Canada GST489 E 2020-2025 free printable template

Show details

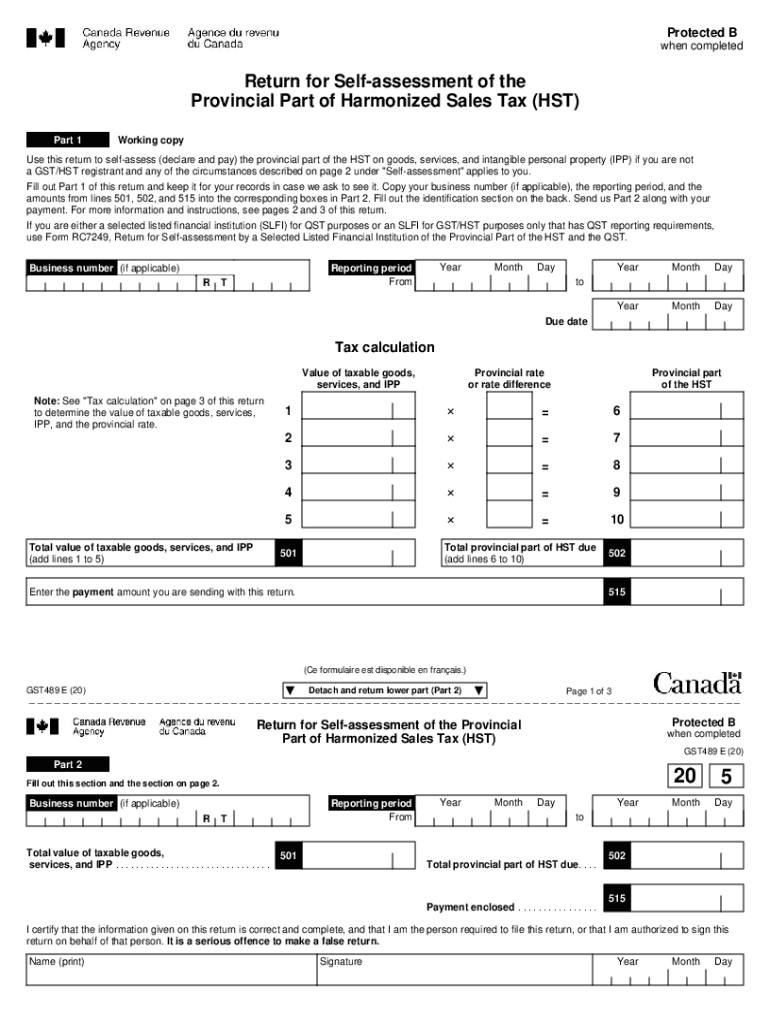

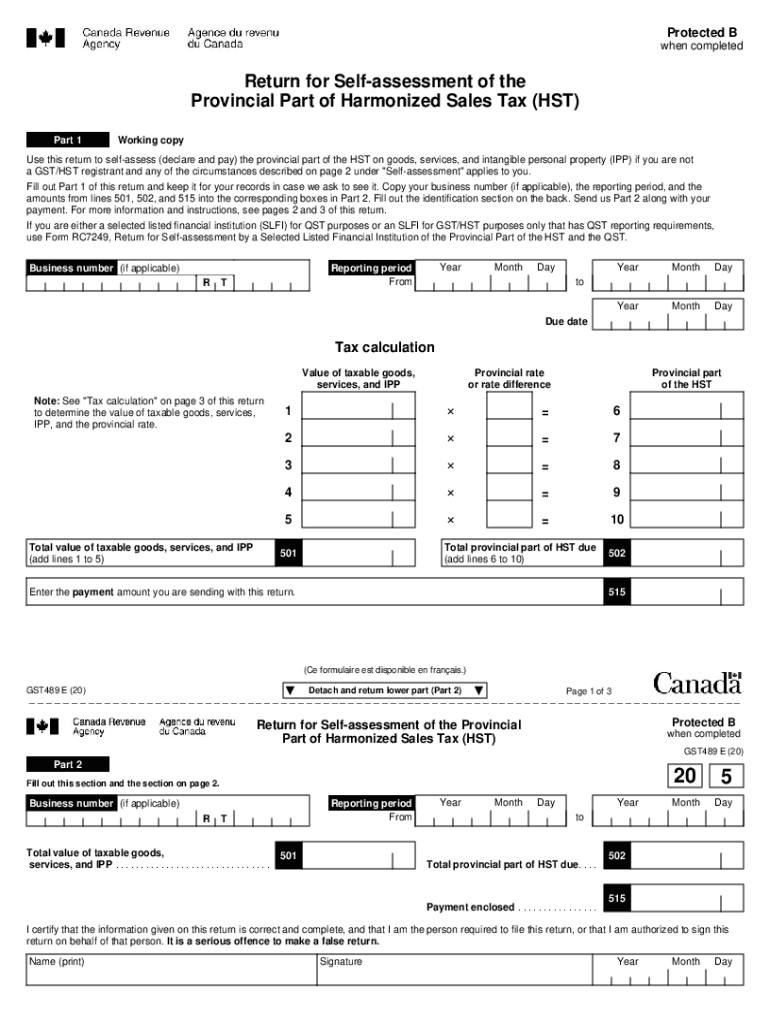

Protected B when completedReturn for Self assessment of the Provincial Part of Harmonized Sales Tax (HST) Part 1Working confuse this return to self assess (declare and pay) the provincial part of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance and benefits plansretail

Edit your insurance and benefits plansretail form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance and benefits plansretail form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance and benefits plansretail online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance and benefits plansretail. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST489 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out insurance and benefits plansretail

How to fill out Canada GST489 E

01

Obtain a copy of the Canada GST489 E form from the Canada Revenue Agency (CRA) website.

02

Fill in your business number (BN) at the top of the form.

03

Indicate the reporting period for which you are filing the form.

04

Provide details about your business, including your legal name and contact information.

05

Report your total sales and any exempt supplies on the form.

06

Calculate the amount of GST/HST collected and any input tax credits you are claiming.

07

Review the completed form for accuracy.

08

Sign and date the form.

09

Submit the form to the CRA by the specified deadline.

Who needs Canada GST489 E?

01

Businesses and organizations that are registered for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada.

02

Entities that need to report their sales and GST/HST collected during the reporting period.

03

Filing is necessary for businesses to reconcile their GST/HST collected with input tax credits claimed.

Fill

form

: Try Risk Free

People Also Ask about

Can I print a CRA remittance voucher?

Personalized remittance vouchers for Individual instalments and amount owing are available for downloading and printing. Printable vouchers are currently limited to those used by individuals for payments at financial institutions, Canada Post retail outlets, or by mail.

How much tax do you pay on lump sum Canada?

Use the following lump-sum withholding rates to deduct income tax: 10% (5% for Quebec) on amounts up to and including $5,000. 20% (10% for Quebec) on amounts over $5,000 up to and including $15,000. 30% (15% for Quebec) on amounts over $15,000.

How do I get a remittance voucher?

To request a remittance voucher, go to: My Business Account, if you are the business owner. Represent a Client, if you are an authorized representative or employee. Call Business Enquiries at 1-800-959-5525.

Can I print a GST remittance form?

