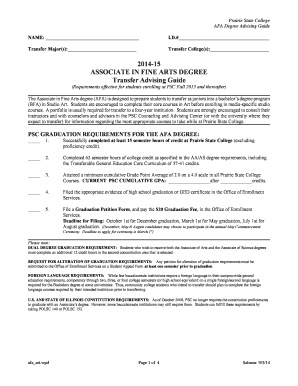

MD State Retirement Agency Form 20 2019-2025 free printable template

Show details

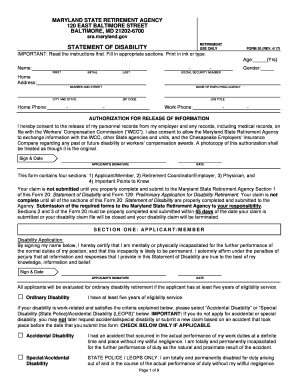

MARYLAND STATE RETIREMENT AGENCY 120 EAST BALTIMORE STREET BALTIMORE, MD 212026700 RETIREMENT USE OVERSTATEMENT OF DISABILITYFORM 20 (REV. 7/19)IMPORTANT: Read the instructions first. Fill in appropriate

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign md state retirement agency form

Edit your maryland state retirement agency form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8822 irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland state retirement agency online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maryland state retirement agency. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD State Retirement Agency Form 20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maryland state retirement agency

How to fill out MD State Retirement Agency Form 20

01

Obtain MD State Retirement Agency Form 20 from the official website or local retirement office.

02

Fill in your personal information, including your name, Social Security number, and contact details.

03

Indicate your employment details, such as your job title and the agency you are retiring from.

04

Review the eligibility criteria and check the appropriate box to confirm your eligibility.

05

Provide details regarding your retirement plan and the date you intend to retire.

06

Sign and date the form at the designated section.

07

Submit the completed form to the MD State Retirement Agency, ensuring you keep a copy for your records.

Who needs MD State Retirement Agency Form 20?

01

Anyone applying for retirement benefits from the Maryland State Retirement Agency.

02

Employees of the State of Maryland who are nearing retirement age.

03

Members of the Maryland State Retirement System who wish to retire.

Fill

form

: Try Risk Free

People Also Ask about

How is state of Maryland pension calculated?

Full service retirement allowances equal 1/55 (1.818 percent) of the highest three years' average final salary (AFS) multiplied by the number of years and months of accumulated creditable service.

How to report a death to the Maryland State Retirement and Pension System?

To report a death, dial 410-625-5555 or toll-free 1-800- 492-5909. After selecting 1 for retiree, a pre-recorded message will play with the latest news from the Maryland State Retirement Agency. You then may select 3 to notify the Retirement Agency of the death of a member or retiree.

How does MD State Pension work?

You contribute 7% of your annual compensation to the EPS. You earn service credit toward your retirement benefits each day you work and pay your required contribution. Your service credit and age determine when you are eligible for retirement and how much your retirement benefit will be.

What is the Maryland form 502?

Choose the Right Income Tax Form If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

What is the tax form for Maryland pensions?

Internal Revenue Service tax form 1099-R provides each payee with detailed information on his or her pension income for the previous year. Most payees receive only one 1099-R tax form each year.

Is my Maryland state pension taxable?

Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.75%. Public pension income is partially taxed, and private pension income is fully taxed.

What is the death benefit for Maryland pension?

Your surviving spouse or a surviving designated beneficiary qualifies for a monthly benefit equal to 50% of the retirement allowance that would be payable to you or a lump sum payment consisting of your accumulated contributions and an amount equal to your annual salary at time of death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit maryland state retirement agency online?

With pdfFiller, it's easy to make changes. Open your maryland state retirement agency in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the maryland state retirement agency in Gmail?

Create your eSignature using pdfFiller and then eSign your maryland state retirement agency immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out maryland state retirement agency on an Android device?

Complete your maryland state retirement agency and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is MD State Retirement Agency Form 20?

MD State Retirement Agency Form 20 is a document used by employees to report their eligibility for retirement benefits and calculate their service credit for retirement purposes within the Maryland State Retirement and Pension System.

Who is required to file MD State Retirement Agency Form 20?

Employees of the Maryland State Government who are participants in the retirement system and are seeking to apply for retirement benefits or need to report changes in service credit are required to file MD State Retirement Agency Form 20.

How to fill out MD State Retirement Agency Form 20?

To fill out MD State Retirement Agency Form 20, applicants should provide accurate personal information, including their name, social security number, and employment details. They must also report their years of service, and any applicable contributions made to the retirement system, and sign the form before submission.

What is the purpose of MD State Retirement Agency Form 20?

The purpose of MD State Retirement Agency Form 20 is to document an individual's service history and to facilitate the calculation of retirement benefits owed to the employee based on their contributions and years of service.

What information must be reported on MD State Retirement Agency Form 20?

MD State Retirement Agency Form 20 requires the reporting of personal identification information, the total years of service, contributions made to the retirement system, employment details, and any other relevant data required by the Maryland State Retirement Agency for the assessment of retirement benefits.

Fill out your maryland state retirement agency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland State Retirement Agency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.