Get the free Corporate Card Program - vpfa boisestate

Show details

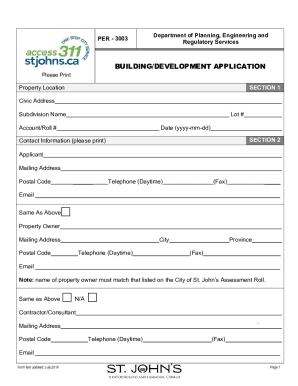

This document serves as an application form for the Diners Club Corporate Card, containing sections for personal information, optional membership in rewards programs, and terms and conditions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate card program

Edit your corporate card program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate card program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate card program online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit corporate card program. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate card program

How to fill out Corporate Card Program

01

Step 1: Obtain the Corporate Card Program application form from your company's finance department or website.

02

Step 2: Fill out your personal details, including your name, position, and department.

03

Step 3: Provide your company's tax ID number and any other required business information.

04

Step 4: Specify the intended usage of the corporate card and any spending limits if applicable.

05

Step 5: Review your company's policy on corporate card usage and adhere to it while completing the form.

06

Step 6: Sign the application and submit it to your supervisor for approval.

07

Step 7: After approval, your application will be processed, and you will receive your corporate card and any related documentation.

Who needs Corporate Card Program?

01

Employees who frequently travel for business purposes.

02

Department heads responsible for managing budgets and expenses.

03

Sales professionals who incur costs on behalf of the company.

04

Staff who make purchases for company events or projects.

05

Finance personnel who need to streamline expense reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is the rule of 72 for credit card debt?

72 ÷ interest rate = number of years for doubling For example, if your credit card has an interest rate of 24%, you would divide 72 by 24, which equals 3. This means that if you don't make any payments, your debt will double in just three years due to accumulated interest.

What does a corporate card mean?

A corporate credit card is a card companies issue to employees to make work-related purchases. The business is liable to repay the balance on the cards, rather than the business' owners or the individual cardholders.

What is the golden rule of credit cards?

The golden rule of Credit Cards is simple: pay your full balance on time, every time. This Credit Card payment rule helps you avoid interest charges, late fees, and potential damage to your credit score.

What is the 50/30/20 rule for credit cards?

This budgeting method divides your monthly income among three main categories: 50% for needs, 30% for wants and 20% for savings and debt repayment.

What is the 2 3 4 rule for credit cards?

The 2/3/4 rule: ing to this rule, applicants are limited to two new cards in 30 days, three new cards in 12 months and four new cards in 24 months.

What is the 5 24 rule for credit cards?

What is the Chase 5/24 rule? To be approved for a Chase credit card, you must have fewer than five approvals for credit cards within the last 24 months. When you apply for a Chase credit card, Chase will count the card you're applying for as part of your allowed five approvals.

What is a corporate card program?

Corporate card programs eliminate the need for employees to use personal funds for business expenses and then request an expense reimbursement. No more waiting weeks for payroll-driven reimbursements or worrying about large charges on personal credit cards.

Is it how do I choose the best corporate card program for my business?

The best corporate card programs offer seamless integration with expense management tools, customizable spending controls, real-time tracking, automated reporting, and robust security features. They may also provide rewards, such as cash back or points, and support global operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate Card Program?

The Corporate Card Program is a financial management tool that allows companies to issue credit cards to employees for business-related expenses.

Who is required to file Corporate Card Program?

Typically, employees who utilize the corporate cards to conduct business expenses and the company's finance or accounting department is responsible for filing and managing the corporate card transactions.

How to fill out Corporate Card Program?

To fill out the Corporate Card Program application, employees usually need to provide personal information, business details, and a justification for the required credit limit along with compliance with company policies.

What is the purpose of Corporate Card Program?

The purpose of the Corporate Card Program is to streamline expense reporting, improve cash flow management, and reduce the administrative burden associated with employee reimbursements.

What information must be reported on Corporate Card Program?

Information that must be reported includes transaction dates, amounts, descriptions of expenses, employee names, and the nature of business for which the expenses were incurred.

Fill out your corporate card program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Card Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.