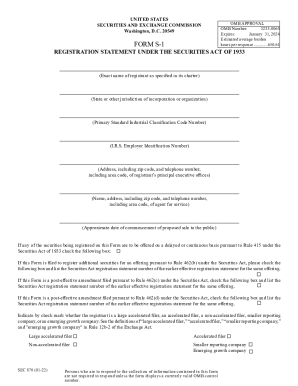

SEC 870 S-1 2008 free printable template

Get, Create, Make and Sign da 31 2008 form

Editing da 31 2008 form online

Uncompromising security for your PDF editing and eSignature needs

SEC 870 S-1 Form Versions

How to fill out da 31 2008 form

How to fill out SEC 870 S-1

Who needs SEC 870 S-1?

Instructions and Help about da 31 2008 form

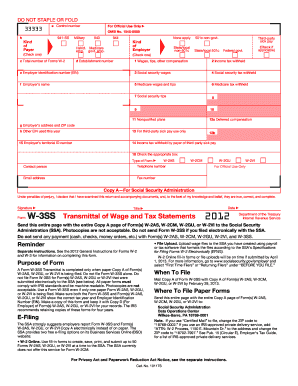

My name is Miranda Chuck, and I'm a CPA, and we're going to talk about the IRS w-4 form for allowances now this form is typically the form you fill out when you first start a job, and you can revise it any time and one of the main differences between this form and other IRS forms is that this one goes directly to your employer and what you're doing is telling the employer how much of the salary you negotiated with your boss that you want them to withhold for you and we mitt to the IRS on your behalf the goal is to have at least 90 percent of the taxes that you're going to owe at the end of the year withheld during the year much less, and you might be subject to penalties and taxes much more, and you're just giving the government an interest-free loan instead of having that money work for you now the form itself is rather straightforward just your name address social security number but one of the lines that the little trickier is line five which talks about the total number of allowances now there is a worksheet for you to help you calculate your personal allowances, so you just go through the decisions, and it's just yes/no, and then they'll tell you how many that you need to you qualify it for and how many to put on your worksheet further if you actually itemize deductions on your tax returns there's another worksheet that will help you go through some yes/no questions to see if there is any adjustment that you might need to make to your w-4 and finally if there are two earners in your family there's another worksheet that you may need to go through and [Music] calculations to see if again you might need any further adjustments to your w-4 and remember you can advise this form at any time

People Also Ask about

What happens after you file an S-1?

What is an S-1 filing?

What is S-1 in accounting?

What is the purpose of an S-3?

What is included in an S-1 filing?

What does to the negative 1 mean?

What does S-1 approval mean?

What is the difference between an S-1 and S-3?

What does s 1 mean in biology?

What does s 1 mean in science?

What does the unit s 1 mean?

What happens after filing S-1?

What is Form S-1 used for?

Is an S-1 and prospectus the same thing?

What does S-1 mean?

Who can file s1 form?

What is an S-1 vs S 3?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete da 31 2008 form online?

How do I edit da 31 2008 form straight from my smartphone?

How do I complete da 31 2008 form on an Android device?

What is SEC 870 S-1?

Who is required to file SEC 870 S-1?

How to fill out SEC 870 S-1?

What is the purpose of SEC 870 S-1?

What information must be reported on SEC 870 S-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.