before submitting.

Who needs IRS 13614-NR?

01

IRS Form 13614-NR is needed by non-resident aliens who are required to file a U.S. tax return, typically for income earned in the U.S.

02

It is also used by individuals who have been in the U.S. for a limited time and need to report their income for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

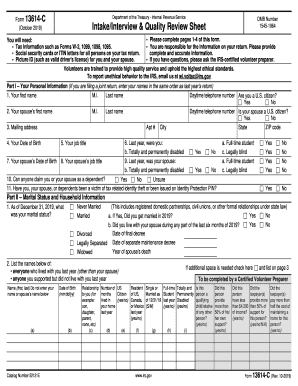

What is the form used for the intake interview?

Form 13614-C, Intake/Interview & Quality Review Sheet, is a tool designed to help ensure taxpayers are given the opportunity to provide all needed information before their tax return is prepared. When used properly, this form effectively contributes to accurate tax return preparation.

What is form 15080?

Form 15080. (October 2022) Department of the Treasury - Internal Revenue Service. Consent to Disclose Tax Return Information to. VITA/TCE Tax Preparation Sites.

What is a nonresident alien w4?

Any individual who is not a citizen or resident of the United States is a nonresident alien individual. For more information about resident and nonresident alien status, please see IRS Publication 519, U.S. Tax Guide for Aliens.

How do I know if I am a resident alien?

You are a resident alien of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year. In some cases, aliens can choose to be treated as U.S. resident aliens.

What is an IRS form 14446?

Form 14446. (November 2022) Department of the Treasury - Internal Revenue Service. Virtual VITA/TCE Taxpayer Consent. This form is required when any part of the tax return preparation process is completed without in-person interaction between the taxpayer and the VITA/TCE volunteer.

What is form 14817 used for?

What is Form 14817 used for? Purpose of Form: Use Form 14157-A if (1) a tax return preparer filed a Form 1040 series tax return or altered your Form 1040 series tax return information without your knowledge or consent AND (2) you are seeking a change to your tax account.

What is a resident alien for IRS?

A resident alien is an individual that is not a citizen or national of the United States and who meets either the green card test or the substantial presence test for the calendar year.

Why is an intake form important?

What's an intake form? An intake form helps service providers streamline the client onboarding process and easily gather information from new clients. This questionnaire is a way for you to get to know your clients in the early stages of your relationship with them.

Who qualifies as resident alien?

You are a resident alien of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year. In some cases, aliens can choose to be treated as U.S. resident aliens.

What is difference between resident alien and nonresident alien?

The main difference between the two is the paperwork and what income is taxed. Resident aliens in the U.S. owe taxes on their entire income (regardless where it was earned), while the non-resident alien tax rate only applies to taxes on the income from U.S. sources.

What is Form 13614-C used for?

Use Form 13614-C, Intake and Interview Sheet to engage your taxpayer in preparing an accurate return.

What is the form 13614-C used for?

Use Form 13614-C, Intake and Interview Sheet to engage your taxpayer in preparing an accurate return.

Can you report a tax preparer to the IRS?

To report a tax return preparer for improper tax preparation practices, complete and send Form 14157, Complaint: Tax Return Preparer PDF with all supporting documentation to the IRS. The form and documentation can be faxed or mailed, but please do not do both.

What does non resident alien mean on w4?

An alien is any individual who is not a U.S. citizen or U.S. national. A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

What is the difference between a nonresident and resident alien?

A non-resident alien is classified as a resident alien for tax purposes if they were physically present in the U.S. for 31 days during the current year and 183 days during a three-year period that includes the current year and the two years immediately before that.

Are you a nonresident alien for federal tax purposes?

A non-resident alien for tax purposes is a person who is not a U.S. citizen and who does not meet either the “green card” or the “substantial presence” test as described in IRS Publication 519, U.S. Tax Guide for Aliens.

How do I prove a dependent to the IRS?

The dependent's birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

How does the IRS define a non resident alien?

An alien is any individual who is not a U.S. citizen or U.S. national. A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

What is an example of a resident alien?

F and J student visa holders are considered resident aliens after five calendar years in the U.S. J researchers and professors are considered resident aliens after two calendar years in the U.S.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS 13614-NR online?

With pdfFiller, you may easily complete and sign IRS 13614-NR online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the IRS 13614-NR in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit IRS 13614-NR on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IRS 13614-NR.

What is IRS 13614-NR?

IRS Form 13614-NR is a document used by the Internal Revenue Service (IRS) for non-resident aliens to provide information necessary for the preparation of their tax returns.

Who is required to file IRS 13614-NR?

Non-resident aliens who have U.S. source income or who need to report their foreign income to the IRS are required to file IRS Form 13614-NR.

How to fill out IRS 13614-NR?

To fill out IRS Form 13614-NR, individuals must provide personal information, income details, and marital status, and must ensure all relevant sections are completed before submission.

What is the purpose of IRS 13614-NR?

The purpose of IRS Form 13614-NR is to gather necessary information from non-resident aliens to accurately assess their tax liability and facilitate the filing of their tax returns.

What information must be reported on IRS 13614-NR?

Information that must be reported on IRS Form 13614-NR includes personal identification details, income sources, tax treaty information, and any deductions or credits applicable.

Fill out your IRS 13614-NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13614-NR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.