DE LM1 9001 2008 free printable template

Show details

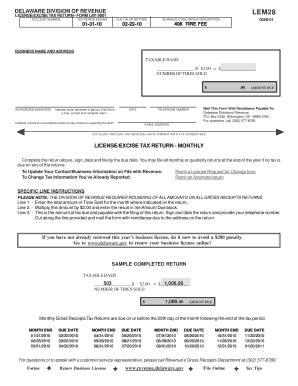

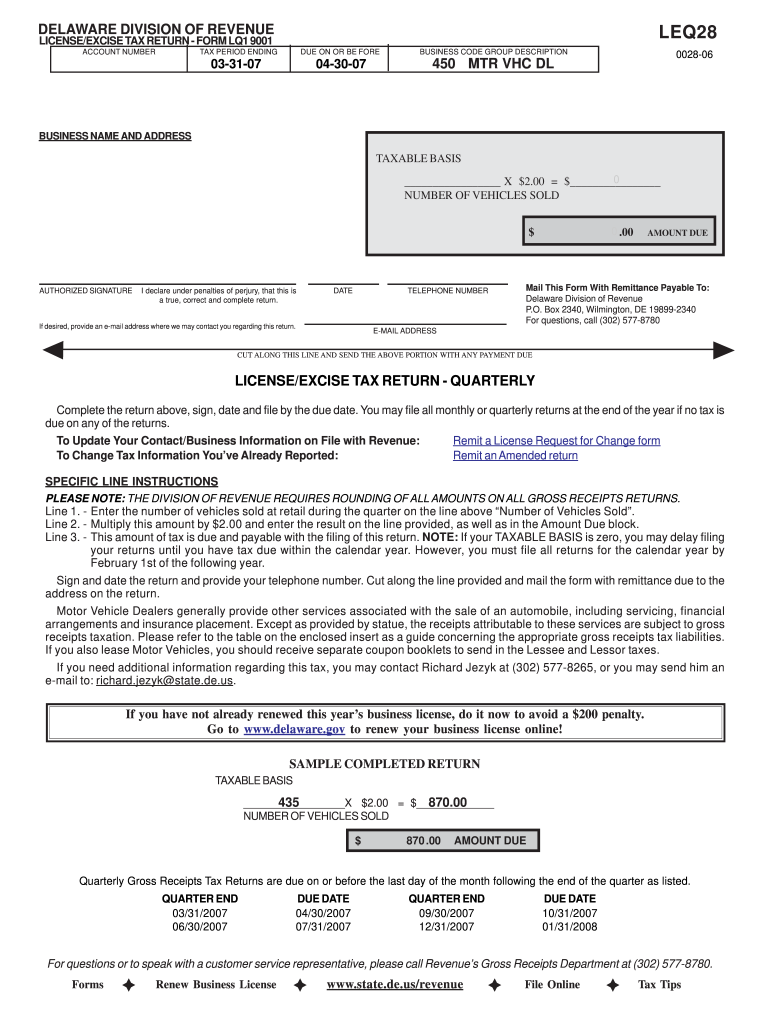

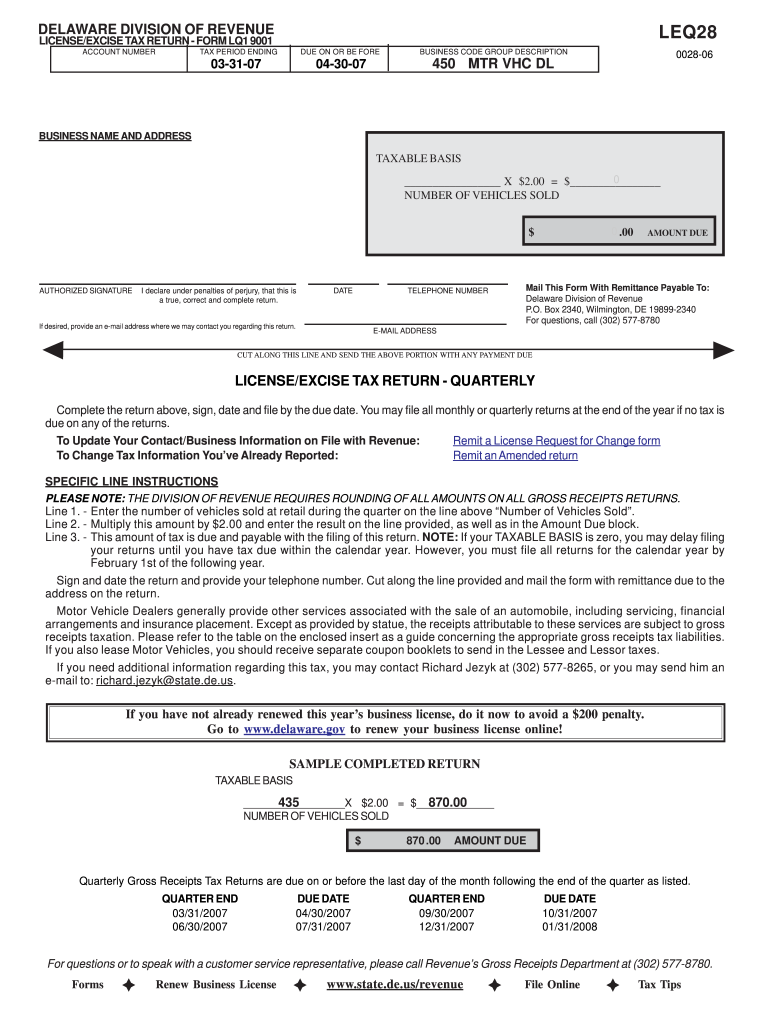

DELAWARE DIVISION OF REVENUE LEQ28 LICENSE/EXCISE TAX RETURN FORM LQ1 9001 ACCOUNT NUMBER TAX PERIOD ENDING 0-000000000-000 DUE ON OR BE FORE 04-30-07 03-31-07 BUSINESS CODE GROUP DESCRIPTION 450

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DE LM1 9001

Edit your DE LM1 9001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DE LM1 9001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DE LM1 9001 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit DE LM1 9001. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE LM1 9001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DE LM1 9001

How to fill out DE LM1 9001

01

Obtain the DE LM1 9001 form from the official website or relevant authority.

02

Carefully read the instructions provided with the form.

03

Fill out your personal information in the designated sections (name, address, contact information).

04

Provide details related to your organization (if applicable) such as registration number and type of business.

05

Complete each section as instructed, ensuring accuracy and clarity in your responses.

06

Attach any required supporting documents to validate the information provided.

07

Review the filled form for any errors or omissions before submission.

08

Submit the completed form either online or by mailing it to the designated office.

Who needs DE LM1 9001?

01

Individuals or organizations that need to comply with specific regulatory requirements or standards.

02

Companies seeking certification or compliance with DE LM1 9001 quality management standards.

03

Businesses involved in sectors that require adherence to DE LM1 9001 for operational practices.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Does an LLC have to file a tax return in Delaware?

As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

Do I need to file a Delaware corporate tax return?

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

