Get the free Oklahoma Capital Gain Deduction for the Nonresident Partner

Show details

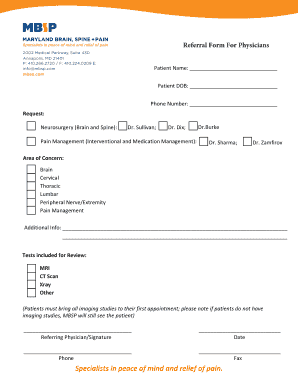

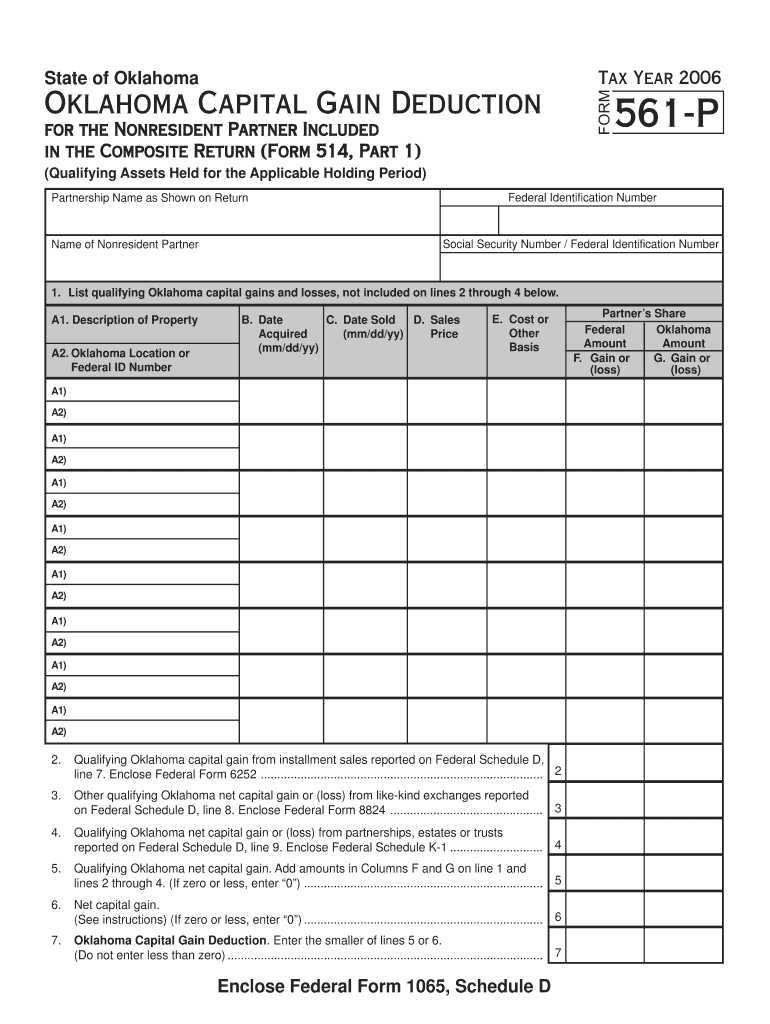

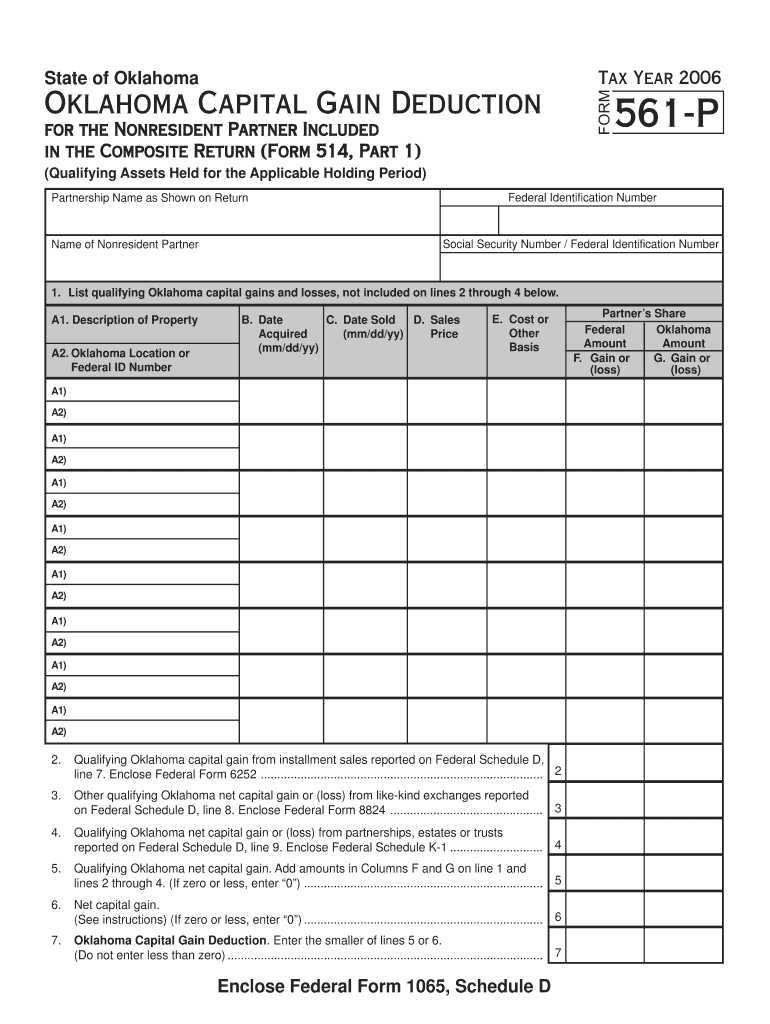

This form is used by nonresident partners to claim the Oklahoma capital gain deduction included in the composite return related to qualifying gains from capital assets.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma capital gain deduction

