SEC 870 S-1 2022-2026 free printable template

Show details

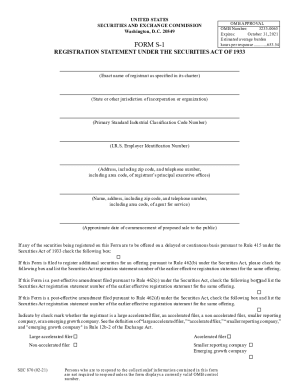

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549FORM S1OMB APPROVAL

OMB Number:

32350065

Expires:

January 31, 2024

Estimated average burden

hours per response .............650.61REGISTRATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form s 1 registration statement

Edit your sec form s 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form registration statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration statement online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit s 1 sec pdf form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SEC 870 S-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SEC 870 S-1

How to fill out SEC 870 S-1

01

Begin by downloading the SEC 870 S-1 form from the SEC's official website.

02

Carefully read the instructions accompanying the form to ensure compliance with all requirements.

03

Fill in the title of the offering at the top of the form.

04

Provide the company name, including the state of incorporation.

05

Complete the section regarding the type of securities being offered.

06

Enter the date of the proposed offering and any relevant financial details.

07

Attach any additional documentation required, including financial statements and legal opinions.

08

Review the entire form for accuracy and completeness.

09

Submit the completed form to the SEC along with any necessary fees.

Who needs SEC 870 S-1?

01

Public companies issuing new securities.

02

Companies looking to register securities for the first time.

03

Investment firms acting on behalf of clients pursuing public offerings.

04

Anyone involved in the capital markets who needs to comply with SEC regulations.

Fill

form

: Try Risk Free

People Also Ask about

What happens after you file an S-1?

Upon filing, a Form S-1 is reviewed by the Securities and Exchange Commission, who may render SEC Comments. Once a Form S-1 is declared effective by the SEC, the company becomes subject to SEC reporting requirements. All companies qualify to use and must comply with Form S-1 registration statement requirements.

What is an S-1 filing?

An S-1 Form is the initial registration that is filed with the SEC when a company first goes public, generally before the initial public offering, or IPO. You may sometimes hear this form referred to as the “registration form,” since it registers the company with the SEC.

What is S-1 in accounting?

SEC Form S-1 is an SEC registration required for U.S. companies that want to be listed on a national exchange. 1. It is basically a registration statement for a company that is usually filed in connection with an initial public offering.

What is the purpose of an S-3?

Key Takeaways. SEC Form S-3 is a regulatory filing that provides simplified reporting for issuers of registered securities. An S-3 filing is utilized when a company wishes to raise capital, usually as a secondary offering after an initial public offering has already occurred.

What is included in an S-1 filing?

In the Form S-1, companies are required to furnish the details on their business model, planned use for capital proceeds, price per share and detailed financials. A filing company must also furnish a prospectus, offering price methodology and information whether any dilution to other listed securities will occur.

What does to the negative 1 mean?

Answer: A positive number to the power negative 1 is a number that is always less than one.

What does S-1 approval mean?

SEC Form S-1 is an SEC registration required for U.S. companies that want to be listed on a national exchange. 1. It is basically a registration statement for a company that is usually filed in connection with an initial public offering.

What is the difference between an S-1 and S-3?

Form S-3 is a shorter registration form than Form S-1, which is used in an initial stock launch or IPO. Form S-3 can be used by a company one year after an IPO.

What does s 1 mean in biology?

Note that the units of relative rate are s -1 as no measurable change is being observed, whereas for average rate the unit used depends on the measurable quantity.

What does s 1 mean in science?

It means meters per second (recall that s−1=1/s, so ms−1=m/s). Cite.

What does the unit s 1 mean?

Unit of time second. The second, symbol s, is the SI unit of time. It is defined by taking the fixed numerical value of the cesium frequency ΔνCs, the unperturbed ground-state hyperfine transition frequency of the cesium 133 atom, to be 9 192 631 770 when expressed in the unit Hz, which is equal to s-1.

What happens after filing S-1?

After a final price is determined, the investment bank and the company sign the underwriting agreement, and the S-1 is updated to include the adjusted price. This version of the S-1 is the final registration statement/prospectus. After the final prospectus is filed, the SEC determines whether the offering is effective.

What is Form S-1 used for?

Form S-1 is the registration statement that the Securities and Exchange Commission (SEC) requires domestic issuers to file in order to publicly offer new securities. That is, issuers file S-1s for initial public offerings (IPOs) and follow-on offerings of new securities.

Is an S-1 and prospectus the same thing?

As per the Securities Act of 1933, the form S-1 is referred to as a registration statement. It must include any material information about the company.. The first part of S-1 form is called the prospectus. The prospectus is a the disclosure document that issuers of securities must provide to potential investors.

What does S-1 mean?

An S-1 Form is the initial registration that is filed with the SEC when a company first goes public, generally before the initial public offering, or IPO. You may sometimes hear this form referred to as the “registration form,” since it registers the company with the SEC.

Who can file s1 form?

The S-1 is a required SEC filing for all companies seeking to become officially registered and listed on a public stock exchange. Under SEC's Securities Act of 1933, the Form S-1 and regulatory approval are necessary for companies to “go public” and issue shares in the open market.

What is an S-1 vs S 3?

Registrant Requirements Form S-3 is a shorter registration form than Form S-1, which is used in an initial stock launch or IPO. Form S-3 can be used by a company one year after an IPO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SEC 870 S-1 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your SEC 870 S-1 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete SEC 870 S-1 online?

Easy online SEC 870 S-1 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the SEC 870 S-1 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SEC 870 S-1 in seconds.

What is SEC 870 S-1?

SEC 870 S-1 is a form used by companies to register securities for public offering with the U.S. Securities and Exchange Commission (SEC).

Who is required to file SEC 870 S-1?

Companies that plan to offer securities to the public are required to file SEC 870 S-1 to ensure compliance with federal securities laws.

How to fill out SEC 870 S-1?

To fill out SEC 870 S-1, companies must provide detailed information about the securities being offered, including business descriptions, financial statements, and risk factors.

What is the purpose of SEC 870 S-1?

The purpose of SEC 870 S-1 is to provide essential information to potential investors and ensure transparency in the securities offering process.

What information must be reported on SEC 870 S-1?

The SEC 870 S-1 requires the reporting of company financial information, use of proceeds, risk factors, management details, and a description of the securities offered.

Fill out your SEC 870 S-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SEC 870 S-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.