ND DoT SFN 17147 2009-2025 free printable template

Show details

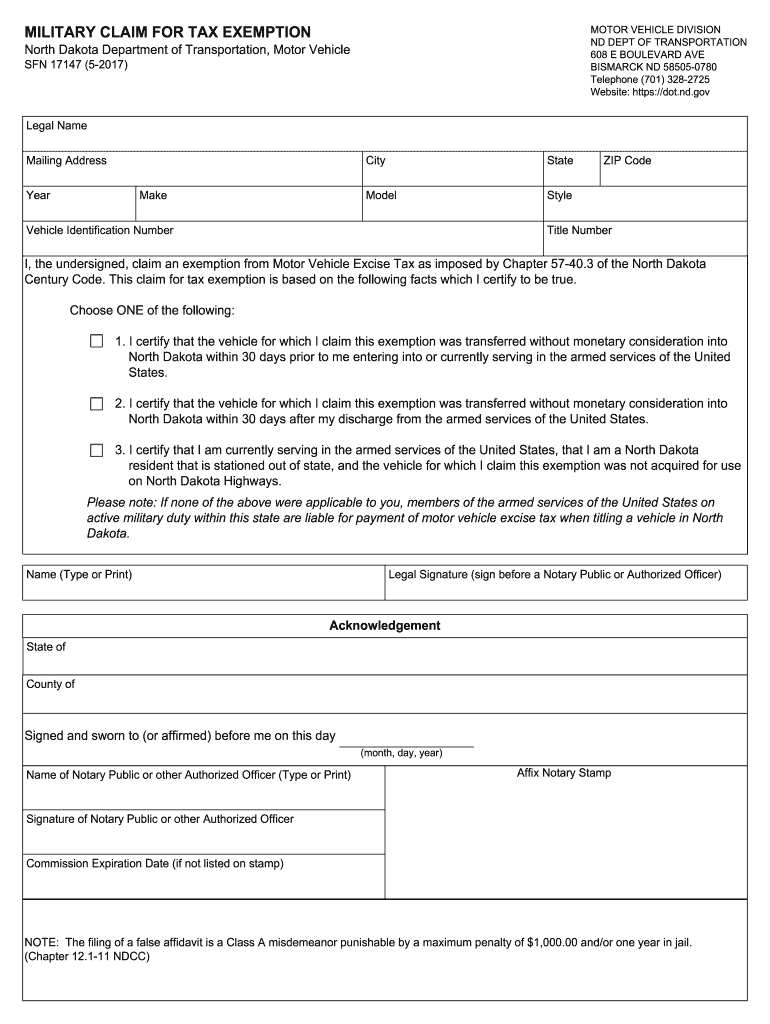

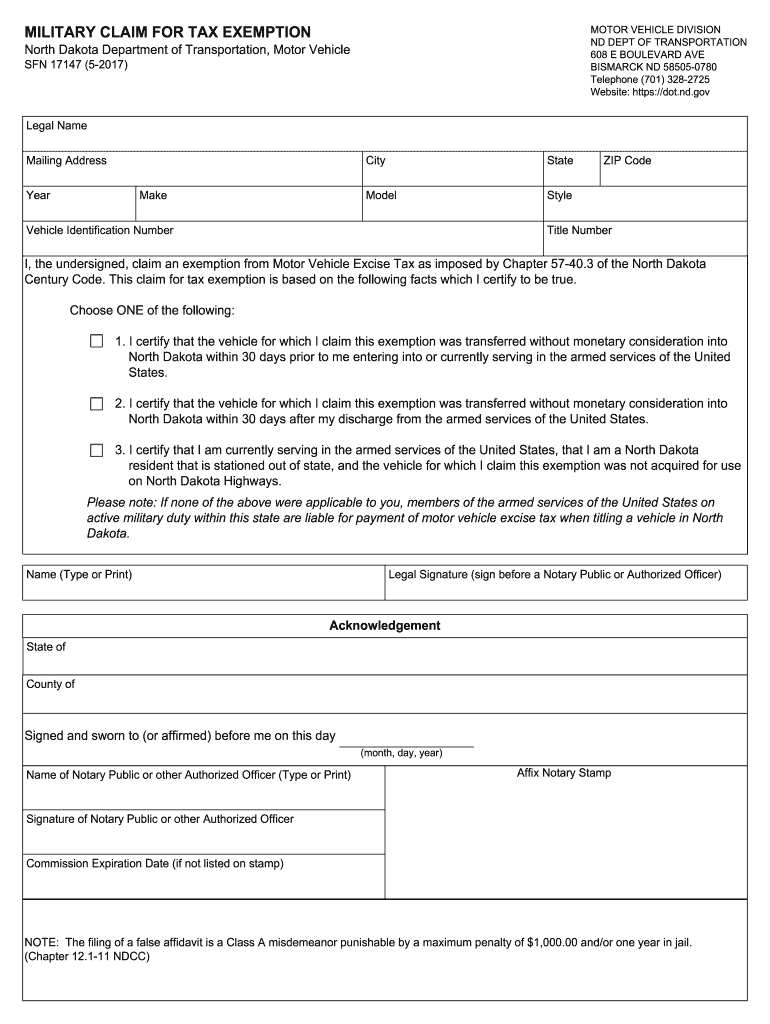

MILITARY CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle Division SFN 17147 07-2009 Legal Name Address City State Year Make Zip Code Style Model Title Number Vehicle Identification Number I the undersigned claim an exemption from Motor Vehicle Excise Tax as imposed by Chapter 57-40. 3 of the North Dakota Century Code. This claim for tax exemption is based on the following facts which I certify to be true. 1. I certify that I am currently on active military duty...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign north dakota claim exemption form

Edit your nd claim tax exemption download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your military claim exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nd military tax exemption online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit north dakota military exemption. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out north dakota military exemption

How to fill out ND DoT SFN 17147

01

Obtain a blank ND DoT SFN 17147 form from the North Dakota Department of Transportation website or local office.

