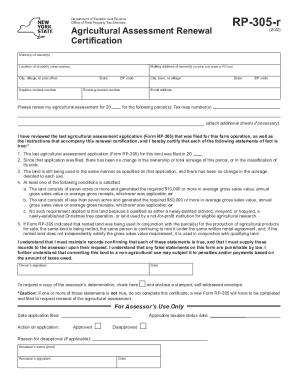

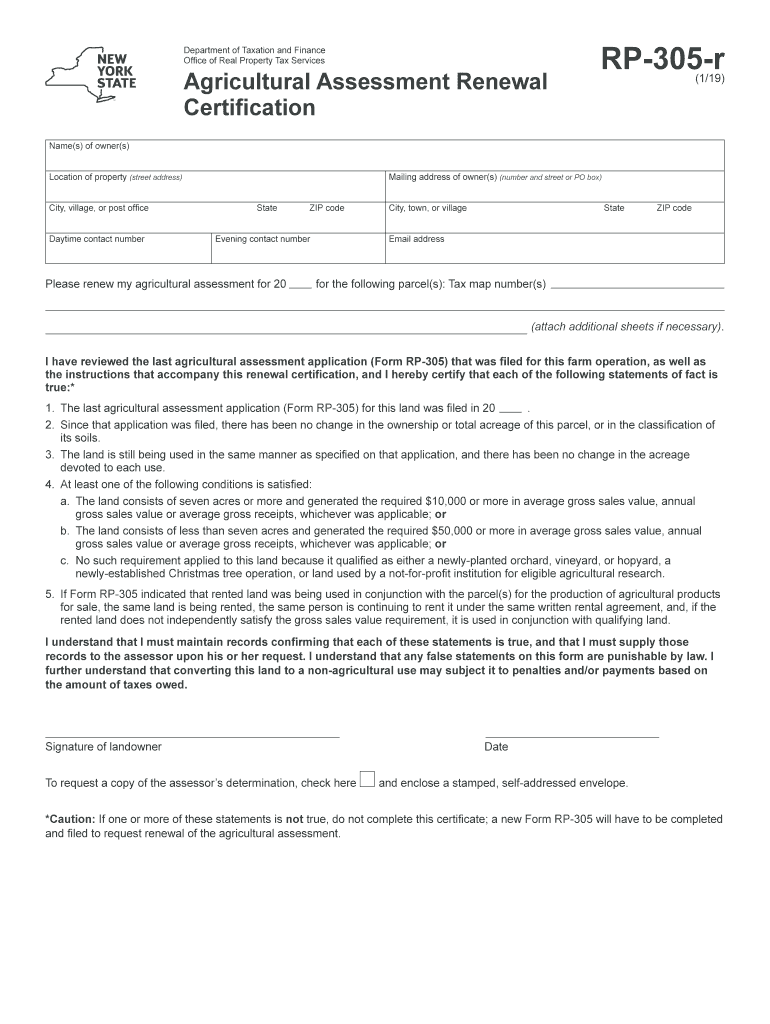

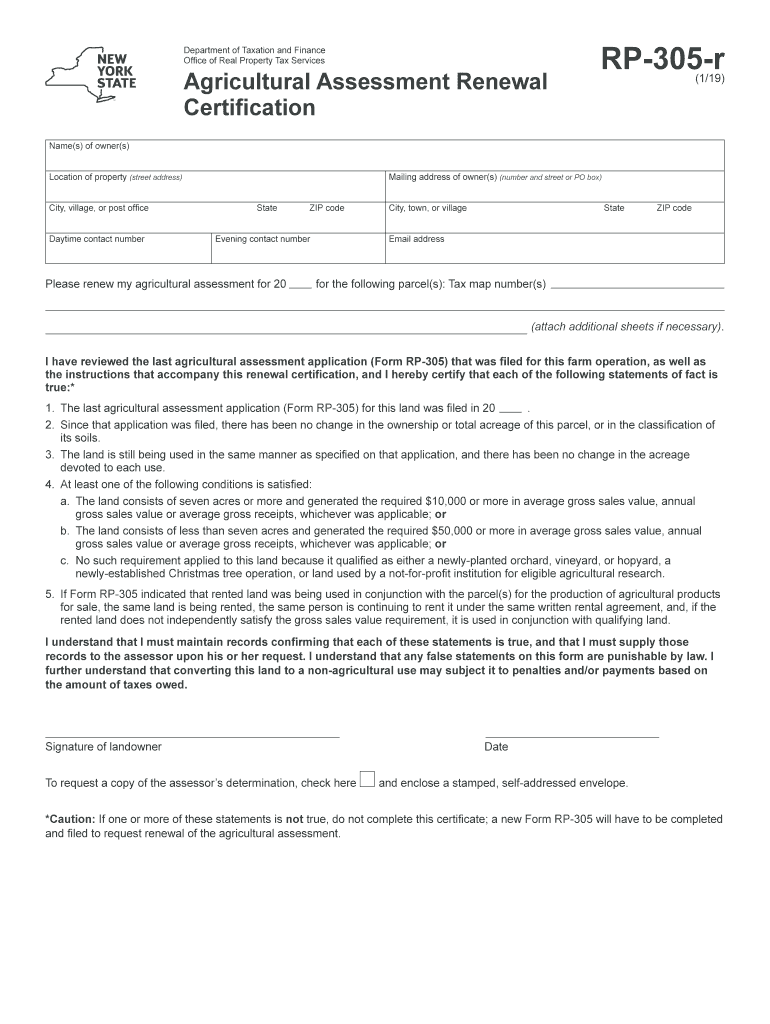

NY DTF RP-305-r 2019 free printable template

Show details

Page 2 of 2 RP-305-r 1/19 General Information Deadline for filing the application If a tax-exempt orchard vineyard or hopyard has been replaced or expanded since the last Form RP-305 was filed the applicant should complete and attach Form RP-305-e to this application. Also the assessor may ask for substantiation of any requirement for obtaining an agricultural assessment including submission of Form RP-305. Notice of approval denial or modification The landowner may use Form RP-305-r to renew...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF RP-305-r

Edit your NY DTF RP-305-r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF RP-305-r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF RP-305-r online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF RP-305-r. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF RP-305-r Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF RP-305-r

How to fill out NY DTF RP-305-r

01

Download the NY DTF RP-305-r form from the New York State Department of Taxation and Finance website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your name, address, and the relevant tax identification number in the specified fields.

04

Provide information about your financial institution if applicable.

05

Specify the type of tax refund or payment you are requesting.

06

Double-check all entered information for accuracy.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate department as instructed.

Who needs NY DTF RP-305-r?

01

Individuals or businesses seeking a refund of overpaid taxes in New York State.

02

Taxpayers who need to report changes to their tax status or financial information.

03

People who have received a notice from the New York State Department of Taxation and Finance regarding refunds.

Fill

form

: Try Risk Free

People Also Ask about

How much does an ag exemption save on property taxes in Texas?

The value of an ag exemption Market values for the same land could be as high as $20,000 per acre. “If you average all the market values from Peaster to Millsap to Aledo, you get an average of about $5,000 per acre,” he said. “The tax savings is just huge if you've got ag.”

Can I get an ag exemption in Texas?

