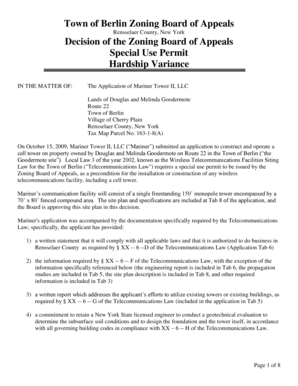

Get the free FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT) - legislature mi

Show details

This document outlines the requirements for a valid and enforceable mortgage in Michigan, detailing the necessary wording and conditions for mortgage agreements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form of deeds mortgages

Edit your form of deeds mortgages form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form of deeds mortgages form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form of deeds mortgages online

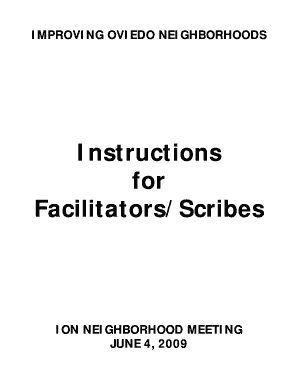

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form of deeds mortgages. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

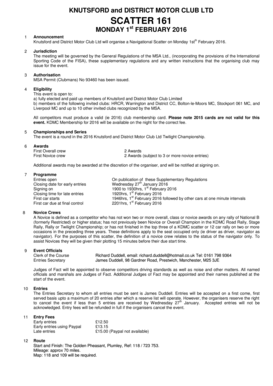

How to fill out form of deeds mortgages

How to fill out FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)

01

Obtain a copy of the FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT).

02

Read the instructions provided at the top of the form carefully.

03

Fill in the date at the top of the form where indicated.

04

Enter the names and addresses of the parties involved in the transaction.

05

Provide a clear description of the property in question, including its legal description.

06

Indicate the type of deed or mortgage being executed (e.g., warranty deed, quitclaim deed).

07

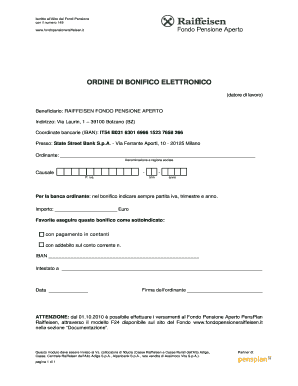

Fill in any necessary details regarding the terms of the agreement, including any financial information.

08

Sign the form in the designated area, ensuring all parties have signed as needed.

09

Have the document notarized where required, by a qualified notary public.

10

Submit the completed form to the appropriate local government office for recording.

Who needs FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

01

Anyone involved in real estate transactions, including buyers and sellers of property.

02

Lenders and financial institutions that are providing mortgages.

03

Real estate attorneys who need to prepare legal documents for property transfers.

04

Notaries public who need to certify the authenticity of signatures on the documents.

05

Individuals or organizations who require formal acknowledgment of the deed or mortgage.

Fill

form

: Try Risk Free

People Also Ask about

What type of deed is the most protective form of property conveyance for a buyer?

Warranty Deed A Warranty Deed guarantees that a property's title is free from encumbrances while transferring its ownership. Warranty Deeds are used in most home sales between unrelated parties because they offer the most protection for buyers without established trust.

What is the original mortgage deed?

A mortgage deed – also known as a legal charge – is a legally binding agreement between you and your mortgage lender. It confirms that you agree to the conditions of your mortgage, including how and when it will be repaid. You will sign a mortgage deed if you are: Buying a home with a mortgage.

What are the different types of mortgages?

What are the 6 types of mortgages? The six main types are simple mortgage, mortgage by conditional sale, English mortgage, fixed-rate mortgage, usufructuary mortgage, and reverse mortgage.

What is the definition of mortgage UK?

A mortgage is a type of loan used to help you buy a home. It's usually a lot larger than any other type of loan. You'll need to pay a deposit up front, and then borrow a lump sum from a lender for the remaining cost of the property. This is secured against your home.

What are the 6 types of mortgages?

What are the 6 types of mortgages? The six main types are simple mortgage, mortgage by conditional sale, English mortgage, fixed-rate mortgage, usufructuary mortgage, and reverse mortgage.

What is the difference between simple mortgage and English mortgage?

Absolute Transfer: Unlike other forms of mortgages where only a lien or charge is created on the property, an English Mortgage involves an absolute transfer of the title to the lender.

What is the meaning of English mortgage?

An English mortgage is a type of mortgage in which the borrower transfers the ownership of the property to the lender as security for the loan. Unlike other types of mortgages, the borrower does not retain possession or ownership rights until the loan is fully repaid.

What is the difference between a mortgage and an English mortgage?

Absolute Transfer: Unlike other forms of mortgages where only a lien or charge is created on the property, an English Mortgage involves an absolute transfer of the title to the lender.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT) refers to a standardized legal document that outlines the format and requirements for executing deeds and mortgages, including the necessary acknowledgments to validate these transactions.

Who is required to file FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

Typically, the property owners, lenders, or their representatives are required to file the FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT) when executing a property transaction.

How to fill out FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

To fill out the FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT), provide the required details such as the names of the parties involved, property description, consideration amount, signatures, and notarization as applicable, ensuring compliance with local regulations.

What is the purpose of FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

The purpose of the FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT) is to legally document property transactions, ensuring that the transfer of ownership or mortgage agreements are valid and enforceable.

What information must be reported on FORM OF DEEDS, MORTGAGES, AND ACKNOWLEDGMENTS (EXCERPT)?

Information that must be reported includes the names and addresses of the parties, legal description of the property, the type of deed or mortgage, amount of consideration, date of execution, and notarization details, if required.

Fill out your form of deeds mortgages online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Of Deeds Mortgages is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.