02

Fill in the applicant's full name, address, and contact information at the top of the form.

03

Provide the specific details regarding the vehicle or equipment involved, including make, model, year, and Vehicle Identification Number (VIN) if applicable.

04

Indicate the reason for submitting the form, such as registration, title transfer, or other requests.

05

Complete any additional sections that apply to your situation, including fees and signatures.

06

Review the form for accuracy and completeness before submission.

07

Submit the completed form to the appropriate ND DoT office, either in person or via mail.

Who needs ND DoT SFN 17147?

01

Individuals or businesses registering a vehicle in North Dakota.

02

Those transferring the title of a vehicle.

03

People seeking to obtain special permits or licenses related to their vehicle or equipment.

04

Anyone who requires documentation for vehicle-related legal purposes.

Video instructions and help with filling out and completing north dakota military exemption

Instructions and Help about north dakota military exemption

Fill

form

: Try Risk Free

People Also Ask about

What is North Dakota pass through withholding?

A “passthrough entity” means a partnership (all types), S corporation, trust, limited liability company not taxed as a C corporation, or other entity not taxed at the entity level for North Dakota income tax purposes.

What is North Dakota Form 307?

Form 307 is mailed to all employers registered to withhold North Dakota state income tax from wages or other payments and to employers that are not required to register but have previously submitted information returns as required by law.

Does North Dakota have a withholding form?

Employers must electronically file Form 306 – Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more.

What is the tax abatement in North Dakota?

2 Year Tax Abatement - Properties with new construction may qualify for a two-year tax abatement. What this abatement does is take $150,000 off of the true & full value of the home, for figuring real estate property taxes, for two years. The two-year tax abatement does not reduce special assessments or drain taxes.

What is North Dakota reciprocity exemption?

North Dakota has income tax reciprocity agreements with Minnesota and Montana. If you are a resident of one of these states, the agreements provide that you do not have to pay North Dakota income tax on wages you earn for work in North Dakota.

At what age do you stop paying property taxes in North Dakota?

65 years of age or older.

What is the North Dakota tax relief credit 2023?

SB 2293 is estimated to reduce North Dakota service members' income taxes by $4 million in the 2023-25 biennium. With the bill, North Dakota joins about 20 other states that don't tax military income, which will help the National Guard with recruiting efforts and incentivize retired veterans to stay in North Dakota.

What is the nd tax relief credit?

The 2021 North Dakota Legislature created a tax relief income tax credit for residents of North Dakota. Full-year residents of North Dakota will receive a credit up to $350. For taxpayers who are full-year residents and married filing jointly, the tax credit is up to $700.

What is tax relief credit mean?

FS-2023-09, April 2023. A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

What is claiming an exemption?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Is it better to claim exemptions or not?

Filing for exemption from withholding won't cause you to pay any less in taxes. If you owe taxes but file as exempt, you'll have to pay the full tax bill when you file your taxes next year. Not only that, but the IRS can charge you additional penalties for failing to withhold.

What are claiming exemptions?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Is it better to claim 0 or 1 exemptions?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do I claim exemptions on my tax form?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

How do I claim my North Dakota sales tax refund?

WHERE TO FILE: A claim for refund must be filed with the North Dakota Office of State Tax Commissioner, Sales and Special Taxes, 600 E. Boulevard Ave. Dept. 127, Bismarck, ND 58505-0599.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute north dakota military exemption online?

pdfFiller has made it simple to fill out and eSign north dakota military exemption. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the north dakota military exemption in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit north dakota military exemption on an iOS device?

You certainly can. You can quickly edit, distribute, and sign north dakota military exemption on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is ND DoT SFN 17147?

ND DoT SFN 17147 is a form used by the North Dakota Department of Transportation for reporting specific transportation-related data.

Who is required to file ND DoT SFN 17147?

Individuals or organizations involved in certain transportation activities, such as vehicle operators or carriers operating within North Dakota, are required to file ND DoT SFN 17147.

How to fill out ND DoT SFN 17147?

To fill out ND DoT SFN 17147, you need to provide accurate information regarding the transportation activity, vehicle details, and other required data as specified on the form.

What is the purpose of ND DoT SFN 17147?

The purpose of ND DoT SFN 17147 is to collect data for regulatory compliance and to assist in transportation planning and management within North Dakota.

What information must be reported on ND DoT SFN 17147?

The information required on ND DoT SFN 17147 includes details about the vehicle, nature of transportation services, dates of operation, and any relevant fees or permits.

Fill out your north dakota military exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

North Dakota Military Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.