Get the free truist bank check sample

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

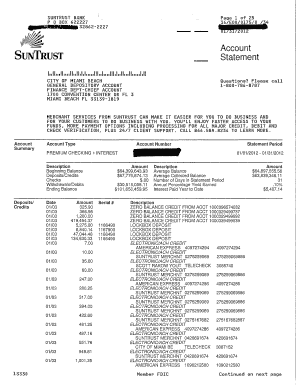

Understanding the Truist Bank Check Sample Form

Overview of the Truist Bank Check Sample Form

The Truist Bank check sample form serves as a template to assist users in drafting and issuing checks with the correct format and necessary information. This form includes essential components, such as the payee's name, date, amount, and signature line, ensuring compliance with banking standards.

Key Features of the Truist Bank Check Sample Form

The check sample form highlights various important features that streamline the check issuance process. Notably, it provides clear sections for entry of the date, recipient details, and payment amount. Additionally, it often includes a memo line for notes, enhancing clarity about the transaction's purpose.

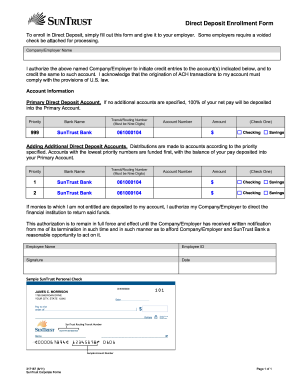

How to Fill Out the Truist Bank Check Sample Form

Filling out the Truist Bank check sample form involves several straightforward steps. First, enter the date at the top right corner. Next, write the payee's name on the line following 'Pay to the Order of.' Continue by filling in the amount in both numeric and written formats. Sign the check at the bottom right to authorize the transaction. Double-check all entries for accuracy before issuing the check.

Best Practices for Accurate Completion

To ensure the check is completed correctly, follow these best practices: use blue or black ink for visibility, write legibly to prevent misinterpretation, and avoid leaving blank spaces to deter unauthorized alterations. Additionally, consider making a photocopy of the completed check for your records.

Common Errors and Troubleshooting

Several common errors can occur when completing the Truist Bank check sample form. These include misspelling the payee's name, incorrect date writing, and discrepancies between the written and numerical amounts. In case of an error, it is advisable to void the check and begin anew rather than attempting to correct the existing one.

Who Needs the Truist Bank Check Sample Form

Individuals and businesses that require a structured method for issuing payments will benefit from using the Truist Bank check sample form. This includes freelancers requesting payment for services provided, small businesses managing payroll, and anyone needing to manage expenses efficiently.

Frequently Asked Questions about truist check sample form

What is the purpose of the Truist Bank check sample form?

The form acts as a template to help users correctly format and issue checks, ensuring that all required information is included.

Can I use the Truist Bank check sample form for electronic payments?

No, the Truist Bank check sample form is specifically designed for physical checks. For electronic payments, a different authorization process is needed.

pdfFiller scores top ratings on review platforms