Yes, anyone producing agricultural or timber products for sale in the regular course of business can claim the agricultural or timber exemption, respectively, on qualifying items (PDF) purchased in Texas. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax.

What is the easiest ag exemption in Texas?

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land.

How do I get agricultural tax exemption in NY?

To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application. New York tax law exempts certain items used in farm production from state and local sales and use taxes.

What qualifies for ag exemption in Texas?

What qualifies as ag exemption? To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. Agricultural purposes include crop and livestock production, beekeeping and similar activities. Many counties have minimum acreage requirements.

How many animals do you need for ag exemption in Texas?

Travis Central Appraisal District. How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY DTF RP-305-r directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your NY DTF RP-305-r and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit NY DTF RP-305-r from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your NY DTF RP-305-r into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the NY DTF RP-305-r in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is NY DTF RP-305-r?

NY DTF RP-305-r is a form used by taxpayers in New York State to report the amount of certain sales tax collected by businesses.

Who is required to file NY DTF RP-305-r?

Businesses in New York State that collect sales tax on taxable sales are required to file NY DTF RP-305-r.

How to fill out NY DTF RP-305-r?

To fill out NY DTF RP-305-r, taxpayers must provide details including their identification information, sales tax collected during the reporting period, deductions, and any credits or adjustments.

What is the purpose of NY DTF RP-305-r?

The purpose of NY DTF RP-305-r is to ensure that businesses accurately report and remit the sales tax they have collected to the New York State Department of Taxation and Finance.

What information must be reported on NY DTF RP-305-r?

The information that must be reported on NY DTF RP-305-r includes the seller's name, address, ID number, total sales, total sales tax collected, and any additional relevant deductions or exemptions.

Fill out your NY DTF RP-305-r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF RP-305-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.