NY RP-459-c 2009 free printable template

Show details

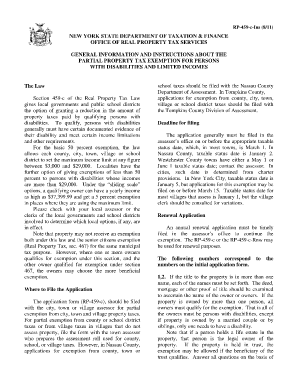

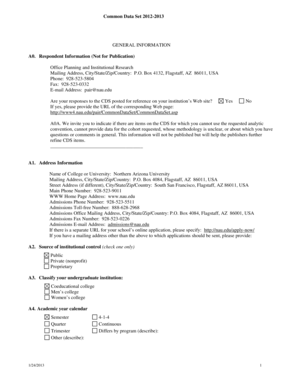

General information and instructions for completing this form are contained in RP-459-c-Ins l. Name and telephone no. RP-459-c 9/09 NEW YORK STATE DEPARTMENT OF TAXATION FINANCE OFFICE OF REAL PROPERTY TAX SERVICES APPLICATION FOR PARTIAL TAX EXEMPTION FOR REAL PROPERTY OF PERSONS WITH DISABILITIES AND LIMITED INCOMES APPLICATION MUST BE FILED WITH YOUR LOCAL ASSESSOR BY TAXABLE STATUS DATE Do not file this form with the Office of Real Property Tax Services. of owner s 2. Mailing address of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY RP-459-c

Edit your NY RP-459-c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY RP-459-c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY RP-459-c online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY RP-459-c. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

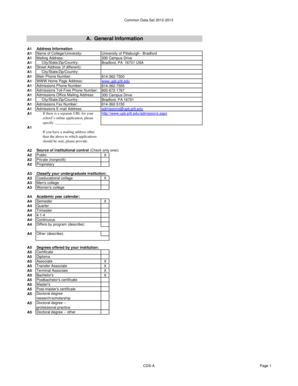

NY RP-459-c Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY RP-459-c

How to fill out NY RP-459-c

01

Obtain the NY RP-459-c form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in the property owner's information including name, address, and contact details.

03

Provide the property's location, including street address and county.

04

Indicate the type of property and the reason for the exemption you are applying for.

05

Detail any additional information required for specific exemptions.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the appropriate local assessor's office before the deadline.

Who needs NY RP-459-c?

01

Property owners in New York State who are seeking exemptions from property taxes.

02

Individuals who have recently purchased property and wish to apply for specific tax benefits.

03

Homeowners looking to reduce their property tax liability under certain categories of exemptions.

Instructions and Help about NY RP-459-c

Fill

form

: Try Risk Free

People Also Ask about

What is the NYC disabled homeowners exemption?

A property tax break for disabled New Yorkers who own one-, two-, or three-family homes, condominiums, or cooperative apartments.Estimated Reduction. If your income is betweenDHE can reduce your home's assessed value by$52,000 and $52,99935%$51,000 and $51,99940%$50,001 and $50,99945%$0 and $50,00050%6 more rows

What is the senior property tax exemption in NYC?

To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption, the law allows each county, city, town, village, or school district to set the maximum income limit at any figure between $3,000 and $50,000.

At what age do you stop paying property taxes in New York State?

Age eligibility Each of the owners of the property must be 65 years of age or over, unless the owners are: husband and wife, or. siblings (having at least one common parent) and. one of the owners is at least 65.

What is Section 467 of the New York State Real Property tax law?

Real Property Tax Law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior citizens. To qualify, seniors must be 65 years of age or older, meet certain income limitations, and other requirements.

How do I apply for property tax exemption in NYC?

To apply for SCHE, you must send proof of income for all owners and spouses, no matter where they reside. You should submit proof of your 2021 income, but if it is unavailable, you can submit proof of your income in 2020. Proof of income from all owners and spouses must be from the same tax year.

What is NYS Real Property tax law Section 457?

Section 457 of the Real Property Tax Law authorizes a partial exemption from real property taxation for newly constructed homes purchased by first-time homebuyers. Counties, cities, towns, and villages may hold public hearings and then adopt local laws granting the exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY RP-459-c in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NY RP-459-c, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit NY RP-459-c on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing NY RP-459-c, you can start right away.

How do I fill out NY RP-459-c on an Android device?

Use the pdfFiller Android app to finish your NY RP-459-c and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is NY RP-459-c?

NY RP-459-c is a property tax exemption application form used in New York State for homeowners to apply for a partial exemption on real property taxes under the New York State Real Property Tax Law.

Who is required to file NY RP-459-c?

Property owners who are seeking a partial exemption from real property taxes for their property and meet the qualifying criteria specified by the New York State Real Property Tax Law are required to file NY RP-459-c.

How to fill out NY RP-459-c?

To fill out NY RP-459-c, property owners must provide personal information, details about the property, income information, and any relevant supporting documentation required for the exemption.

What is the purpose of NY RP-459-c?

The purpose of NY RP-459-c is to allow eligible homeowners to apply for property tax exemptions to reduce their tax burden, thereby making home ownership more affordable.

What information must be reported on NY RP-459-c?

Information that must be reported on NY RP-459-c includes the property owner's name, address, the description of the property, income details, and any additional information required by the local tax assessor.

Fill out your NY RP-459-c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY RP-459-C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.