Get the free Acknowledgement of Insurance Requirements - resources css

Show details

This document is an acknowledgment that a parent or guardian affirms the student-athlete's insurance coverage while participating in intercollegiate athletics at The College of St. Scholastica and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acknowledgement of insurance requirements

Edit your acknowledgement of insurance requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acknowledgement of insurance requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit acknowledgement of insurance requirements online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit acknowledgement of insurance requirements. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

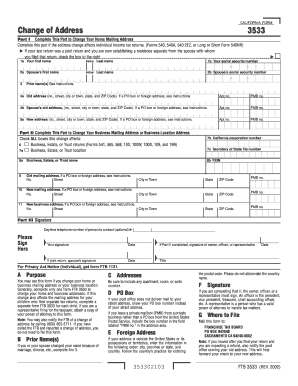

How to fill out acknowledgement of insurance requirements

How to fill out Acknowledgement of Insurance Requirements

01

Start by downloading the Acknowledgement of Insurance Requirements form from the relevant source.

02

Read the instructions provided at the beginning of the form carefully.

03

Fill in your contact information, including name, address, and phone number in the designated fields.

04

Provide the details of the insurance policy you hold, including policy number and provider name.

05

Indicate the type of coverage you have, such as general liability or professional liability.

06

Include the effective date and expiration date of your insurance.

07

Sign and date the form to confirm that the information is accurate and complete.

08

Submit the completed form to the designated department or individual.

Who needs Acknowledgement of Insurance Requirements?

01

Anyone applying for a permit, license, or contract that requires proof of insurance.

02

Contractors or vendors working with government agencies or large organizations.

03

Businesses that need to verify insurance coverage before engaging in a partnership.

Fill

form

: Try Risk Free

People Also Ask about

What is an insurance Acknowledgement form?

0:28 2:15 First off is the acknowledgement. Form the second thing is a list of flood losses you're going to beMoreFirst off is the acknowledgement. Form the second thing is a list of flood losses you're going to be getting this every year at renewal. And this acknowledgement.

What is acknowledgement with an example?

Acknowledgement Meaning Most often, we use the word acknowledgement to describe the act of accepting or recognizing that something is true. For example, if you're talking about a problem that your elected officials haven't adequately addressed, you might say, “We need more government acknowledgement of this issue."

How do you write an Acknowledgement letter in English?

What is written in acknowledgement? Title and date: Clearly state the purpose of the acknowledgment and the date. Recipient details: Addressing the relevant person or organization. Opening statement: Politely acknowledging receipt. Details of the acknowledgement: Specific information about what is being acknowledged.

What is an example of an acknowledgement statement in a policy?

By signing this form, I acknowledge that I have received a copy of the personnel policies currently in effect for my office as of this date, and I understand that it is my responsibility to read and comply with the policies.

What is proof of insurance coverage?

Proof of insurance is a document or ID card containing information about you and your policy. It usually includes your name, insurer's name, policy number and effective dates. If law enforcement pulls you over or if you're involved in an accident with another driver, you'll need to show proof of car insurance.

What is an insurance acknowledgement form?

0:28 2:15 First off is the acknowledgement. Form the second thing is a list of flood losses you're going to beMoreFirst off is the acknowledgement. Form the second thing is a list of flood losses you're going to be getting this every year at renewal. And this acknowledgement.

What is acknowledgement in insurance?

A claim acknowledgement letter is a formal document sent by an insurance company to a policyholder in response to a claim they have filed. This letter serves several key purposes: Acknowledges Receipt: It confirms that the insurance company has received the claim.

What is the purpose of an acknowledgement letter?

A letter of acknowledgement aims to intimate the concerned party that the documents or items requested in a previous communication have been received. The acknowledgement letter is a professional courtesy extended by businesses to maintain professional relationships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Acknowledgement of Insurance Requirements?

Acknowledgement of Insurance Requirements is a document that certifies that an individual or organization understands and agrees to the insurance requirements set forth by an entity, often in relation to contracts or agreements.

Who is required to file Acknowledgement of Insurance Requirements?

Typically, contractors, subcontractors, or any parties engaged in work that requires insurance coverage as stipulated by an agreement or contract are required to file the Acknowledgement of Insurance Requirements.

How to fill out Acknowledgement of Insurance Requirements?

To fill out the Acknowledgement of Insurance Requirements, individuals should provide their contact information, details of the insurance coverage (including types and limits), and a signature acknowledging their understanding and compliance with the insurance requirements.

What is the purpose of Acknowledgement of Insurance Requirements?

The purpose of the Acknowledgement of Insurance Requirements is to ensure that all parties involved are aware of and compliant with the insurance obligations necessary to mitigate risks associated with a project or contract.

What information must be reported on Acknowledgement of Insurance Requirements?

Information that must be reported on the Acknowledgement of Insurance Requirements includes the name of the insured, type of insurance (e.g., general liability, workers' compensation), coverage amounts, policy numbers, and effective dates.

Fill out your acknowledgement of insurance requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acknowledgement Of Insurance Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.