IRS 13614-NR 2019 free printable template

Show details

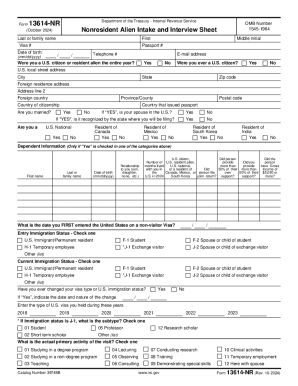

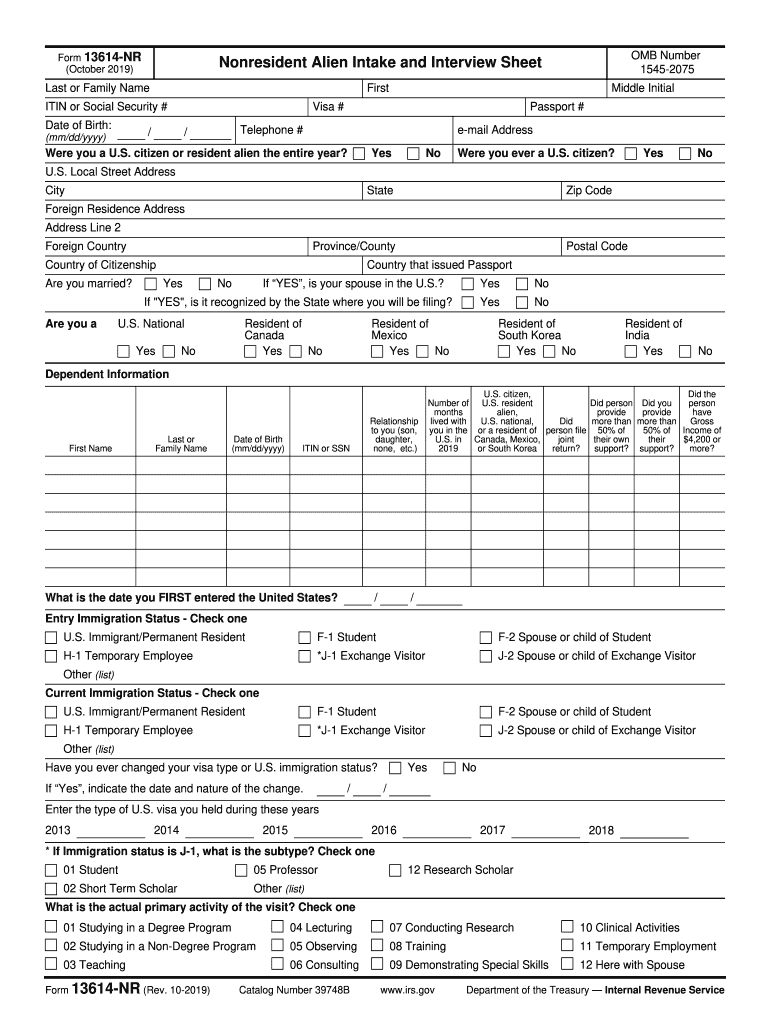

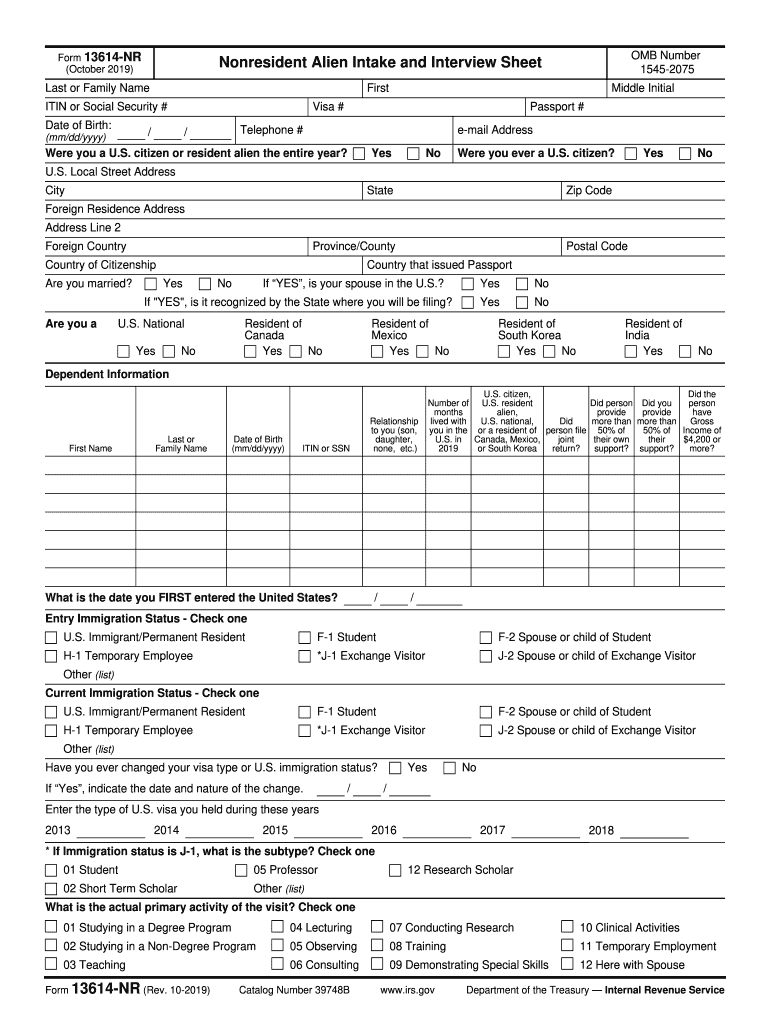

Form 13614NR

(October 2019)Nonresident Alien Intake and Interview Sheets or Family NameFirstITIN or Social Security #

Date of Birth:Middle Initial Visa #/(mm/dd/YYY)Passport #Telephone #/OMB Number

15452075email

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13614-NR

Edit your IRS 13614-NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13614-NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 13614-NR online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 13614-NR. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13614-NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13614-NR

How to fill out IRS 13614-NR

01

Gather necessary documents including your identification, income statements, and any records of tax withheld.

02

Obtain the IRS Form 13614-NR from the IRS website or an authorized location.

03

Start filling out the form by providing your personal information such as name, address, and identification number.

04

Indicate your filing status (e.g., single, married, etc.) and the reason for filing.

05

List all sources of income you received during the tax year.

06

Complete the section regarding deductions or credits you may be eligible for.

07

Review the entire form for accuracy, making sure all sections are filled out correctly.

08

Sign and date the form before submitting it to the appropriate IRS address.

Who needs IRS 13614-NR?

01

Non-resident Aliens who are required to file a U.S. federal tax return.

02

Individuals who have U.S. income and are not citizens or permanent residents.

03

Foreign students, scholars, or researchers who received income from U.S. sources.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I am a resident alien or nonresident alien?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

What is a non resident alien for tax purposes?

People are considered nonresident aliens if they are tourists, students, and certain businesspeople. Unlike resident aliens, nonresident aliens must file taxes on any income generated within the United States. Any foreign-earned income doesn't qualify for taxation in the U.S.

What is a 13614-C?

Form 13614-C, Intake, Interview & Quality Review, is the intake form developed by the IRS-SPEC office—the part of IRS that administers the VITA program. ▪Form 13614-C is: ▪designed to capture the information that is needed to prepare a. complete and accurate tax return. ▪

