Get the free Alabama Form 40 2-D Barcode Scenario Test #2 - ador state al

Show details

This document is an individual income tax return form for Alabama residents and part-year residents for the tax year 2003, detailing income, deductions, tax liability, and payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alabama form 40 2-d

Edit your alabama form 40 2-d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama form 40 2-d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama form 40 2-d online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit alabama form 40 2-d. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alabama form 40 2-d

How to fill out Alabama Form 40 2-D Barcode Scenario Test #2

01

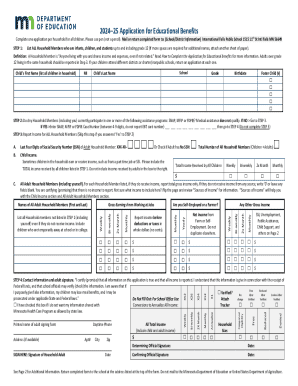

Gather all relevant personal information including Social Security number, filing status, and address.

02

Download the Alabama Form 40 2-D Barcode Scenario Test #2 from the Alabama Department of Revenue website.

03

Complete the personal information section at the top of the form.

04

Report your income in the designated income sections, including wages, interest, dividends, and any other sources of income.

05

Fill out the deductions and credits sections as applicable to your situation.

06

Double-check all entries for accuracy and ensure all required fields are filled out.

07

Review the instructions provided with the form for any additional requirements or specifics.

08

Print the completed form and scan it to create a 2-D barcode as directed by the guidelines.

09

Submit the form as per the submission guidelines provided, ensuring to keep a copy for your records.

Who needs Alabama Form 40 2-D Barcode Scenario Test #2?

01

Individuals residing in Alabama who are required to file a state income tax return.

02

Taxpayers seeking to claim specific deductions or credits on their state tax return.

03

Individuals who may need to report income from various sources such as employment or investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum late payment penalty?

The failure-to-pay penalty is one-half of one percent for each month, or part of a month, up to a maximum of 25%, of the amount of tax that remains unpaid from the due date of the return until the tax is paid in full.

What is the penalty for late tax payments in Alabama?

In the event the taxpayer fails to pay the tax shown due on a monthly or quarterly return on or before the due date prescribed for the payment of the tax, a penalty of 10 percent of the amount of the tax not paid on or before the due date shall be added.

What is a 2D barcode return?

Conventional barcodes get wider as more data is encoded, while 2D barcodes make use of the vertical dimension for data. These barcodes contain all pertinent tax information from your return and are scanned by computers with the IRS or state tax agency.

What is the penalty for late payments on form 40 in Alabama?

In lieu of the penalty provided in the immediately preceding sentence, for any tax for which a monthly or quarterly return is required, or for which no return is required, the department shall add a failure to timely pay penalty of 10 percent of the unpaid amount stated in the notice and demand unless payment is

Are you required to file both form 40 and form 40NR for your Alabama income?

(1) Every resident individual taxpayer required to file a return should do so using Form 40 or Form 40A, copies of which may be obtained from the Department. Nonresidents should file using Form 40NR. For use of Form 40A, see Rule 810-3-81-.

Who needs to file business privilege tax in Alabama?

ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

What is the penalty for late payment?

The penalty for late tax payment includes interest under Sections 234A, 234B, and 234C and possible late fees under Section 234F. Interest is charged at 1% per month, while late filing fees can be up to Rs. 5,000. Persistent non-payment may lead to notices, penalties, or prosecution by the Income Tax Department.

What is the late filing penalty?

The failure-to-file penalty is usually 5% of the tax owed for each month your return is overdue, up to 25% of the bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

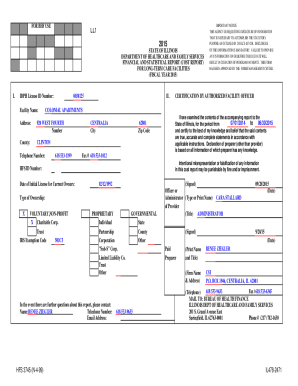

What is Alabama Form 40 2-D Barcode Scenario Test #2?

Alabama Form 40 2-D Barcode Scenario Test #2 is a specific version of the Alabama state income tax return form designed to include 2-D barcode technology for efficient processing.

Who is required to file Alabama Form 40 2-D Barcode Scenario Test #2?

Taxpayers who have a certain income level or who are claiming specific deductions or credits are typically required to file Alabama Form 40 2-D Barcode Scenario Test #2.

How to fill out Alabama Form 40 2-D Barcode Scenario Test #2?

To fill out Alabama Form 40 2-D Barcode Scenario Test #2, taxpayers should provide their personal information, report income details, claim deductions, and ensure that all entries are accurate before submitting the form.

What is the purpose of Alabama Form 40 2-D Barcode Scenario Test #2?

The purpose of Alabama Form 40 2-D Barcode Scenario Test #2 is to collect state income tax information from residents for taxation purposes, utilizing barcode technology to streamline form processing.

What information must be reported on Alabama Form 40 2-D Barcode Scenario Test #2?

Information that must be reported includes taxpayer identification details, total income, taxable income amount, claimed deductions, credits, and any additional information required for compliance with Alabama tax laws.

Fill out your alabama form 40 2-d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Form 40 2-D is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.