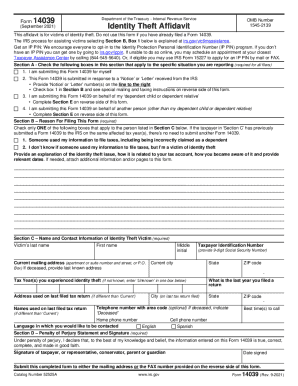

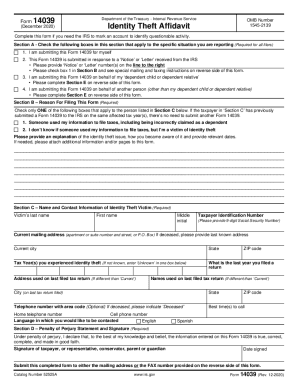

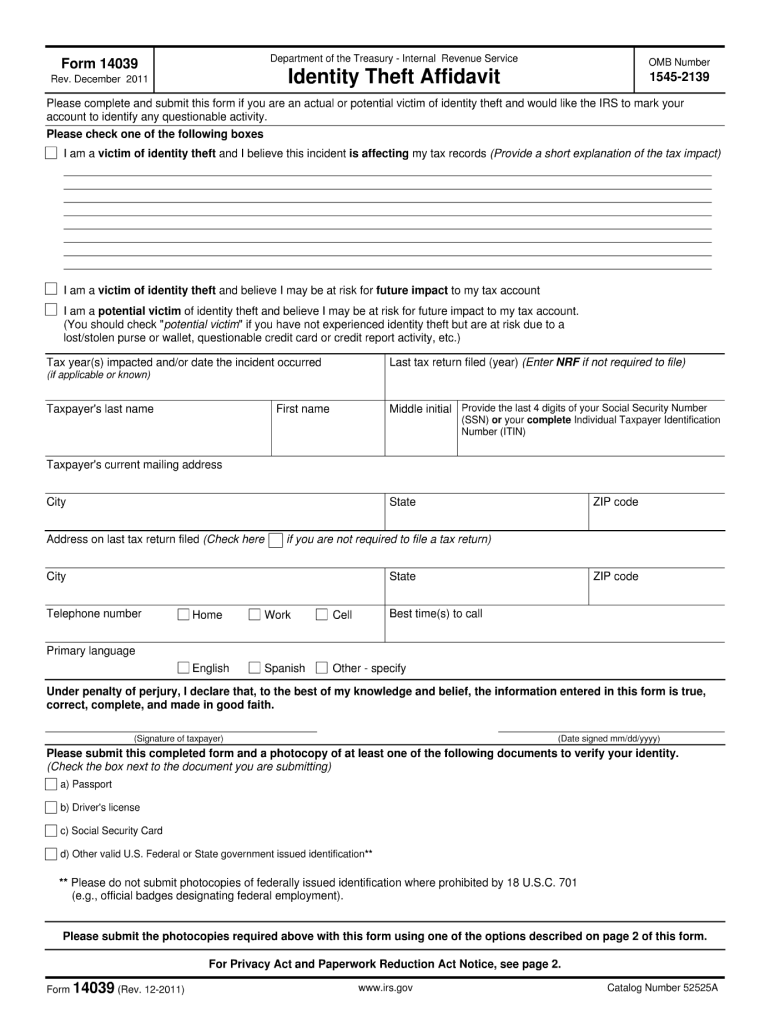

IRS 14039 2011 free printable template

Instructions and Help about IRS 14039

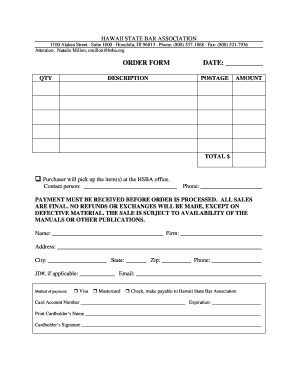

How to edit IRS 14039

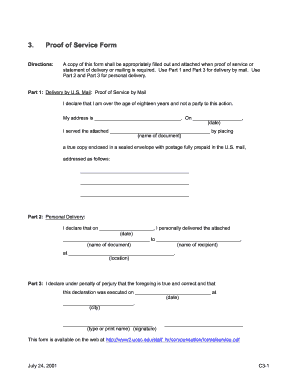

How to fill out IRS 14039

About IRS 14 previous version

What is IRS 14039?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

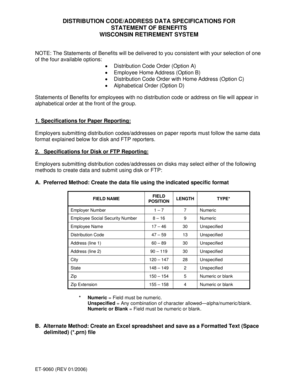

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 14039

What should I do if I realize there is a mistake on my submitted sample of sworn declaration?

If you discover a mistake after submitting your sample of sworn declaration, it's essential to act quickly. You can submit an amended declaration to correct the errors. Ensure that you highlight the changes and indicate that it supersedes the previous submission.

How can I verify the status of my submitted sample of sworn declaration?

To check the status of your sample of sworn declaration, you may use any tracking system provided by the filing authority. If you e-filed, keep an eye out for confirmation emails or notifications regarding the processing. Should you encounter issues, check common e-file rejection codes.

Are there specific legal considerations for nonresidents when filing a sample of sworn declaration?

Yes, nonresidents may have different requirements when filing a sample of sworn declaration. It’s crucial to be aware of local laws and ensure that you provide any necessary documentation, especially if representing a foreign payee.

What technical requirements should I be aware of when e-filing my sample of sworn declaration?

When e-filing your sample of sworn declaration, ensure that your software is compatible with the filing platform. Check browser compatibility and make sure your device meets the technical requirements for a smooth submission process.

What should I do if I receive a notice or audit regarding my sample of sworn declaration?

If you receive a notice or are audited concerning your sample of sworn declaration, it’s important to prepare relevant documentation promptly. Review the notice thoroughly, and consider seeking legal advice to ensure appropriate responses and compliance with any requests.

See what our users say