Get the free Schedule ND-1CS - nd

Show details

This document is a schedule that individuals in North Dakota must complete to calculate income tax on proceeds from the sale of unused angel fund investment tax credits or research and experimental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule nd-1cs - nd

Edit your schedule nd-1cs - nd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule nd-1cs - nd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

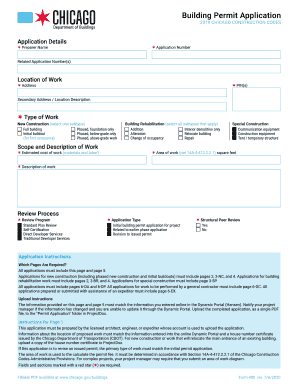

How to edit schedule nd-1cs - nd online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule nd-1cs - nd. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule nd-1cs - nd

How to fill out Schedule ND-1CS

01

Gather necessary information including your personal details and tax identification number.

02

Obtain the Schedule ND-1CS form from the official tax website or your local tax office.

03

Begin filling in your name, address, and other personal information at the top of the form.

04

Fill in the section for your income sources, detailing any income you need to report.

05

Include any deductions or credits that apply to your situation in the relevant sections.

06

Review the form for accuracy, ensuring all entries are correct and complete.

07

Sign and date the form as required.

08

Submit the completed Schedule ND-1CS according to the provided instructions, either by mail or electronically.

Who needs Schedule ND-1CS?

01

Individuals or entities that need to report their income for specific tax purposes.

02

Taxpayers who are required to provide additional information alongside their main tax return.

03

Those who have income sources that may not be covered in the basic tax form.

Fill

form

: Try Risk Free

People Also Ask about

Can you get an English GCSE online?

With a 100% pass rate and success rates that are much higher than the national average, you can enrol with confidence! Our FREE* and uniquely flexible online English GCSE course means that even if you are working full-time or caring for family, you can fit learning around your busy life.

How do I study for GCSE English?

Top Tips for English GCSE Find out in advance which books you'll be studying and READ THEM. Use sites such as Save My Exams. Feel the pain and practise your creative writing anyway! Annotate, annotate, annotate. Nail the key vocabulary. Expand your vocabulary. Write essay plans and ask your teacher to check them.

Can I study GCSE by myself?

In fact, taking GCSEs privately is well within your grasp. Not only does it allow you to study at your own pace, but it also offers flexibility in choosing where and when to sit the exams. If you're interested in completing a GCSE, then why not take a look at our range of online GCSE courses?

Can you do GCSE English online?

Yes, this GCSE English course is ideal for students sitting their GCSE English resit. It is the most comprehensive GCSE English course online. Book your resit in English whenever you are ready.

Can I study GCSE English online?

This course enables you to study for an GCSE in English Language by distance learning at home or at work. Your course materials will be sent online or by post, so receiving your materials is easy and hassle-free. Full tutor support will be available via email, so help is only a click away!

Can you do GCSE outside UK?

lf you wish to study for a GCSE or A Level qualification, you will need to sit the examination in the UK. Please remember that most GCSEs and A Levels have several examinations which may well be spread over several weeks. IGCSE examinations, on the other hand, can be taken at test centres all over the world.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule ND-1CS?

Schedule ND-1CS is a specific form used for reporting nonresident income tax in certain jurisdictions, often required for individuals who earn income from sources within that jurisdiction.

Who is required to file Schedule ND-1CS?

Individuals who are not residents of the jurisdiction but have earned income from sources within that jurisdiction are required to file Schedule ND-1CS.

How to fill out Schedule ND-1CS?

To fill out Schedule ND-1CS, taxpayers should provide their personal information, report their income from the jurisdiction, calculate any tax due, and ensure all required documentation is attached.

What is the purpose of Schedule ND-1CS?

The purpose of Schedule ND-1CS is to ensure that nonresidents accurately report and pay taxes on income earned from within the jurisdiction, maintaining compliance with tax laws.

What information must be reported on Schedule ND-1CS?

The information that must be reported on Schedule ND-1CS includes the taxpayer's personal details, sources and amounts of income earned in the jurisdiction, and details of any deductions or credits applicable.

Fill out your schedule nd-1cs - nd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Nd-1cs - Nd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.