If you need to keep a copy of your GST/HST return calculations for record purposes, you can use the printer-friendly version of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Working Copy.

What is a qualified retroactive lump sum payment?

A ''Qualifying Retroactive lump sum payment'' is a lump sum that is paid to an individual (other than a trust) in a year and that relates to one or more prior eligible taxation years during which the individual was a resident of Canada throughout the year.

What is a remittance voucher?

A remittance voucher is a slip that provides Canada Revenue Agency (CRA) specific account information and has to accompany your payments. A payment form is a document that provides a format or guidance on how to calculate an amount.

What is RC 159?

GST/HST Amount Owing Remittance (RC 159) This form is used to make payments on an existing debt or to make a prepayment for an anticipated reassessment. Click on Remit. Enter information into the form provided. You will then have the option to remit the payment to the CRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit insurance and benefits plansretail in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing insurance and benefits plansretail and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the insurance and benefits plansretail in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your insurance and benefits plansretail and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit insurance and benefits plansretail on an iOS device?

Use the pdfFiller mobile app to create, edit, and share insurance and benefits plansretail from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Canada GST489 E?

Canada GST489 E is a form used to report and claim certain input tax credits for businesses under the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST) in Canada.

Who is required to file Canada GST489 E?

Businesses that are registered for GST/HST and wish to claim input tax credits for certain expenses must file Canada GST489 E.

How to fill out Canada GST489 E?

To fill out Canada GST489 E, businesses need to provide their contact information, the details of the expenses for which they are claiming credits, and any required supporting documentation.

What is the purpose of Canada GST489 E?

The purpose of Canada GST489 E is to allow businesses to claim input tax credits for eligible expenses that are subject to GST/HST.

What information must be reported on Canada GST489 E?

Businesses must report their GST/HST registration number, details of the purchases being claimed, the amount of GST/HST paid, and any other relevant information related to the claim.

Fill out your insurance and benefits plansretail online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance And Benefits Plansretail is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.