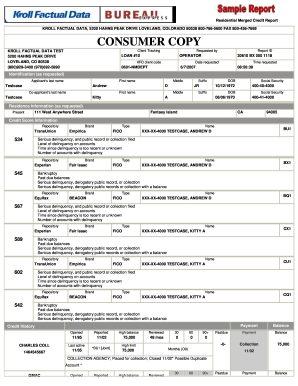

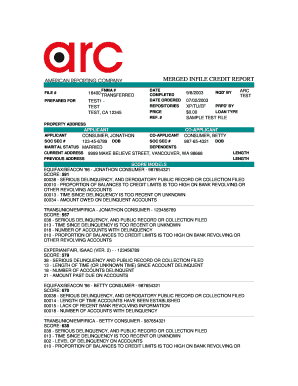

Sample Transunion Credit Report

What is a sample TransUnion credit report?

A sample TransUnion credit report is a document that provides detailed information about an individual's credit history and financial health. It includes data on credit accounts, payment history, public records, and other relevant financial information. This report is generated by TransUnion, one of the major credit reporting agencies in the United States.

What are the types of sample TransUnion credit report?

TransUnion offers various types of credit reports tailored to different purposes. The common types of sample TransUnion credit reports include:

How to complete a sample TransUnion credit report

Completing a sample TransUnion credit report is a straightforward process. Here are the steps you need to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.