Do I need to file a Delaware tax return for an LLC?

Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

Where do I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Who has to pay Delaware gross receipts tax?

A. When you engage in business in the State of Delaware, you may be required to pay Gross Receipts Tax. This tax is paid by the seller of goods (tangible or otherwise) or the provider of services in the state.

Who is required to file a Delaware tax return?

File a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the DE LM1 9001 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your DE LM1 9001 in minutes.

How do I fill out DE LM1 9001 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign DE LM1 9001 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit DE LM1 9001 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign DE LM1 9001 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is DE LM1 9001?

DE LM1 9001 is a specific regulatory form used for reporting certain information to a regulatory authority, often related to compliance or financial reporting.

Who is required to file DE LM1 9001?

Entities or individuals as specified by the regulatory authority, typically those subject to particular regulations concerning financial reporting or compliance obligations.

How to fill out DE LM1 9001?

To fill out DE LM1 9001, one typically needs to follow the instructions provided with the form, input the required information accurately, and ensure all fields are complete before submission.

What is the purpose of DE LM1 9001?

The purpose of DE LM1 9001 is to collect information necessary for regulatory compliance, oversight, and ensuring entities meet their reporting obligations.

What information must be reported on DE LM1 9001?

Information that must be reported may include financial data, operational details, compliance indicators, and other specifics as required by the regulatory authority.

Fill out your DE LM1 9001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DE lm1 9001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.