What is the purpose of Form 13614-C?

Use Form 13614-C, Intake and Interview Sheet to engage your taxpayer in preparing an accurate return.

What is the difference between a non resident alien and a resident alien?

Resident aliens generally are taxed on their worldwide income, similar to U.S. citizens. A non-resident alien is a lawful permanent resident of the U.S. at any time if they have been given the privilege, ing to the immigration laws, of residing permanently as an immigrant.

What is IRS form 13614-C used for?

Form 13614-C, Intake/Interview & Quality Review Sheet, is a tool designed to help ensure taxpayers are given the opportunity to provide all needed information before their tax return is prepared. When used properly, this form effectively contributes to accurate tax return preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 13614-NR for eSignature?

Once your IRS 13614-NR is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out IRS 13614-NR using my mobile device?

Use the pdfFiller mobile app to fill out and sign IRS 13614-NR on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit IRS 13614-NR on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS 13614-NR on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS 13614-NR?

IRS 13614-NR is a form used by non-resident aliens to provide information required for the preparation of their federal income tax returns.

Who is required to file IRS 13614-NR?

Non-resident aliens who are required to file a U.S. tax return, particularly those with income from U.S. sources, must complete IRS 13614-NR.

How to fill out IRS 13614-NR?

To fill out IRS 13614-NR, individuals must provide their personal information, including name, address, and taxpayer identification number, as well as details about their income and tax situation, ensuring all relevant sections are accurately completed.

What is the purpose of IRS 13614-NR?

The purpose of IRS 13614-NR is to collect necessary information from non-resident aliens to assist in the correct filing of their U.S. tax returns.

What information must be reported on IRS 13614-NR?

Information required on IRS 13614-NR includes personal identification details, residency status, income types and amounts, tax withholding information, and any deductions or credits claimed.

Fill out your IRS 13614-NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13614-NR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.