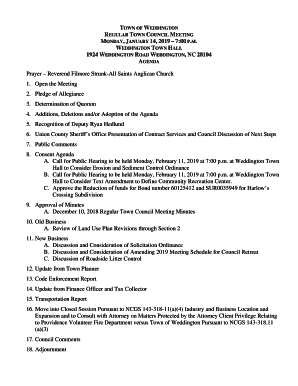

Get the free IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE - tax idaho

Show details

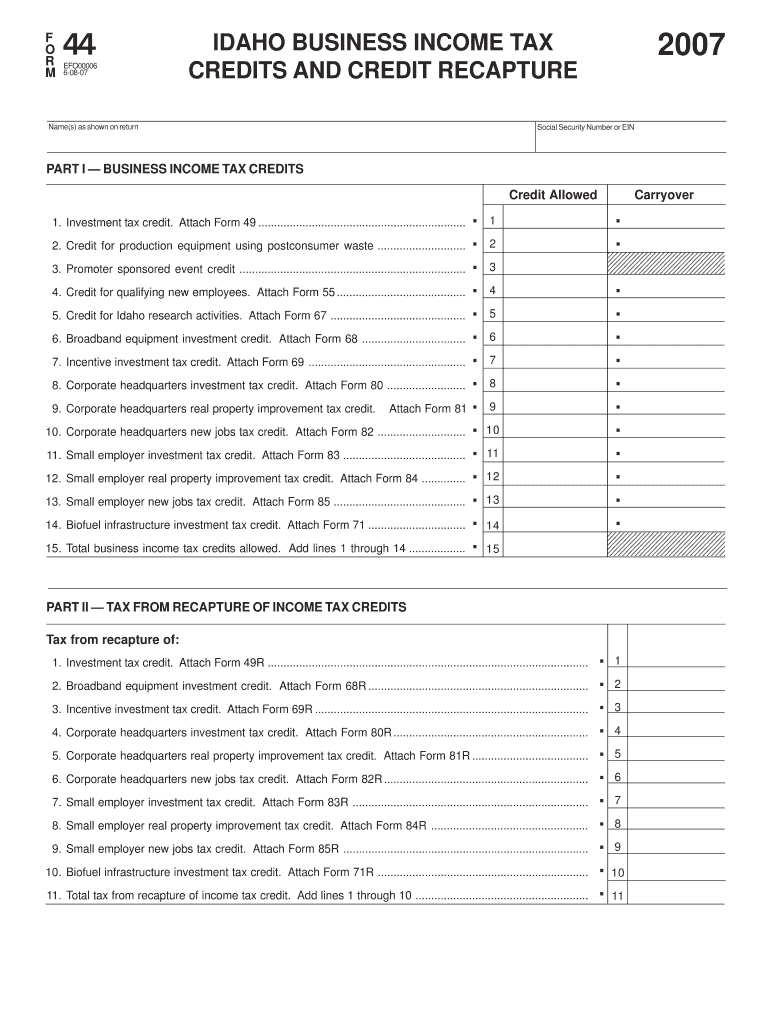

This document outlines the various business income tax credits available in Idaho, as well as the process for recapturing certain income tax credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign idaho business income tax

Edit your idaho business income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idaho business income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing idaho business income tax online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit idaho business income tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out idaho business income tax

How to fill out IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE

01

Gather all necessary documentation related to your business income and expenses.

02

Obtain the proper IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE forms from the Idaho State Tax Commission website.

03

Complete the taxpayer information section on the form with accurate details.

04

List all applicable business income tax credits you are eligible for, ensuring you understand eligibility requirements for each credit.

05

Attach any required supporting documentation for each credit claimed.

06

Calculate any credit recapture amounts, if applicable, based on the guidelines provided on the form.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the Idaho State Tax Commission by the specified deadline, either through mail or electronically.

Who needs IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

01

Businesses operating in Idaho that are eligible for income tax credits.

02

Business owners looking to reduce their tax liabilities through available credits.

03

Entities that have previously claimed tax credits and need to account for credit recapture.

Fill

form

: Try Risk Free

People Also Ask about

How much is a tax credit worth?

A tax credit reduces the specific amount of the tax that an individual owes. For example, say that you have a $500 tax credit and a $3,500 tax bill. The tax credit would reduce your bill to $3,000. Refundable tax credits do provide you with a refund if they have money left over after reducing your tax bill to zero.

Can you cash out a tax credit?

Some tax credits are refundable. If a taxpayer's tax bill is less than the amount of a refundable credit, they can get the difference back in their refund. Some taxpayers who aren't required to file may still want to do so to claim refundable tax credits. Not all tax credits are refundable, however.

How much are tax credits sold for?

Credits are typically sold at a discount to their face value, indicated as cents on the dollar (e.g., a $0.93 TTC price indicates a 7% discount to the face value of the tax credit).

Is it legal to buy tax credits?

Since 2023, federal legislation has allowed corporate taxpayers to purchase transferable tax credits from clean energy developers and manufacturers.

What is a tax credit recapture form?

A taxpayer needs to report the recapture of credits on Form 4255 in the taxable year when the recapture event occurs. The recapture amount reported under Form 4255 will increase the tax liability. If the taxpayer fails to report the recapture accurately, penalties and interest will apply.

What is recapture of investment tax credit?

IRS Form 4255 is used to calculate how much additional tax you might owe if you need to "recapture" (or pay back) some or all of an investment credit you previously claimed. You might need to do this if: You sold or got rid of the property within 5 years of placing it in service.

What does recapture of credits mean?

Recapture refers to the government's recovery of a taxpayer's gain from beneficial treatment — such as depreciation tax credits, deductions , or other tax credits — since the beneficial treatment no longer applies. For example, 26 U.S.C.

Can I sell my tax credits?

What are transferable tax credits? The Inflation Reduction Act, passed in 2022, permits certain federal clean energy and manufacturing tax credits to be sold for cash, creating a more efficient way to deploy and recycle capital.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE refers to tax credits available to businesses in Idaho that reduce their overall tax liability. It also includes provisions for recapturing those credits if certain conditions are not met.

Who is required to file IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

Businesses operating in Idaho that claim tax credits must file forms related to IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE to report their use of the credits and any necessary recaptures.

How to fill out IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

To fill out IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE, businesses need to complete the appropriate tax forms detailing the credits claimed and any required recapture calculations, ensuring that all information is accurate and substantiated.

What is the purpose of IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

The purpose of IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE is to incentivize business investment and economic growth in Idaho by providing financial relief through tax credits while ensuring compliance through recapture provisions.

What information must be reported on IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE?

Businesses must report the total amount of credits claimed, any calculations for recapture, and supporting documentation, such as proof of eligibility for the credits, on IDAHO BUSINESS INCOME TAX CREDITS AND CREDIT RECAPTURE forms.

Fill out your idaho business income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idaho Business Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.