Get the free Credit Reports and Scores Control Your Credit Card Debt Handout - facsmail

Show details

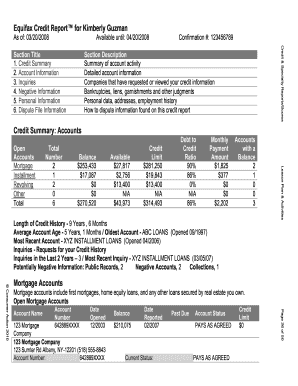

Equifax Credit Report for Kimberly Guzman As of: 03/20/2008 Available until: 04/20/2008 Credit & Specialty Reports/Scores Section Title 1. Credit Summary 2. Account Information 3. Inquiries 4. Negative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit reports and scores

Edit your credit reports and scores form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit reports and scores form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit reports and scores online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit reports and scores. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit reports and scores

How to fill out credit reports and scores:

01

Obtain a copy of your credit report: Start by requesting a copy of your credit report from one or all of the major credit bureaus - Experian, TransUnion, and Equifax. You can often request a free copy once a year.

02

Review your credit report for errors: Carefully examine your credit report for any errors or discrepancies. This could include incorrect personal information, accounts that don't belong to you, or negative items that should have been removed. If you spot any errors, dispute them with the credit bureau.

03

Understand the components of your credit report: Familiarize yourself with the various sections of your credit report. This typically includes personal information, account information, payment history, public records, and inquiries. Understanding what each section means will help you analyze your creditworthiness.

04

Check your credit score: Along with your credit report, you should also check your credit score. This three-digit number represents your creditworthiness and is calculated using the information in your credit report. Many credit card companies and financial institutions provide free access to your credit score.

05

Analyze your credit report and score: Look for any red flags or areas for improvement in your credit report. This could include late payments, high credit card balances, or numerous inquiries. Identifying these issues will help you create a plan to address them and improve your creditworthiness.

06

Make timely payments: One of the most crucial factors in improving your credit score is making payments on time. Set up automatic payments or reminders to ensure you don't miss any due dates. Consistently paying your bills on time will positively impact your credit history.

07

Reduce your debt: If you have high credit card balances or other outstanding debts, come up with a strategy to pay them down. Aim to keep your credit utilization ratio below 30% by paying off as much debt as possible. Lowering your debt can significantly improve your credit score.

08

Limit new credit applications: Applying for new credit too frequently can negatively impact your credit score. Each application typically triggers a hard inquiry, which can temporarily lower your score. Be strategic about applying for new credit and only do so when necessary.

Who needs credit reports and scores?

01

Individuals looking to borrow money: Lenders use credit reports and scores to evaluate an individual's creditworthiness when deciding whether to approve a loan. If you plan on taking out a mortgage, car loan, or personal loan, having a good credit report and score is crucial.

02

Renters and landlords: Many landlords and property management companies review an applicant's credit report before approving a rental application. A positive credit history can increase your chances of securing a desirable rental property. As a landlord, it's important to assess potential tenants' creditworthiness to minimize the risk of non-payment.

03

Job seekers: Some employers conduct credit checks as part of their hiring process, especially for roles that involve financial responsibilities or access to sensitive information. A good credit report and score can enhance your chances of landing certain job opportunities.

04

Individuals seeking insurance coverage: Insurance companies may consider credit reports and scores when determining the premium rates for auto, home, or life insurance policies. A better credit score can potentially result in lower insurance premiums.

05

Anyone interested in monitoring their financial health: Even if you are not currently in need of credit, keeping tabs on your credit report and score is essential for monitoring your financial well-being. Regularly reviewing your credit information allows you to detect and address any errors, identity theft, or suspicious activities promptly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit reports and scores to be eSigned by others?

Once your credit reports and scores is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the credit reports and scores form on my smartphone?

Use the pdfFiller mobile app to complete and sign credit reports and scores on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete credit reports and scores on an Android device?

Use the pdfFiller mobile app and complete your credit reports and scores and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is credit reports and scores?

Credit reports and scores are documents that contain information about an individual's credit history and financial behavior, including their credit accounts, payment history, and credit utilization.

Who is required to file credit reports and scores?

Financial institutions, credit card companies, and other lenders are required to file credit reports and scores for their customers.

How to fill out credit reports and scores?

Credit reports and scores are typically filled out electronically through credit reporting agencies or credit bureaus. Lenders can also provide information directly to these agencies.

What is the purpose of credit reports and scores?

The purpose of credit reports and scores is to assess an individual's creditworthiness and help lenders make informed decisions about extending credit.

What information must be reported on credit reports and scores?

Credit reports and scores must include information about the individual's payment history, credit accounts, outstanding balances, and any derogatory marks.

Fill out your credit reports and scores online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Reports And Scores is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.