Get the free 740-X

Show details

This document is for filing an amended Kentucky Individual Income Tax Return, allowing taxpayers to report changes in their income, deductions, and tax liability for correction purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 740-x

Edit your 740-x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 740-x form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 740-x online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 740-x. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 740-x

How to fill out 740-X

01

Gather your original Form 740 and any supporting documentation.

02

Obtain Form 740-X from the appropriate tax authority's website or office.

03

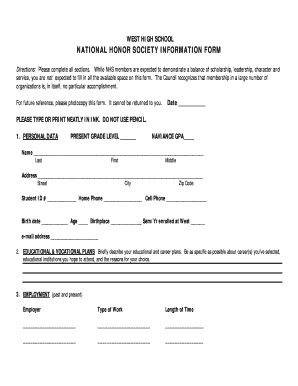

Begin filling out your personal information at the top of the 740-X form.

04

Indicate the tax year for which you are filing the amendment.

05

Provide the information from your original 740 form for comparison.

06

Clearly explain the reason for the amendment in the designated section.

07

Fill in the corrected amounts on the 740-X, noting any increases or decreases.

08

Attach any required additional documentation that supports your amendments.

09

Review your completed form for accuracy and completeness.

10

Submit the 740-X form according to the instructions, either electronically or by mail.

Who needs 740-X?

01

Anyone who has discovered an error on their original Form 740.

02

Taxpayers who need to amend their income, deductions, or credits.

03

Individuals who received additional information after filing that affects their tax return.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax changes for Kentucky in 2025?

On February 6, 2025, Governor Beshear signed House Bill 1, which reduces the Kentucky individual income tax rate from 4% to 3.5%, effective for tax years beginning on or after January 1, 2026. The individual income tax rate may be reduced in subsequent years if fiscal conditions are met.

Who qualifies for family size tax credit in Kentucky?

Nonrefundable Family Size Tax Credit The family size tax credit is based on modified gross income and the size of the family. If total modified gross income is $41,496 or less for 2024, you may qualify for the Kentucky family size tax credit.

Who must file a Kentucky nonresident tax return?

Who needs the Instructions for Kentucky Nonresident Tax Return? Full-year nonresidents earning Kentucky income need this form to report their earnings for tax purposes. Part-year residents who earned income while living in Kentucky must file to comply with tax regulations.

What is a form 740 in Kentucky?

Form 740 (2023): Kentucky Individual Income Tax Return Full-Year Residents. Tax Forms Tax Codes. Form 740 is the Kentucky Individual Income Tax Return used by residents of the state of Kentucky to report their income and calculate any taxes owed or due for the tax year 2023.

Is KY getting rid of state income tax?

A 2022 Kentucky law reduced the state's income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero. But unlike in Mississippi, the triggers aren't automatic. Rather, the Kentucky General Assembly must approve each additional decrease in the tax rate.

What states are considering eliminating income tax?

Economic uncertainty and the prospect of reduced federal aid also have made many lawmakers more cautious this legislative season, he said. But lawmakers in several states — including Oklahoma, South Carolina and West Virginia — have continued their march to eliminate state income taxes.

Are Mississippi and Kentucky on track to eliminate income taxes on wages?

Associated Press: Mississippi and Kentucky Aim to End Personal Income Taxes. About 45 years have passed since a U.S. state last eliminated its income tax on wages and salaries. But with recent actions in Mississippi and Kentucky, two states now are on a path to do so, if their economies keep growing.

Is KY doing away with state income tax?

What has Kentucky done? A 2022 Kentucky law reduced the state's income tax rate and set a series of revenue-based triggers that could gradually lower the tax to zero. But unlike in Mississippi, the triggers aren't automatic. Rather, the Kentucky General Assembly must approve each additional decrease in the tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 740-X?

740-X is an amended individual income tax return form used in the state of Kentucky.

Who is required to file 740-X?

Individuals who need to correct errors or make changes to their previously submitted Kentucky individual income tax returns must file 740-X.

How to fill out 740-X?

To fill out 740-X, obtain the form from the Kentucky Department of Revenue's website, complete the required sections detailing the changes, and submit it along with any necessary documentation.

What is the purpose of 740-X?

The purpose of 740-X is to provide taxpayers a mechanism to amend their prior tax returns to reflect accurate information, potentially resulting in a refund or additional tax liability.

What information must be reported on 740-X?

740-X must report the taxpayer's name, address, Social Security number, details of the original return, and the specific changes being made along with an explanation for those changes.

Fill out your 740-x online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

740-X is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.