Canada GST489 E 2013 free printable template

Show details

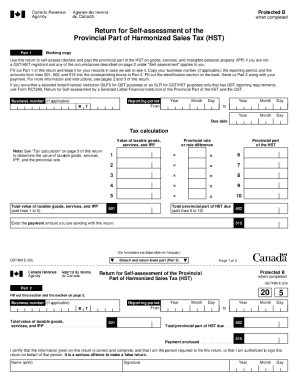

However if your regular GST/HST return for the reporting period that includes April 1 2013 is due after July 31 2013 and you meet the following conditions you must use Form GST489. Total tax due Enter the payment amount you are sending with this return. GST489 E 13 Part of Harmonized Sales Tax HST Part 2 Detach and return lower part Part 2 Vous pouvez obtenir ce formulaire en fran ais www. Special rules for motor vehicles For a motor vehicle imported or brought into a participating province...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada GST489 E

Edit your Canada GST489 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST489 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada GST489 E online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada GST489 E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST489 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST489 E

How to fill out Canada GST489 E

01

Obtain the Canada GST489 E form from the Canada Revenue Agency (CRA) website or your local tax office.

02

Fill out your legal name and business number at the top of the form.

03

Indicate the reporting period for which you are filing by entering the appropriate dates.

04

Complete the 'Input Tax Credits' section by listing all eligible expenses and their corresponding tax amounts.

05

Calculate the total of your Input Tax Credits and enter it in the designated box.

06

In the 'Net Tax Calculation' section, subtract the total input tax credits from the total GST/HST collected.

07

If you owe tax, indicate the payment method and provide any necessary account information.

08

Review all entered information for accuracy before submission.

09

Sign and date the form at the bottom.

10

Submit the form either by mailing it to the specified address or electronically, if applicable.

Who needs Canada GST489 E?

01

Businesses that are registered for GST/HST in Canada and have incurred expenses for which they want to claim Input Tax Credits.

02

Companies that have collected GST/HST during the reporting period and need to reconcile their collected tax with claimed credits.

03

Self-employed individuals who need to report their sales and claim input tax credits related to their business expenses.

Fill

form

: Try Risk Free

People Also Ask about

Can I print a CRA remittance voucher?

Personalized remittance vouchers for Individual instalments and amount owing are available for downloading and printing. Printable vouchers are currently limited to those used by individuals for payments at financial institutions, Canada Post retail outlets, or by mail.

How much tax do you pay on lump sum Canada?

Use the following lump-sum withholding rates to deduct income tax: 10% (5% for Quebec) on amounts up to and including $5,000. 20% (10% for Quebec) on amounts over $5,000 up to and including $15,000. 30% (15% for Quebec) on amounts over $15,000.

How do I get a remittance voucher?

To request a remittance voucher, go to: My Business Account, if you are the business owner. Represent a Client, if you are an authorized representative or employee. Call Business Enquiries at 1-800-959-5525.

Can I print a GST remittance form?

If you need to keep a copy of your GST/HST return calculations for record purposes, you can use the printer-friendly version of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy.

What is a qualified retroactive lump sum payment?

A ''Qualifying Retroactive lump sum payment'' is a lump sum that is paid to an individual (other than a trust) in a year and that relates to one or more prior eligible taxation years during which the individual was a resident of Canada throughout the year.

What is a remittance voucher?

A remittance voucher is a slip that provides Canada Revenue Agency (CRA) specific account information and has to accompany your payments. A payment form is a document that provides a format or guidance on how to calculate an amount.

What is RC 159?

GST/HST Amount Owing Remittance (RC 159) This form is used to make payments on an existing debt or to make a prepayment for an anticipated reassessment. Click on Remit. Enter information into the form provided. You will then have the option to remit the payment to the CRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada GST489 E without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Canada GST489 E into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in Canada GST489 E?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your Canada GST489 E to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit Canada GST489 E on an iOS device?

You certainly can. You can quickly edit, distribute, and sign Canada GST489 E on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada GST489 E?

Canada GST489 E is a form used to apply for a rebate of Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) for certain eligible purchases made by individuals or specific entities.

Who is required to file Canada GST489 E?

Individuals or organizations that have made purchases that qualify for a GST/HST rebate are required to file Canada GST489 E. This often includes members of certain groups, such as charities or public institutions.

How to fill out Canada GST489 E?

To fill out Canada GST489 E, one must provide personal information, detail the eligible purchases, calculate the amount of GST/HST paid, and submit it to the appropriate tax authority.

What is the purpose of Canada GST489 E?

The purpose of Canada GST489 E is to allow eligible individuals and entities to claim a rebate for the GST/HST they have paid on qualifying purchases, thus relieving some of the financial burden incurred by these taxes.

What information must be reported on Canada GST489 E?

The information that must be reported on Canada GST489 E includes the applicant's contact information, details of eligible purchases, the GST/HST paid, and any necessary supporting documentation.

Fill out your Canada GST489 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst489 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.