Get the free 2010 Investment Advisory Agreement App Page-ALIC - insurance arkansas

Show details

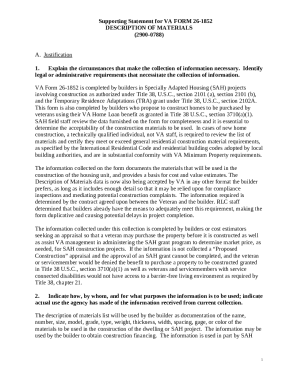

This document outlines the application component pages for the Investment Advisory Agreement for variable products from Ameritas Life Insurance Corp.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010 investment advisory agreement

Edit your 2010 investment advisory agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 investment advisory agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2010 investment advisory agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2010 investment advisory agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2010 investment advisory agreement

How to fill out 2010 Investment Advisory Agreement App Page-ALIC

01

Obtain the 2010 Investment Advisory Agreement App Page-ALIC form from the appropriate financial authority or website.

02

Read through the entire form carefully to understand the required information.

03

Begin filling out the personal information section, including your full name, address, and contact details.

04

Provide the necessary financial information, such as your investment objectives and risk tolerance.

05

Detail any previous investment experience and any relevant details about your financial status.

06

Review the terms and conditions outlined in the agreement and ensure you understand them.

07

Sign and date the agreement where indicated to validate your consent.

08

Submit the completed form to the designated financial advisor or firm as instructed.

Who needs 2010 Investment Advisory Agreement App Page-ALIC?

01

Individuals seeking professional financial advice and investment management.

02

Clients looking to establish a formal agreement with an investment advisor.

03

Prospective investors who need to outline their investment goals and expectations.

Fill

form

: Try Risk Free

People Also Ask about

What is an investment advisory contract?

Investment advisory contracts are legal documents that outline the relationship between the client and the investment advisor. They provide clear guidelines of what is expected of each party in order for your needs to be met.

Are investment advisory contracts required to be written?

Although the Investment Advisers Act does not expressly require that agreements or advisory contracts be in writing, it is generally considered best practice to have a written agreement between the investment adviser and the client and certain provisions of the Investment Advisers Act, such as Section 205, and SEC Rule

What books and records are required for investment advisers?

The records required of investment advisers who have custody of client assets include: Journals showing securities transactions. Separate client ledger. Copies of trade confirmations. Record for each security held by client showing amount and location.

What is the ABC rule for investment advisors?

ing to the Investment Advisers Act of 1940, anyone in the business of rendering advice about securities for compensation is, absent an exclusion or exemption, required to register as an investment adviser. Thus, Advice, Business, Compensation, and Securities (ABCS) are the key elements in this definition.

What are the regulatory requirements for investment advisors?

Generally, the SEC regulates RIAs that manage $100 million or more in client assets, also known as assets under management (AUM). There are certain exemptions to this rule that allow for SEC registration even if the assets threshold hasn't been met.

What is the SEC rule for investment advisers?

Investment Advisers Act of 1940 This law regulates investment advisers. With certain exceptions, this Act requires that firms or sole practitioners compensated for advising others about securities investments must register with the SEC and conform to regulations designed to protect investors.

What is the difference between investment management agreement and investment advisory agreement?

Investment Advisory Agreement means the investment advisory agreement entered into between the Adviser and the Fund, as from time to time in effect. Investment Management Agreement means the Investment Management Agreement, dated as of the date hereof, by and between the Investment Manager and the Borrower.

What is the investment advisory agreement?

Investment advisory services agreement is a cornerstone for any relationship between a financial advisor and a client. It's a legally binding contract that outlines key terms and conditions, which include the scope of services, fee structures, and mutual responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

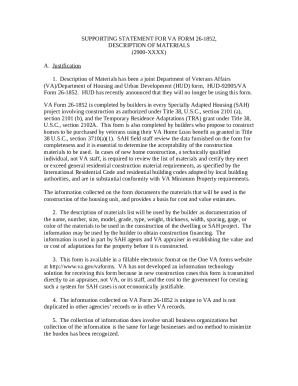

What is 2010 Investment Advisory Agreement App Page-ALIC?

The 2010 Investment Advisory Agreement App Page-ALIC is a form used for submitting investment advisory agreements, typically related to the registration of investment advisors and their compliance with regulatory requirements.

Who is required to file 2010 Investment Advisory Agreement App Page-ALIC?

Investment advisors who are registering with regulatory authorities, such as the SEC or state regulators, and who enter into advisory agreements with their clients are required to file the 2010 Investment Advisory Agreement App Page-ALIC.

How to fill out 2010 Investment Advisory Agreement App Page-ALIC?

To fill out the 2010 Investment Advisory Agreement App Page-ALIC, you must provide details about the advisory firm, the nature of the services offered, client information, terms of the advisory agreement, and any associated fees. Ensure all sections are completed accurately in accordance with the instructions provided with the form.

What is the purpose of 2010 Investment Advisory Agreement App Page-ALIC?

The purpose of the 2010 Investment Advisory Agreement App Page-ALIC is to ensure transparency and compliance in the advisory relationship by outlining the terms of the agreement between the investment advisor and their clients.

What information must be reported on 2010 Investment Advisory Agreement App Page-ALIC?

The information that must be reported on the 2010 Investment Advisory Agreement App Page-ALIC includes the advisor's name and registration details, client names, services provided, fee structures, terms of the agreement, and any potential conflicts of interest.

Fill out your 2010 investment advisory agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010 Investment Advisory Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.