Edit your oklahoma capital gain deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma capital gain deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma capital gain deduction online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma capital gain deduction. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma capital gain deduction

How to fill out Oklahoma Capital Gain Deduction for the Nonresident Partner

01

Gather all relevant documents, including the partnership agreement and tax forms.

02

Calculate the total capital gains realized by the partnership.

03

Determine the portion of the capital gains attributable to the nonresident partner based on their ownership percentage.

04

Complete the appropriate form for the Oklahoma Capital Gain Deduction, ensuring the nonresident partner's details are correctly filled out.

05

Attach the necessary supporting documentation, such as K-1 forms and partnership tax returns.

06

Submit the completed form and documentation by the tax filing deadline.

Who needs Oklahoma Capital Gain Deduction for the Nonresident Partner?

01

Nonresident partners in an Oklahoma partnership who have realized capital gains from the sale of assets held by the partnership.

02

Partners looking to reduce their taxable income in Oklahoma through the capital gain deduction.

Fill

form

: Try Risk Free

People Also Ask about

Can I take the standard deduction if I have capital gains?

Keep in mind that the standard deduction — or itemized deduction if it is larger — renders the first portion of your income non-taxable. Once your deductions have been used up, additional income becomes taxable. First, any ordinary income — which includes your net short-term capital gains — fills up each tax bracket.

Do non-residents pay capital gains?

Nonresident aliens aren't subject to U.S. capital gains tax but capital gains taxes will be owed in their countries of origin. Certain nonresident aliens who are in the U.S. for more than 183 days are subject to capital gains taxes.

Where to show capital gain exemption?

Yes, exemptions under Sections 54, 54F, and 54EC are available for LTCG on the sale of house property. It is also mandatory to report the sale of the property in your ITR. Yes, you must disclose any gain or loss from the sale of property under the 'Income from Capital Gains' section.

Is the basic exemption limit applicable for capital gains?

He sold the investment after four years in FY 2024-25 for Rs. 18,00,000, resulting in a capital gain of Rs.8,00,000. *Basic exemption limit of Rs.3,00,000 is exhausted against the capital gains income and the remaining amount is taxed. This is assuming that the tax payer has no other income.

Is there a limit to offsetting capital gains?

There is no limit on using capital losses to offset capital gains. There are, however, limits when deducting a net capital loss from taxable income. This loss deduction is capped at $3,000 per year or $1,500 per year for married filing separately.

Can I offset anything against capital gains tax?

Offset any losses you've made on other assets against your gain. So, if you have a share portfolio or family heirloom that sold at a loss, for example, you can use that to reduce the taxable gain against another asset you're selling, such as property.

Can capital gains be set off against basic exemption limit?

The basic exemption limit is the maximum amount that shall not be taxable. Such limit is INR 2.5 lacs, but for senior citizens(60 years or more but less than 80), it is INR 3 lacs and INR 5 lacs for super-senior citizens(80 years of age and above). Thus, the tax rate is nil for income within these specified limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Capital Gain Deduction for the Nonresident Partner?

The Oklahoma Capital Gain Deduction for the Nonresident Partner is a tax deduction that allows nonresident partners to reduce their Oklahoma taxable income by the amount of capital gains derived from the sale of qualifying assets, provided certain conditions are met.

Who is required to file Oklahoma Capital Gain Deduction for the Nonresident Partner?

Nonresident partners in partnerships that derive income from Oklahoma sources and have capital gains from the sale of qualifying assets are required to file for the Oklahoma Capital Gain Deduction.

How to fill out Oklahoma Capital Gain Deduction for the Nonresident Partner?

To fill out the Oklahoma Capital Gain Deduction, nonresident partners must complete the relevant forms provided by the Oklahoma Tax Commission, detailing their capital gains and associated documentation for the qualifying assets.

What is the purpose of Oklahoma Capital Gain Deduction for the Nonresident Partner?

The purpose of the Oklahoma Capital Gain Deduction for the Nonresident Partner is to incentivize investment in Oklahoma by reducing the tax burden on nonresident partners when they realize capital gains from the sale of certain qualified assets.

What information must be reported on Oklahoma Capital Gain Deduction for the Nonresident Partner?

Information that must be reported includes the amount of capital gains, details about the qualifying assets, proof of residency status, and any applicable supporting documentation that validates the claim for the deduction.

Fill out your oklahoma capital gain deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Capital Gain Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.