MD State Retirement Agency Form 20 2013 free printable template

Show details

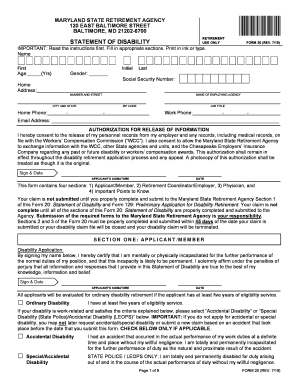

MARYLAND STATE RETIREMENT AGENCY 120 EAST BALTIMORE STREET BALTIMORE MD 21202-6700 sra.maryland. gov RETIREMENT USE ONLY STATEMENT OF DISABILITY FORM 20 REV. Sign Maryland State Retirement Agency 120 East Baltimore St. Baltimore MD 21202-6700 410-625-5555 / 1-800-492-5909 sra.maryland. gov DATE OF BIRTH Month Day Year NAME First Initial Last 1. In accordance with Maryland s Health General Article 4-303 I authorize the use or disclosure of the a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD State Retirement Agency Form 20

Edit your MD State Retirement Agency Form 20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD State Retirement Agency Form 20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MD State Retirement Agency Form 20 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MD State Retirement Agency Form 20. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD State Retirement Agency Form 20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD State Retirement Agency Form 20

How to fill out MD State Retirement Agency Form 20

01

Locate the MD State Retirement Agency Form 20 from the official website or your workplace.

02

Provide your personal information, including full name, address, and contact details at the top of the form.

03

Fill out your employment details, including your agency name, position title, and employment dates.

04

Indicate the reason for submitting the form, such as retirement or withdrawal from the retirement system.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the designated address as directed on the form.

Who needs MD State Retirement Agency Form 20?

01

Employees of the Maryland State Retirement and Pension System who are retiring or withdrawing from their retirement plan.

02

Former employees who are eligible for benefits and need to formalize their retirement request.

03

Individuals seeking to consolidate or transfer their retirement benefits.

Fill

form

: Try Risk Free

People Also Ask about

How is state of Maryland pension calculated?

Full service retirement allowances equal 1/55 (1.818 percent) of the highest three years' average final salary (AFS) multiplied by the number of years and months of accumulated creditable service.

How to report a death to the Maryland State Retirement and Pension System?

To report a death, dial 410-625-5555 or toll-free 1-800- 492-5909. After selecting 1 for retiree, a pre-recorded message will play with the latest news from the Maryland State Retirement Agency. You then may select 3 to notify the Retirement Agency of the death of a member or retiree.

How does MD State Pension work?

You contribute 7% of your annual compensation to the EPS. You earn service credit toward your retirement benefits each day you work and pay your required contribution. Your service credit and age determine when you are eligible for retirement and how much your retirement benefit will be.

What is the Maryland form 502?

Choose the Right Income Tax Form If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

What is the tax form for Maryland pensions?

Internal Revenue Service tax form 1099-R provides each payee with detailed information on his or her pension income for the previous year. Most payees receive only one 1099-R tax form each year.

Is my Maryland state pension taxable?

Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.75%. Public pension income is partially taxed, and private pension income is fully taxed.

What is the death benefit for Maryland pension?

Your surviving spouse or a surviving designated beneficiary qualifies for a monthly benefit equal to 50% of the retirement allowance that would be payable to you or a lump sum payment consisting of your accumulated contributions and an amount equal to your annual salary at time of death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the MD State Retirement Agency Form 20 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your MD State Retirement Agency Form 20 in seconds.

Can I create an electronic signature for signing my MD State Retirement Agency Form 20 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MD State Retirement Agency Form 20 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit MD State Retirement Agency Form 20 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign MD State Retirement Agency Form 20 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is MD State Retirement Agency Form 20?

MD State Retirement Agency Form 20 is a form used in Maryland for reporting retirement contributions and benefits related to retirement plans administered by the Maryland State Retirement Agency.

Who is required to file MD State Retirement Agency Form 20?

Employees participating in the Maryland State Retirement and Pension System are required to file MD State Retirement Agency Form 20 as part of their retirement planning and benefits process.

How to fill out MD State Retirement Agency Form 20?

To fill out MD State Retirement Agency Form 20, individuals should provide personal information such as their name, social security number, and retirement plan details while ensuring that all information is accurate and complete.

What is the purpose of MD State Retirement Agency Form 20?

The purpose of MD State Retirement Agency Form 20 is to collect necessary information regarding an individual's retirement contributions and benefits, ensuring proper processing of retirement savings and eligibility for pension programs.

What information must be reported on MD State Retirement Agency Form 20?

Information that must be reported on MD State Retirement Agency Form 20 includes the participant's personal information, details of employment, contribution amounts, and any beneficiaries designated for retirement benefits.

Fill out your MD State Retirement Agency Form 20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD State Retirement Agency Form 20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.