DE LM1 9001 2010-2025 free printable template

Show details

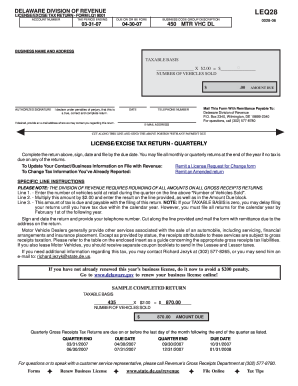

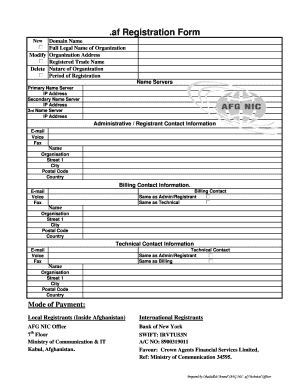

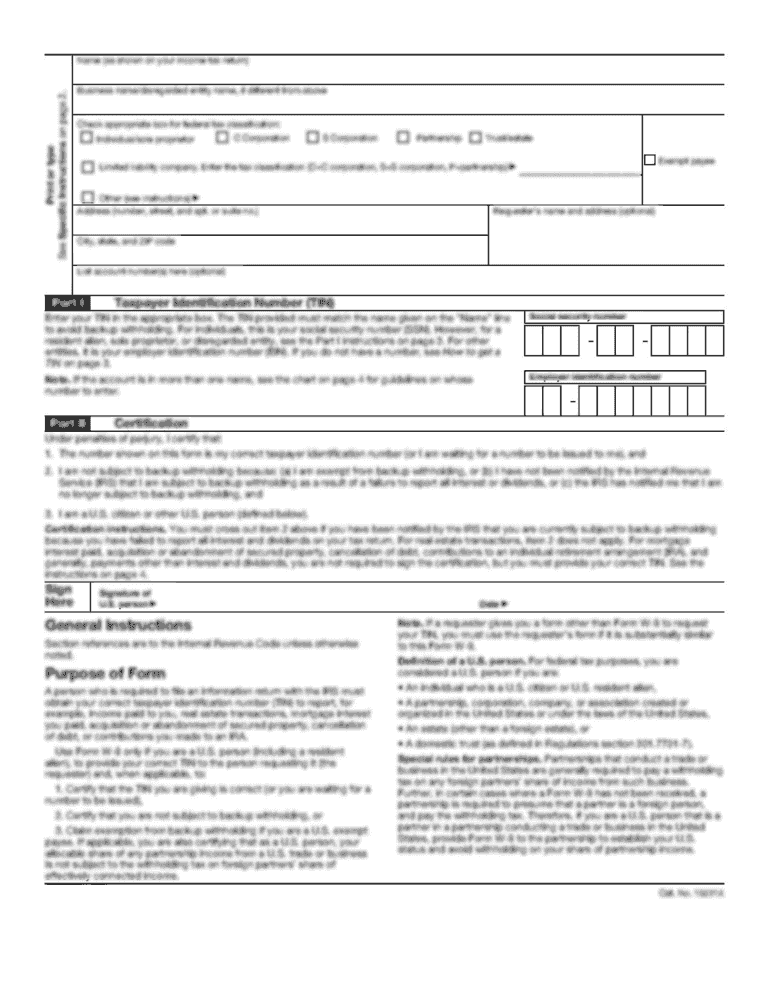

DELAWARE DIVISION OF REVENUELEM28LICENSE/EXCISE TAX RETURN FORM LM1 9001 ACCOUNT NUMBER PERIOD ENDING ON OR BE AGRIBUSINESS CODE GROUP DESCRIPTION0000000000000013110022210406 TIRE FEE002801Reset00280106000000000000001311002221000000000004060000000Print

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign amended returns ampamp form

Edit your amended returns ampamp form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amended returns ampamp form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit amended returns ampamp form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit amended returns ampamp form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DE LM1 9001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out amended returns ampamp form

How to fill out DE LM1 9001

01

Gather all necessary personal and financial information.

02

Start by filling out your personal details in Section 1, including your name, address, and contact information.

03

Move to Section 2 and indicate your employment details, including your employer's name and your position.

04

In Section 3, provide details about your income, including salary and any additional earnings.

05

Complete Section 4 by detailing your expenses, such as housing, transportation, and other necessary costs.

06

Review Section 5 which may require you to provide additional supporting documents or declarations.

07

Double-check all filled sections for accuracy and completeness.

08

Sign and date the form at the designated area in Section 6.

