Get the free Corporate Income and Franchise Tax Return

Show details

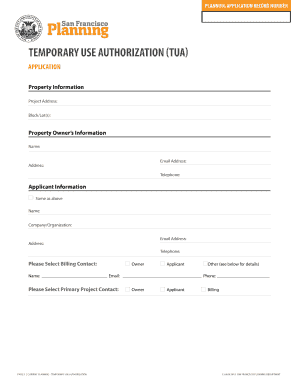

This document is a tax return form for corporations to report their income and franchise tax in the state of Mississippi for the fiscal year 2006.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate income and franchise

Edit your corporate income and franchise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate income and franchise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate income and franchise online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corporate income and franchise. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate income and franchise

How to fill out Corporate Income and Franchise Tax Return

01

Gather necessary financial documents, including profit and loss statements, balance sheets, and prior year tax returns.

02

Determine the tax year for the return and confirm you are using the correct form based on your corporation type.

03

Complete the identification section of the form, including your corporation's name, address, and federal identification number.

04

Calculate the total income by adding all revenues generated by the corporation.

05

Deduct allowable business expenses from the total income to determine the taxable income.

06

Apply any applicable tax credits and adjustments to arrive at the final tax liability.

07

Review the completed form for accuracy and completeness.

08

Sign and date the return to certify its accuracy.

09

Submit the return by the specified deadline to the appropriate tax authority, either electronically or by mail.

Who needs Corporate Income and Franchise Tax Return?

01

Corporations that conduct business in the state and meet certain income thresholds need to file a Corporate Income and Franchise Tax Return.

02

Entities that have elected to be taxed as corporations for federal income tax purposes are also required to file.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of corporate earnings?

Earnings is just a financial word for income, or how much money a company makes. A company's current earnings or income, and the earnings the investment community thinks it will make in the future, have a large impact on what the price of that particular stock is today.

What is defined as corporate income?

The United States defines taxable income for a corporation as all gross income, i.e. sales plus other income minus cost of goods sold and tax exempt income less allowable tax deductions, without the allowance of the standard deduction applicable to individuals.

What is corporate income tax in Brazil?

percent. Dec 2024. Brazil Corporate Tax Rate. In Brazil, the corporate income tax rate is a combination of a 15 percent basic rate, a 10 percent surtax on income that exceeds BRL 240,000 per year and 9 percent social contribution on pre-tax profits.

What is the meaning of corporate income?

Corporate Income means, for any Plan Year, the consolidated pre-tax income generated by the Company.

What is the correct meaning of corporate?

Corporate means relating to large companies, or to a particular large company. Interest rates are higher for corporate clients than for private clients. The economy is growing, and corporate profits are rising. Corporate means relating to large companies, or to a particular large company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

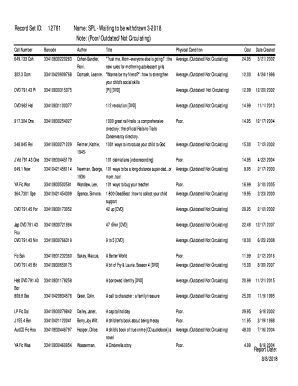

What is Corporate Income and Franchise Tax Return?

The Corporate Income and Franchise Tax Return is a tax form that corporations use to report their income, calculate their tax liability, and document their business activities to state revenue agencies.

Who is required to file Corporate Income and Franchise Tax Return?

Corporations operating within the state, including domestic and foreign corporations doing business in the jurisdiction, are typically required to file a Corporate Income and Franchise Tax Return.

How to fill out Corporate Income and Franchise Tax Return?

To fill out the Corporate Income and Franchise Tax Return, corporations must gather financial information, including income, deductions, and credits, complete the tax form accurately, and submit it to the appropriate state tax authority by the deadline.

What is the purpose of Corporate Income and Franchise Tax Return?

The purpose of the Corporate Income and Franchise Tax Return is to assess the amount of tax owed by a corporation based on its income and business activities, ensuring compliance with state tax laws.

What information must be reported on Corporate Income and Franchise Tax Return?

The information that must be reported includes gross revenue, cost of goods sold, deductions for business expenses, tax credits, and other relevant financial data necessary for calculating tax liability.

Fill out your corporate income and franchise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Income And Franchise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.