Get the free Attestation for Financial Statements - controller admin ri

Show details

This document serves as an attestation for financial statements required to issue bonds or certificates of indebtedness in accordance with the laws of Rhode Island.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign attestation for financial statements

Edit your attestation for financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your attestation for financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing attestation for financial statements online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit attestation for financial statements. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

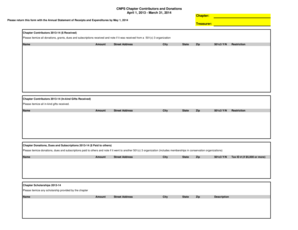

How to fill out attestation for financial statements

How to fill out Attestation for Financial Statements

01

Gather all necessary financial documents, including balance sheets, income statements, and cash flow statements.

02

Review the financial statements for accuracy and completeness.

03

Identify the required format and specific guidelines for the attestation, as specified by the relevant authority or organization.

04

Fill out the attestation form, including details such as the name of the entity, date of the financial statements, and the period covered.

05

Provide any additional required disclosures, such as accounting policies or notes if necessary.

06

Sign and date the attestation form, ensuring that the person signing is authorized to do so.

07

Submit the completed attestation along with the financial statements to the appropriate regulatory body or stakeholder.

Who needs Attestation for Financial Statements?

01

Businesses that are required to provide verified financial information to stakeholders.

02

Organizations seeking external financing or investment.

03

Entities undergoing audits or reviews to comply with regulatory requirements.

04

Non-profit organizations that need to demonstrate financial accountability to donors and grantors.

Fill

form

: Try Risk Free

People Also Ask about

What are the two main types of financial audits?

The two types of financial audits are internal and external audits. Both help companies maintain their financial integrity by evaluating their financial information, operational efficiency, and effectiveness of internal controls.

What is the difference between financial audit and attestation?

Attestation VS Audit Attestation is an evaluation and review of how truthful the data or information is compared to a stated purpose. An audit is a methodical examination of data to find flaws, risks, or compliance concerns that may not have been identified previously.

What is a financial attestation?

Attestation in accounting is the process of verifying and validating financial statements. This is done through an audit or by providing a letter of opinion from a certified public accountant (CPA).

What is a CPA attestation?

Attestation is the process in which a Certified Public Accountant (CPA) engages with a business to provide an opinion, assurance or the results from procedures they perform over subject matter, which can include financial statements.

How do you certify financial statements?

The process of creating a certified income statement involves the preparation of financial statements and the subsequent review or audit of those statements by a CPA or auditor. The purpose of this process is to provide assurance to stakeholders that the certified financial statement examples are accurate and reliable.

What is an attestation in finance?

In finance, an attestation service is a CPA's declaration that the numbers are accurate and reliable. As the service is completed by an independent party, it validates the financial information prepared by internal accountants.

Is auditing a subset of attestation?

Auditing is a subset of attestation engagements that focuses on providing clients with advice and decision support. Attestation is a subset of auditing that improves the quality of information or its context for decision makers.

What is the difference between audit and attestation?

Attestation VS Audit Attestation is an evaluation and review of how truthful the data or information is compared to a stated purpose. An audit is a methodical examination of data to find flaws, risks, or compliance concerns that may not have been identified previously.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Attestation for Financial Statements?

Attestation for Financial Statements is an independent evaluation and confirmation process where an auditor or a third-party evaluator verifies the accuracy and compliance of a company's financial statements, ensuring they are presented fairly in accordance with the applicable accounting standards.

Who is required to file Attestation for Financial Statements?

Typically, publicly traded companies and organizations that are required by regulatory bodies, investors, or stakeholders to provide assurance on their financial statements are mandated to file attestation reports.

How to fill out Attestation for Financial Statements?

To fill out Attestation for Financial Statements, an authorized individual or accountant must complete a standardized form which includes details about the financial statements being attested, the period covered, and the auditor's opinion on the compliance and accuracy of the statements.

What is the purpose of Attestation for Financial Statements?

The purpose of Attestation for Financial Statements is to provide stakeholders with assurance regarding the reliability of the financial information presented, helping to foster trust and transparency in the company's financial reporting.

What information must be reported on Attestation for Financial Statements?

The attestation must report the financial statements being evaluated, the accounting principles used, the period covered, the auditor's opinion, any identified discrepancies, and relevant disclosures regarding internal controls and compliance.

Fill out your attestation for financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Attestation For Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.