Who needs DE LM1 9001?

01

Individuals applying for government benefits or services in need of financial assessment.

02

People seeking assistance with housing, food security, or healthcare provisions.

03

Applicants for loans or financial aid requiring documentation of personal finances.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Does an LLC have to file a tax return in Delaware?

As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

Do I need to file a Delaware corporate tax return?

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) regardless of the amount, if any, of its gross income or its taxable income.

Do I need to file a Delaware tax return for an LLC?

Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.

Where do I get Delaware tax forms?

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Who has to pay Delaware gross receipts tax?

A. When you engage in business in the State of Delaware, you may be required to pay Gross Receipts Tax. This tax is paid by the seller of goods (tangible or otherwise) or the provider of services in the state.

Who is required to file a Delaware tax return?

File a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit amended returns ampamp form in Chrome?

Install the pdfFiller Google Chrome Extension to edit amended returns ampamp form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit amended returns ampamp form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign amended returns ampamp form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit amended returns ampamp form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share amended returns ampamp form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

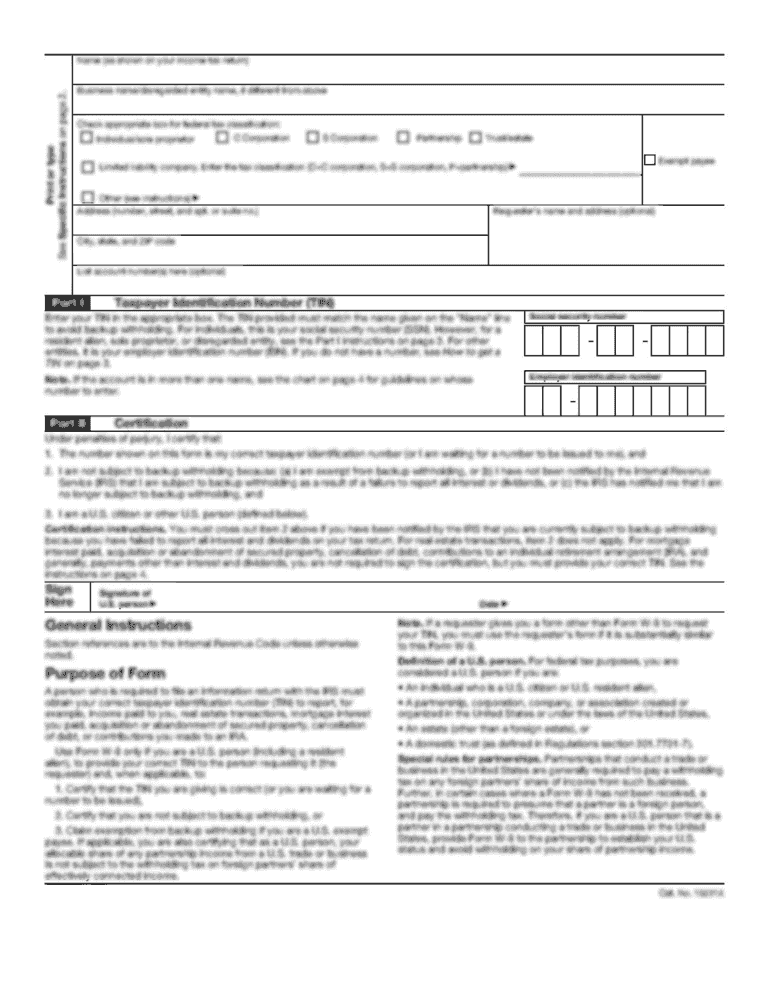

What is DE LM1 9001?

DE LM1 9001 is a specific form or document required for reporting information related to certain transactions or compliance with regulations, typically used in a specific jurisdiction.

Who is required to file DE LM1 9001?

Individuals or organizations that engage in activities or transactions that meet the criteria set by the regulatory authority are required to file DE LM1 9001.

How to fill out DE LM1 9001?

To fill out DE LM1 9001, you need to provide the requested information in the appropriate fields, ensuring accuracy and completeness, and then submit it to the designated authority.

What is the purpose of DE LM1 9001?

The purpose of DE LM1 9001 is to gather essential data for regulatory, monitoring, or compliance purposes, ensuring that stakeholders adhere to the relevant laws.

What information must be reported on DE LM1 9001?

The specific information that must be reported on DE LM1 9001 typically includes identification details, transaction specifics, and any other relevant data as specified by the governing body.

Fill out your amended returns ampamp form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amended Returns Ampamp Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.