Get the free California Schedule P (100W) 2006

Show details

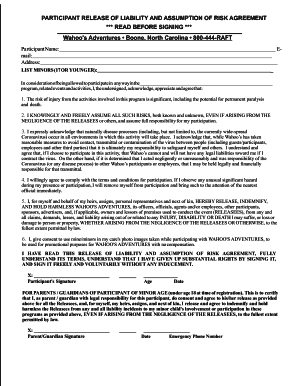

This document is a tax form used in California to compute the Tentative Minimum Tax (TMT) and the Alternative Minimum Tax (AMT) for corporations filing under the water's-edge election. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california schedule p 100w

Edit your california schedule p 100w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california schedule p 100w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california schedule p 100w online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california schedule p 100w. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california schedule p 100w

How to fill out California Schedule P (100W) 2006

01

Obtain the California Schedule P (100W) 2006 form either online or from the California Franchise Tax Board.

02

Fill out your company information at the top of the form, including name, address, and entity number.

03

Complete Part I by providing the necessary information regarding the federal taxable income.

04

For Part II, list any adjustments to income that are specific to California.

05

In Part III, report the distribution of income and expenses among shareholders, if applicable.

06

Use Part IV to declare any prior year losses or other adjustments.

07

Review all entries for accuracy and completeness before submitting the form.

08

File the completed Schedule P (100W) alongside your California corporate tax return.

Who needs California Schedule P (100W) 2006?

01

Any corporation operating in California that is required to file a California corporate tax return.

02

Companies that need to report income, deductions, and credits specific to California.

03

Corporations that are part of a combined report for California tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to pay California franchise tax?

All businesses registered with the state of California have to pay the California Franchise Taxes (except for tax-exempt businesses like nonprofits). This means that C corps, S corps, LLCs, LPs, LLPs, and LLLPs all are all responsible for the California Franchise Tax.

What is the difference between form 100 and 100W in California?

Form 100 California Corporation Franchise or Income Tax Return is the regular return for CA corporations. Form 100W California Corporation Franchise or Income Tax Return--Water's-Edge Filers can be filed by combined groups that meet the requirements.

Who must file California Form 100?

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

What is California Schedule P?

Use Schedule P (540), Alternative Minimum Tax and Credit Limitations – Residents, to determine if: You owe AMT. Your credits must be reduced or eliminated entirely. Your credits may be limited even if you do not owe AMT, so be sure to complete Side 1 and Side 2 of Schedule P (540).

What is the minimum tax in California 100S?

CA 100 or 100 S The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21. The amount due for the current return can be paid via the PMT screen or with voucher CA 3586-V.

What is form 100W in California?

General Information. C corporations filing on a water's-edge basis are required to use Form 100W to file their California tax returns. In general, water's-edge rules provide for an election out of worldwide combined reporting.

What is California 100S?

Form 100S is used if a corporation has elected to be a small business corporation (S corporation). All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. The tax rate for financial S corporations is 3.5%.

What is California law sb100?

This bill would state that it is the policy of the state that eligible renewable energy resources and zero-carbon resources supply 100% of retail sales of electricity to California end-use customers and 100% of electricity procured to serve all state agencies by December 31, 2045.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is California Schedule P (100W) 2006?

California Schedule P (100W) 2006 is a tax form used by corporations in California to report and calculate their California state tax liabilities, specifically for corporations that are classified as 'water's-edge' or 'worldwide.'

Who is required to file California Schedule P (100W) 2006?

Corporations that are doing business in California and are required to file Form 100 (California Corporation Franchise or Income Tax Return) must also file Schedule P (100W) if they have income that is subject to apportionment.

How to fill out California Schedule P (100W) 2006?

To fill out California Schedule P (100W) 2006, corporations must gather their financial data, including gross income and expenses. They need to provide information on their apportionment factors, calculate their California taxable income, and report any additional adjustments necessary for state tax calculations.

What is the purpose of California Schedule P (100W) 2006?

The purpose of California Schedule P (100W) 2006 is to determine the portion of a corporation's income that is taxable in California, which aids in calculating the correct amount of state taxes owed.

What information must be reported on California Schedule P (100W) 2006?

Corporations must report their total income, apportionment factors, relevant deductions, adjustments, and other pertinent financial data in California Schedule P (100W) 2006.

Fill out your california schedule p 100w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Schedule P 100w is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.