Get the free Appeals Procedures: Sales and Use Taxes and Special Taxes - boe ca

Show details

This document outlines the appeals procedures for sales and use taxes and special taxes administered by the State Board of Equalization (BOE), detailing how taxpayers can contest determinations of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appeals procedures sales and

Edit your appeals procedures sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appeals procedures sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appeals procedures sales and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appeals procedures sales and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out appeals procedures sales and

How to fill out Appeals Procedures: Sales and Use Taxes and Special Taxes

01

Obtain the Appeals Procedures form from the relevant tax authority's website or office.

02

Read the instructions carefully to understand the requirements for filing an appeal.

03

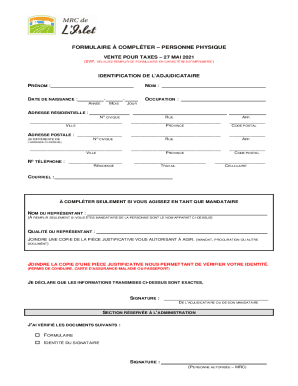

Complete the section detailing your personal or business information, including name, address, and contact details.

04

Provide specific information about the sales or use tax assessment you are appealing, including dates and amounts involved.

05

Clearly state the reasons for your appeal, including any supporting evidence or documents.

06

Review the appeal for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form by the deadline, following the submission guidelines provided by the tax authority.

Who needs Appeals Procedures: Sales and Use Taxes and Special Taxes?

01

Businesses or individuals who believe they have been incorrectly assessed sales and use taxes or special taxes.

02

Taxpayers who have received a notice of determination from tax authorities regarding tax liability.

03

Anyone who wishes to challenge a decision made by tax authorities related to sales and use tax assessments.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a powerful appeal letter?

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. Be Factual. Include factual detail but avoid dramatizing the situation. Be Specific. Documentation. Stick to the Point. Do Not Try to Manipulate the Reader. How to Talk About Feelings. Be Brief.

Can I sue the CDTFA?

If CDTFA does not act on your claim for refund within six months of the date you filed it, you have the option of deeming the claim denied by CDTFA and proceeding with a lawsuit. If you do so, however, CDTFA's administrative review of your claim ceases, and the dispute will be resolved in the court action you filed.

What does the Office of Tax Appeals do?

OTA is dedicated solely to the adjudication of tax disputes and has no functions or purposes other than deciding tax appeals for California taxpayers. An appeal to OTA presents the final opportunity for taxpayers to resolve their tax disputes with the state's tax agencies administratively, without going to court.

How do I write an appeal letter for taxes?

The following should be provided in the protest: Taxpayer's name and address, and a daytime telephone number. A statement that taxpayer wants to appeal the IRS findings to the Appeals Office. A copy of the letter proposed tax adjustment. The tax periods or years involved.

How do I write an appeal letter for income tax?

Dear Sir or Madam, I hereby appeal the income tax assessment for the year [TAX YEAR] dated [DATE]. Thank you in advance. ? You can include your mailing address either under your name or in your email signature to ensure the tax office can contact you by post.

How to write a letter of tax appeal?

The written protest must contain the following information: Your name and address; The date and symbols from the examination report listing the proposed adjustments; The tax periods or years involved; A statement of the adjustments being protested;

How to appeal paying taxes?

Taxpayers may appeal an assessment or refund claim denial originating from the Franchise Tax Board (FTB) or the California Department of Tax and Fee Administration (CDTFA). You must file an appeal with OTA through the Office of Tax Appeals Portal (OTAP).

How do I write an effective letter of appeal to the IRS?

The following should be provided in the protest: Taxpayer's name and address, and a daytime telephone number. A statement that taxpayer wants to appeal the IRS findings to the Appeals Office. A copy of the letter proposed tax adjustment. The tax periods or years involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Appeals Procedures: Sales and Use Taxes and Special Taxes?

Appeals Procedures for Sales and Use Taxes and Special Taxes refer to the formal process through which taxpayers can contest or appeal decisions made by tax authorities regarding the assessment, collection, or enforcement of sales and use taxes and special taxes.

Who is required to file Appeals Procedures: Sales and Use Taxes and Special Taxes?

Any taxpayer who believes that an assessment or decision made by the tax authority regarding sales and use taxes or special taxes is incorrect may file an appeal. This typically includes businesses and individuals subject to these taxes.

How to fill out Appeals Procedures: Sales and Use Taxes and Special Taxes?

To fill out the Appeals Procedures, the taxpayer must complete the designated appeal form provided by the tax authority, ensuring all required information is accurately reported, including the taxpayer's details, the tax assessment in question, and the reasons for the appeal.

What is the purpose of Appeals Procedures: Sales and Use Taxes and Special Taxes?

The purpose of Appeals Procedures is to provide a structured method for taxpayers to challenge tax assessments or decisions, ensuring due process and allowing for a fair review of the taxpayer's claims.

What information must be reported on Appeals Procedures: Sales and Use Taxes and Special Taxes?

The information that must be reported typically includes the taxpayer's identification details, the specific tax assessment being appealed, a detailed explanation of the grounds for the appeal, supporting documentation, and any other relevant information as required by the tax authority.

Fill out your appeals procedures sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appeals Procedures Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.