SC DoR WH-1606 2016 free printable template

Show details

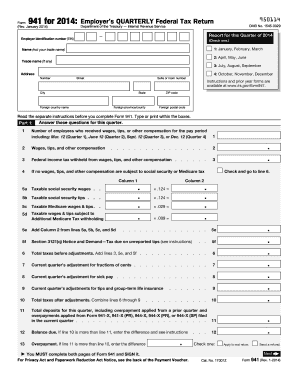

BALANCE DUE 6. 14-0809 ANNUAL SC STATE RECONCILIATION INFORMATION LINE 7 THROUGH 10 INFORMATION IS REQUIRED 7. STATE OF SOUTH CAROLINA WH-1606 DEPARTMENT OF REVENUE Rev. 9/22/16 SC WITHHOLDING FOURTH QUARTER AND ANNUAL RECONCILIATION RETURN QUARTER Place an X in all boxes that apply. Dor. sc.gov. Payments can be made by VISA or MasterCard or by Electronic Funds Withdrawal EFW. Do not mail this form when filing online. Confirmation will be given for a successfully filed return. DUE DATES...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form wh 1606pdffillercom 2016

Edit your form wh 1606pdffillercom 2016 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form wh 1606pdffillercom 2016 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form wh 1606pdffillercom 2016 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form wh 1606pdffillercom 2016. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR WH-1606 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form wh 1606pdffillercom 2016

How to fill out SC DoR WH-1606

01

Begin by downloading the SC DoR WH-1606 form from the official website.

02

Fill in your personal information at the top of the form, including your full name, address, and contact details.

03

Indicate the purpose of the claim by selecting the appropriate box.

04

Provide details of your employment history by listing your previous employers and dates of employment.

05

Include information about the reasons for your claim, ensuring you explain your situation clearly.

06

Review the form for accuracy and completeness before submitting.

07

Submit the completed form as instructed, either electronically or by mail.

Who needs SC DoR WH-1606?

01

Any individual seeking to claim unemployment benefits in South Carolina.

02

Individuals who have lost their job through no fault of their own.

03

Workers needing to provide verification of wages for their unemployment claim.

Fill

form

: Try Risk Free

People Also Ask about

What tax type is 1606?

BIR Form 1606, or also known as Withholding Tax Remittance Return for Onerous Transfer of Real Estate Property other than Capital Assets.

What is the withholding tax for SC?

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows • Mar 7, 2022

What is tax type 1601?

What is it? BIR Form 1601-EQ is a tax form that is used to remit all other forms of final withholding taxes. Much like form 1601FQ, 1601-EQ forms can be used in remitting taxes withheld for the 3rd month of the quarter, in ance with the provisions listed within the TRAIN law.

What is the state tax withholding for SC?

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows • Mar 7, 2022

What are two types of the South Carolina state income tax forms?

Form NameForm NumberForm NameComposite Return AffidavitForm NumberI-338Form NameRecapture of South Carolina Housing Tax CreditForm NumberSC SCH TC 63RForm NameDeferred Income Taxes for South CarolinaForm NumberSC SCH TD-1Form NameIndividual Declaration of Estimated TaxForm NumberSC1040ES7 more rows

Does South Carolina have a state tax withholding form?

Form SC W-4, South Carolina Employee's Withholding Allowance Certificate, has also been updated for 2021. Beginning for calendar year 2021, employees are required to submit, at the time of hire, both the state Form SC W-4 and the federal Form W-4.

How do I apply for a SC withholding number?

You can apply for a SC Withholding File Number using either of two (2) ways: 1) Register on MyDORWAY. You will be given a confirmation number after completing questions and the registration process. The SC reference number is your Withholding File Number.

What is the out of state withholding in South Carolina?

In South Carolina, non-residents may be subject to withholding on their gain amounts. The South Carolina Code of Laws, Section 12-8-580, says that the purchasers are to withhold 7% of gain for individuals and 5% of gain for corporations that are considered a non-resident seller.

Is South Carolina a mandatory withholding state?

South Carolina Income Tax Withholding Employers in South Carolina must withhold state income taxes from wages paid to nonresidents for services performed within South Carolina. Residents working outside of South Carolina are also subject to withholding for that income.

What does South Carolina withholding mean?

South Carolina Withholding Tax Withholding Tax is taken out of taxpayer wages to go towards the taxpayers' total yearly Income Tax liability.

How do I set up withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form wh 1606pdffillercom 2016?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific form wh 1606pdffillercom 2016 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute form wh 1606pdffillercom 2016 online?

Completing and signing form wh 1606pdffillercom 2016 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit form wh 1606pdffillercom 2016 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign form wh 1606pdffillercom 2016 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is SC DoR WH-1606?

SC DoR WH-1606 is a form used in South Carolina for reporting wages and withholding tax information for employees.

Who is required to file SC DoR WH-1606?

Employers who withhold South Carolina income tax from employee wages are required to file SC DoR WH-1606.

How to fill out SC DoR WH-1606?

To fill out SC DoR WH-1606, employers need to provide details such as the employer's name, address, Federal Employer Identification Number (FEIN), employee wages, and withholding amounts.

What is the purpose of SC DoR WH-1606?

The purpose of SC DoR WH-1606 is to report employee wage information and the amount of state income tax withheld to the South Carolina Department of Revenue.

What information must be reported on SC DoR WH-1606?

Information that must be reported on SC DoR WH-1606 includes the employer's details, total wages paid, total state tax withheld, and employee identification information.

Fill out your form wh 1606pdffillercom 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Wh 1606pdffillercom 2016 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.