SC DoR WH-1606 2004 free printable template

Show details

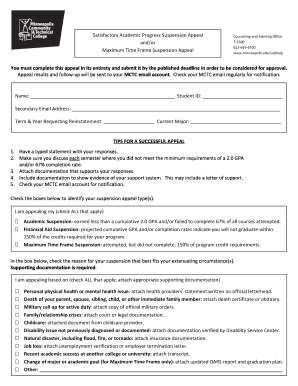

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE WH-1606 (Rev. 8/10/04) 3131 QUARTER SC WITHHOLDING FOURTH QUARTER/ANNUAL RECONCILIATION Mail To: South Carolina Department of Revenue, Withholding, Columbia

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR WH-1606

Edit your SC DoR WH-1606 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR WH-1606 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR WH-1606 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC DoR WH-1606. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR WH-1606 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR WH-1606

How to fill out SC DoR WH-1606

01

Obtain the SC DoR WH-1606 form from the South Carolina Department of Revenue website or your local office.

02

Fill in your legal name and Social Security number at the top of the form.

03

Provide your mailing address, making sure it is current and complete.

04

Indicate the type of tax you are reporting, along with the tax year.

05

Calculate your total income and any deductions applicable to your situation.

06

Complete the applicable sections for credits and other adjustments.

07

Review all information for accuracy before proceeding.

08

Sign and date the form at the designated section.

09

Submit the completed form to the appropriate South Carolina Department of Revenue office.

Who needs SC DoR WH-1606?

01

Individuals or entities filing taxes in South Carolina who need to report wages or income.

02

Businesses required to report withholding tax to the South Carolina Department of Revenue.

03

Employers who need to document employee wages and withholdings for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What tax type is 1606?

BIR Form 1606, or also known as Withholding Tax Remittance Return for Onerous Transfer of Real Estate Property other than Capital Assets.

What is the withholding tax for SC?

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows • Mar 7, 2022

What is tax type 1601?

What is it? BIR Form 1601-EQ is a tax form that is used to remit all other forms of final withholding taxes. Much like form 1601FQ, 1601-EQ forms can be used in remitting taxes withheld for the 3rd month of the quarter, in ance with the provisions listed within the TRAIN law.

What is the state tax withholding for SC?

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows • Mar 7, 2022

What are two types of the South Carolina state income tax forms?

Form NameForm NumberForm NameComposite Return AffidavitForm NumberI-338Form NameRecapture of South Carolina Housing Tax CreditForm NumberSC SCH TC 63RForm NameDeferred Income Taxes for South CarolinaForm NumberSC SCH TD-1Form NameIndividual Declaration of Estimated TaxForm NumberSC1040ES7 more rows

Does South Carolina have a state tax withholding form?

Form SC W-4, South Carolina Employee's Withholding Allowance Certificate, has also been updated for 2021. Beginning for calendar year 2021, employees are required to submit, at the time of hire, both the state Form SC W-4 and the federal Form W-4.

How do I apply for a SC withholding number?

You can apply for a SC Withholding File Number using either of two (2) ways: 1) Register on MyDORWAY. You will be given a confirmation number after completing questions and the registration process. The SC reference number is your Withholding File Number.

What is the out of state withholding in South Carolina?

In South Carolina, non-residents may be subject to withholding on their gain amounts. The South Carolina Code of Laws, Section 12-8-580, says that the purchasers are to withhold 7% of gain for individuals and 5% of gain for corporations that are considered a non-resident seller.

Is South Carolina a mandatory withholding state?

South Carolina Income Tax Withholding Employers in South Carolina must withhold state income taxes from wages paid to nonresidents for services performed within South Carolina. Residents working outside of South Carolina are also subject to withholding for that income.

What does South Carolina withholding mean?

South Carolina Withholding Tax Withholding Tax is taken out of taxpayer wages to go towards the taxpayers' total yearly Income Tax liability.

How do I set up withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SC DoR WH-1606?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific SC DoR WH-1606 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in SC DoR WH-1606 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your SC DoR WH-1606, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete SC DoR WH-1606 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your SC DoR WH-1606, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is SC DoR WH-1606?

SC DoR WH-1606 is a form used in South Carolina for reporting wages and withholding taxes for employees.

Who is required to file SC DoR WH-1606?

Any employer in South Carolina who has employees and withhold taxes from their wages is required to file SC DoR WH-1606.

How to fill out SC DoR WH-1606?

To fill out SC DoR WH-1606, you need to provide information including the employer's details, the employees' wage and tax information, and any applicable deductions.

What is the purpose of SC DoR WH-1606?

The purpose of SC DoR WH-1606 is to ensure that employers report the wages of their employees and any South Carolina state income tax withheld.

What information must be reported on SC DoR WH-1606?

SC DoR WH-1606 must report the total wages paid, the amount of state tax withheld, and details about the employer and employees.

Fill out your SC DoR WH-1606 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR WH-1606 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.