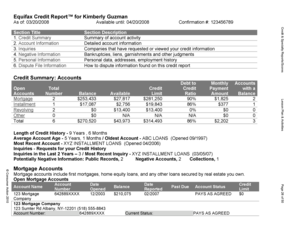

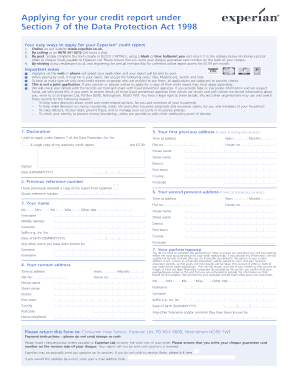

What is sample equifax credit report?

A sample equifax credit report is a document that provides a comprehensive overview of an individual's credit history and financial standing. It includes information such as credit accounts, payment history, credit utilization, and public records. The equifax credit report is a valuable tool for lenders, employers, and individuals to assess creditworthiness and make informed financial decisions.

What are the types of sample equifax credit report?

There are several types of sample equifax credit reports that cater to different purposes and needs. The most common types include:

Basic Equifax Credit Report: This provides a summary of an individual's credit history, including credit accounts, payment history, and public records.

Equifax Credit Score Report: This includes the individual's credit score, along with detailed information about factors affecting the score.

Equifax Decision Power Credit Report: This report provides a comprehensive assessment of an individual's creditworthiness, including credit risk indicators and predictive scores.

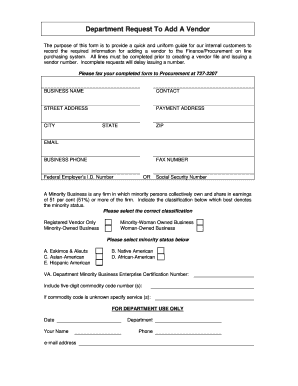

Business Equifax Credit Report: This is specifically designed for businesses to evaluate the creditworthiness of other businesses or potential partners.

How to complete sample equifax credit report

Completing a sample equifax credit report is a straightforward process. Here are the steps to follow:

01

Gather all relevant financial information, including credit account details, payment history, and any other supporting documents.

02

Review the sample equifax credit report form carefully and ensure you understand each section.

03

Enter the requested information accurately and honestly. Double-check all entries for errors.

04

Attach any required supporting documents digitally or physically, if applicable.

05

Submit the completed equifax credit report as per the provided instructions.

06

Keep a copy of the submitted report for future reference.

pdfFiller is an excellent online platform that empowers users to create, edit, and share documents online, including sample equifax credit reports. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and effectively.