Canada GST21E 2009 free printable template

Show details

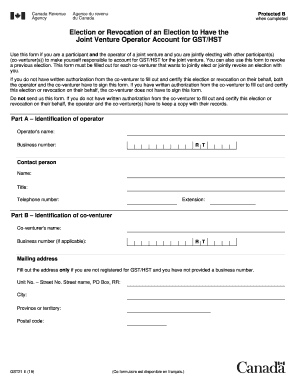

ELECTION OR REVOCATION OF AN ELECTION TO HAVE THE JOINT VENTURE OPERATOR ACCOUNT FOR GST/HST

Use this form if you are a participant and the operator of a joint venture, and you are jointly electing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada GST21E

Edit your Canada GST21E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST21E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada GST21E online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada GST21E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST21E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST21E

How to fill out Canada GST21E

01

Begin by downloading the Canada GST21E form from the Canada Revenue Agency (CRA) website.

02

Fill in your business number (BN) at the top of the form.

03

Indicate the reporting period for which you are filing the GST return.

04

Provide your total sales figures for the reporting period.

05

Report any taxable, zero-rated, and exempt sales.

06

Complete the section for input tax credits (ITCs) by listing your eligible purchases.

07

Calculate net tax by subtracting your ITCs from the total GST collected.

08

Sign and date the form certifying all information provided is true and correct.

09

Submit the completed form by mail or electronically, following the CRA's submission guidelines.

Who needs Canada GST21E?

01

Businesses that are registered for the Goods and Services Tax (GST) in Canada and need to report their GST collected and input tax credits.

Fill

form

: Try Risk Free

People Also Ask about

How are joint ventures taxed in Canada?

Joint Ventures A joint venture is not considered to be a separate entity either for legal or tax purposes. Instead, the joint venturers each pay tax on their respective shares of revenues and expenses generated by the joint venture's operations.

Does a joint venture need to be registered in Canada?

There is no requirement under Canadian law to register or file the agreement that governs a joint venture. It is a confidential private contract between the contracting parties.

What is the difference between a joint venture and a partnership in Canada?

A partnership calculates capital cost allowance at the partnership level. In a joint venture, co-venturers may claim as little or as much as suits their situation, and unlike partnerships, joint ventures do not have to file information returns.

Is a joint venture the same as a general partnership?

Although a joint venture is very similar to a partnership, a joint venture is generally more limited in scope and duration. A joint venture is generally considered to be a partnership for a single transaction. The rights and liabilities of joint venturers are governed by the principles applicable to partnerships.

Do joint ventures file tax returns Canada?

In a joint venture, co-venturers may claim as little or as much as suits their situation, and unlike partnerships, joint ventures do not have to file information returns.

What is the difference between a joint venture and a general partnership Canada?

A partnership is usually only made up of persons, two or more, who form a legally recognized association for the purpose of operating a business. A joint venture, on the other hand, can be individuals or entities such as corporations, or even governments and businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Canada GST21E online?

pdfFiller has made it simple to fill out and eSign Canada GST21E. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in Canada GST21E without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your Canada GST21E, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete Canada GST21E on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Canada GST21E. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada GST21E?

Canada GST21E is a form used by businesses to report and remit Goods and Services Tax (GST) and/or Harmonized Sales Tax (HST) to the Canada Revenue Agency (CRA).

Who is required to file Canada GST21E?

Businesses that are GST/HST registrants and have collected tax on their sales are required to file Canada GST21E to report their tax liabilities and payments.

How to fill out Canada GST21E?

To fill out Canada GST21E, businesses need to provide their business information, calculate the total GST/HST collected during the reporting period, deduct any input tax credits claimed, and report the net tax payable.

What is the purpose of Canada GST21E?

The purpose of Canada GST21E is to ensure compliance with GST/HST regulations by providing a standardized way for businesses to report their tax collections and payments to the CRA.

What information must be reported on Canada GST21E?

Information that must be reported on Canada GST21E includes the business name and number, reporting period, total GST/HST collected, input tax credits claimed, and net tax remittance amount.

Fill out your Canada GST21E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst21e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.