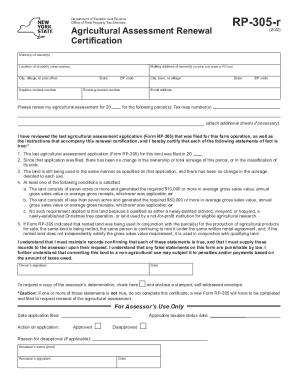

NY DTF RP-305-r 2011 free printable template

Show details

INSTRUCTIONS Use of this form. Form RP-305-r may be used to renew an application for an agricultural assessment for a parcel for the current year s assessment roll if the last long form application form RP-305 or renewal form RP-305-r filed for the parcel was approved and the conditions which determine the parcel s eligibility have not changed. The questions in item 1 are designed to determine whether the parcel s status has changed. Please consider items 1 c and 1 g carefully to determine...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF RP-305-r

Edit your NY DTF RP-305-r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF RP-305-r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF RP-305-r online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF RP-305-r. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF RP-305-r Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF RP-305-r

How to fill out NY DTF RP-305-r

01

Obtain the NY DTF RP-305-r form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Indicate the type of request you are making on the form.

04

Provide details related to the request, including any relevant financial information or tax periods.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form by mail or electronically, as instructed.

Who needs NY DTF RP-305-r?

01

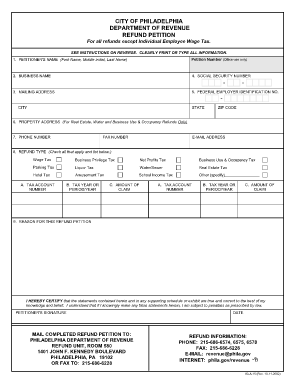

Individuals or entities that need to request a refund of overpaid New York State taxes.

02

Taxpayers needing to clarify or amend their tax registration.

03

Those who are filing for a credit for particular tax periods.

Fill

form

: Try Risk Free

People Also Ask about

How much does an ag exemption save on property taxes in Texas?

The value of an ag exemption Market values for the same land could be as high as $20,000 per acre. “If you average all the market values from Peaster to Millsap to Aledo, you get an average of about $5,000 per acre,” he said. “The tax savings is just huge if you've got ag.”

Can I get an ag exemption in Texas?

Yes, anyone producing agricultural or timber products for sale in the regular course of business can claim the agricultural or timber exemption, respectively, on qualifying items (PDF) purchased in Texas. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax.

What is the easiest ag exemption in Texas?

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land.

How do I get agricultural tax exemption in NY?

To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. New York tax law exempts certain items used in farm production from state and local sales and use taxes.

What qualifies for ag exemption in Texas?

What qualifies as ag exemption? To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. Agricultural purposes include crop and livestock production, beekeeping and similar activities. Many counties have minimum acreage requirements.

How many animals do you need for ag exemption in Texas?

Travis Central Appraisal District. How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF RP-305-r without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NY DTF RP-305-r into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send NY DTF RP-305-r to be eSigned by others?

When you're ready to share your NY DTF RP-305-r, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in NY DTF RP-305-r?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NY DTF RP-305-r to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is NY DTF RP-305-r?

NY DTF RP-305-r is a form used by taxpayers in New York State to report certain information related to sales tax.

Who is required to file NY DTF RP-305-r?

Businesses and individuals who have a tax obligation or are involved in certain transactions that require sales tax reporting must file NY DTF RP-305-r.

How to fill out NY DTF RP-305-r?

To fill out NY DTF RP-305-r, taxpayers must provide their basic information, details of the transactions being reported, and any applicable tax amounts.

What is the purpose of NY DTF RP-305-r?

The purpose of NY DTF RP-305-r is to ensure accurate reporting and compliance with New York State sales tax regulations.

What information must be reported on NY DTF RP-305-r?

Information that must be reported on NY DTF RP-305-r includes taxpayer identification, transaction details, amounts involved, and other relevant sales tax data.

Fill out your NY DTF RP-305-r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF RP-305-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.